Cryptocurrencies and blockchain networks are secured by two primary different consensus mechanisms, those being Proof-of-Work (PoW) and Proof-of-Stake (PoS). There are multiple different types of Proof-of-Stake projects that use various forms of the consensus mechanism, but we will just focus on the Proof-of-Work vs Proof-of-Stake debate in this article.

There has been a fierce debate raging in the crypto industry for years over which consensus mechanism is better, and indeed, both have their strengths and weaknesses, many of which we will explore here today.

In this Proof-of-Work vs Proof-of-Stake article, we'll explore the pros and cons of each consensus mechanism so that you can decide which one makes more sense for your project, or provide you with some insight into which camp you belong to, if either.

Just so we are on the same page, it may be helpful to list a few of the major blockchains that utilized Proof-of-Work:

- Bitcoin (BTC)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Monero (XMR)

- Zcash (ZEC)

- Dogecoin (DOGE)

Interestingly, Ethereum also used Proof-of-Work until it completed its merge in 2022.

Here are some main cryptocurrencies that utilize some form of Proof-of-Stake:

- Ethereum 2.0 (ETH)

- Cardano (ADA)

- Polkadot (DOT)

- Binance Coin (BNB)

- Solana (SOL)

- Avalanche (AVAX)

- Tezos (XTZ)

- Cosmos (ATOM)

- Algorand (ALGO)

- VeChain (VET)

If you are interested in Guy's take, you can find his spin on this subject below:

Page Contents 👉

Proof-of-Work Basics

Proof-of-Work is a commonly employed blockchain consensus mechanism. It was the first, and in most opinions, is the most secure and decentralized form of consensus. Proof-of-Work involves analyzing or solving complex mathematical puzzles when a transaction has been sent to an online network using computing power.

This computing expense is intended to make fraud costs greater than possible rewards for dishonest actions, thus, securing the network.

What is Proof-of-Work?

Proof-of-Work is the traditional way of securing the blockchain. In this system, miners compete against each other to solve complex mathematical problems. For example, one might need to find an equation with a specific number at the end which would then be used as a block identifier and added to the chain. The first miner to do so will win the block reward (usually in Bitcoin or some other cryptocurrency).

PoW is energy intensive (more on that later) and has been criticized for its high carbon footprint as it requires high levels of computing power. However, it also offers many benefits.

Pros of PoW

- It's highly secure because it makes tampering extremely difficult unless you control over 51% of all hashing power.

- It often provides greater decentralization than PoS systems because anyone can become a miner if they have enough hardware resources.

- It's more transparent as anyone can see which transactions are being added to the blockchain.

- It's more trustworthy as miners compete against each other for block rewards, creating a system of checks and balances that prevents any one person from gaining too much power over the network.

PoW is a computational process that is used to confirm transactions on a decentralized network, which ensures the integrity of the network and prevents fraud.

By requiring a not insignificant amount of computational energy to solve a mathematical puzzle, known as mining, new cryptocurrencies are minted into existence, while transactions are validated on the network.

While PoW has been successful in securing many cryptocurrencies, it is not without its drawbacks, which will be covered in a later section.

A Brief History of Proof of Work

The concept of PoW dates back to the early 1990s when it was proposed in a scientific paper called On Memory-Bound Functions For Fighting Spam, as a way to prevent spam emails. The idea was to require email senders to solve a mathematical puzzle in order to send an email, thereby requiring a small amount of computational power to be expended. While this idea was never widely adopted for email, which is great for those of us who are bad at math, this concept would later be adapted for use in cryptocurrency.

In 2008, Satoshi Nakamoto released the Bitcoin Whitepaper, the world’s first successful decentralized cryptocurrency. In this paper, Nakamoto introduced the concept of PoW as a way to secure the Bitcoin blockchain, which is why the PoW consensus mechanism is sometimes referred to as the Nakamoto Consensus.

The Nakamoto Proof-of-Work Consensus. Image via etherplan.com

Satoshi’s White Paper explains the several steps to run the network are:

New transactions are broadcast to all nodes.

- Each node collects new transactions into a block.

- Each node works on finding a difficult proof-of-work for its block.

- When a node finds a proof-of-work, it broadcasts the block to all nodes.

- Nodes accept the block only if all transactions in it are valid and not already spent.

- Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

- The longest chain is the one that wins. When new proof-of-work is found, and that chain becomes longer, all the other nodes converge into the lowest blocks.

Since the introduction of Bitcoin, PoW has been adapted and modified by many other cryptocurrencies, including Ethereum (pre-merge), Litecoin, and Dogecoin.

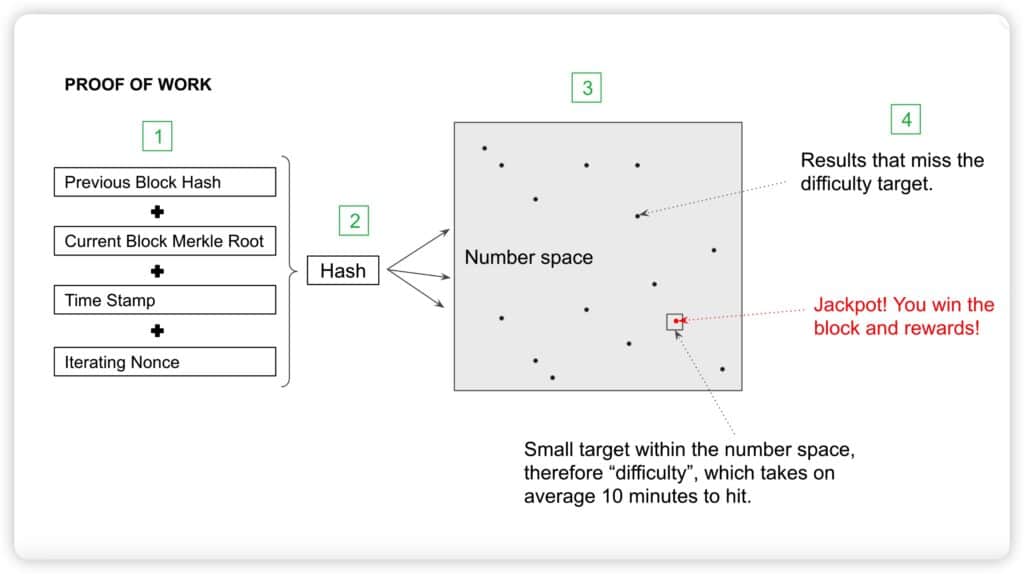

How Does PoW Work?

Without getting too technical, at its core, PoW works by requiring a significant amount of computational energy to be expended in order to solve a mathematical puzzle. This puzzle is designed to be difficult to solve, but easy to verify once a solution has been found.

If you are someone who wants to get more into the nitty gritty of PoW, I recommend this fantastic article on PoW Security from Etherplan.com that breaks it down.

In the case of Bitcoin, the puzzle involves finding a hash, or a random string of letters and numbers, that is less than a predetermined target value. To do this, miners must use their computational power to perform millions of calculations per second until they find a hash that meets the criteria.

Image via Etherplan

Once a miner has found a valid solution, they broadcast it to the network, where it is verified by other nodes. If the solution is valid, the miner is rewarded with the cryptocurrency being mined. The block contains a list of verified transactions and is added to the blockchain, which acts as a public ledger of all transactions on that network.

Understanding Proof-of-Stake (PoS)

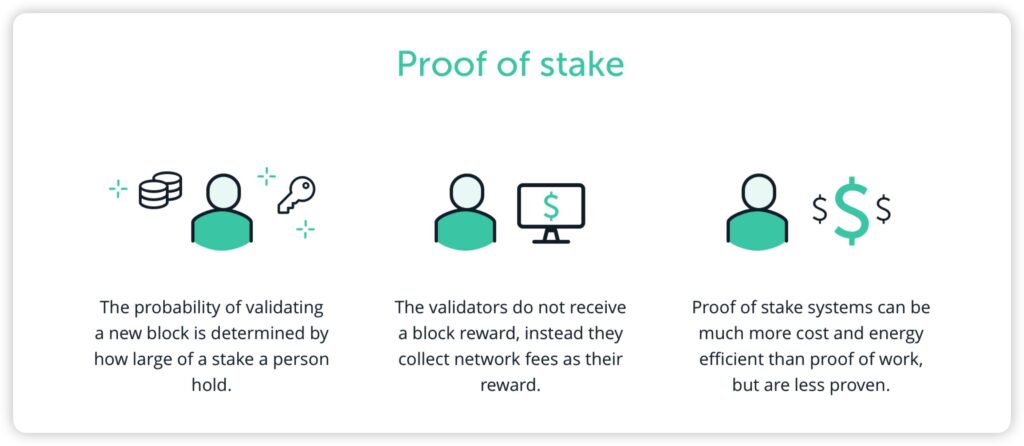

Proof-of-Stake is an alternate method of securing networks and validating transactions with less computing power required. Users can become validators on the network by choosing to lock up a number of their tokens, then are chosen randomly for the verification of transaction data and verification of block data. To be validators, coin holders need to “stake” a number of coins as an economic incentive.

Image via Ledger

This is a very simplistic explanation of PoS in its most basic form. Different blockchain networks can use a multitude of variations of PoS, some of the main ones Guy covers below:

What is Proof-of-Stake?

Proof-of-Stake is a concept that is gaining popularity in the blockchain industry faster than Proof-of-Work. Unlike Proof of Work, which requires a significant amount of computational power to verify transactions and earn rewards, PoS works by requiring users to hold (stake) a certain amount of cryptocurrency in order to participate in the network.

In a PoS system, validators are chosen to create and validate new blocks on the blockchain based on the amount of cryptocurrency they have staked or held as collateral. The more cryptocurrency a validator stakes, the higher the probability that they will be selected to create the next block and earn the block reward.

Image via Ledger

In most PoS consensus mechanisms, validators are required to put up a certain amount of cryptocurrency as a stake, which serves as collateral for their participation in the network. This stake acts as a guarantee that the validator will act honestly and in the best interest of the network, as validators who behave dishonestly risk losing their stake due to slashing or other means of penalization.

Garrick Hileman, head of research at Blockchain.com perhaps puts it best as he explains:

“In proof of stake, the cryptocurrency holders ‘vote' to approve legitimate transactions. As a reward for voting on legitimate transactions, ‘stakers' are paid in newly created cryptocurrency over time,”

He continues:

“Two major benefits of proof of stake over proof of work are that PoS can be less energy intensive and have greater transaction throughput (speed) and capacity,”

Pros of Proof-of-Stake:

- Less energy intensive- some projects are “eco-friendly”

- Cost-effective- Validators only need to hold a certain amount of crypto to participate in the network, making it often more accessible than needing to run PoW mining equipment.

- Many projects support delegation meaning that average people can participate by staking low amounts and generating returns.

- Security- Validators are incentivized to act with integrity as they risk losing their stake from malicious behaviour

- Decentralization- some projects are highly decentralized as validator nodes can be widely distributed and dispersed around the globe.

- Flexibility- PoS can allow for greater flexibility in the governance and decision-making of the network. Validators can be given the power to vote on proposals or changes to the network in the interest of the community.

There are a few caveats regarding the above strengths though, keep in mind that security, decentralization, and flexibility “CAN” be benefits for some networks, but not every PoS cryptocurrency is automatically decentralized just because it has the capabilities to be. Binance Coin and Solana are two examples here. Although they are PoS, there are few validators capable of securing the network, making them quite centralized. Generally speaking, PoW projects are more decentralized than the majority of PoS cryptos. You can learn more in this PoS article from Ledger.

Flexibility can also be considered a weakness. One of the strengths of Bitcoin is that it is not flexible, nor should it be. Its strength is that it is set in stone and nobody can mess with it. Many PoS cryptocurrencies can have their qualities, things like supply, security, and governance changed, similar to our modern financial system, and we all see the problems that can create.

A Brief History of Proof-of-Stake

The concept of PoS dates back to 2011 when it was first discussed on the Bitcointalk forum, but was officially put into practice in 2012 when it was first introduced by Sunny King and Scott Nadal in a whitepaper for Peercoin. At the time, PoW was the dominant method for securing cryptocurrencies, but King and Nadal saw the potential in a different approach that relied on users holding a certain amount of cryptocurrency in order to validate transactions without using as much energy.

A Look at the Original Proof-of-Stake Peercoin’s Whitepaper. Image via peercoin.net

Since the introduction of Peercoin, PoS has been adopted and modified by many centralized and decentralized cryptocurrency networks, including Cardano, Polkadot, Ethereum 2.0, and many major layer one cryptocurrencies.

How does PoS Work?

Again, without being too technical, PoS works by requiring users to hold a certain amount of cryptocurrency in order to participate in the network. This amount is known as a stake, and users are required to stake their cryptocurrency in order to validate transactions and earn rewards.

In order to validate cryptocurrency transactions, the PoS algorithm uses a pseudo-random selection process to select validators from a group of nodes. The system can use a combination of criteria such as staking age, randomization, and the number of funds staked on the node. The amount of coins staked determines the chances for a node being selected as the next validator, which is often criticized as it centralizes the selection process based on wealth.

For this reason, additional unique methods are often employed, with the most common methods being coin age selection and randomized block section. Algorand achieved something quite effective when creating a fair randomization process, you can learn more about that in our Algorand review.

Here is a great diagram from Coinmonks showing the basic structure of PoS

Image via medium/coinmonks

Once a user has been selected to create a block, they must verify transactions and create a hash, or a unique identifier for the block. This hash is then broadcast to the network, where it is verified by other nodes. If the hash is valid, the user is rewarded with a block of cryptocurrency.

Proof-of-Work vs Proof-of-Stake: The Biggest Differences

The biggest topic to cover is one of major contention in the crypto and ecological communities, and it revolves around energy use. To preface this section, I would like to mention there has been a gross amount of negligence, malicious misinformation, rumours, and downright FUD regarding energy and Bitcoin mining.

To put it bluntly, the negative effects of Bitcoin mining have been glorified in the media, either out of malicious intent or ignorance. I can’t go into detail here, as we put together this in-depth article on Bitcoin mining that highlights its true effects, purposes, and positives.

Guy also covers this in his video on Bitcoin mining, and the last resource to put the “Bitcoin mining is bad” narrative to rest, is this fantastic video from our friends at Altcoin Daily who put out this great video on why Bitcoin mining is GOOD for the environment.

But…

Okay, yes, when comparing the two consensus mechanisms, PoW does use substantially more energy, there is no getting around that, for better or for worse.

Another significant difference between PoW vs PoS is that PoW is quite limited in the amount of transaction throughput it can handle, with Bitcoin only being able to handle about 5-7 transactions per second, and it takes about 10 minutes to settle a transaction. This is excluding the Lightning Network, of course.

Compare this to a PoS like NEAR protocol, which can handle a theoretical 100k TPS with a finality time of about 2 seconds. PoS is like a Ferrari while PoW is akin to the horse and carriage from a transaction efficiency perspective.

Both networks are susceptible to 51% attacks, with PoS being more vulnerable. In a 51% attack on PoS, a single entity needs to control the majority of the computational power on the network, which would allow them to manipulate the blockchain. This has become basically impossible on Bitcoin due to the mining difficulty and size of the network.

A 51% attack on a PoS network can be carried out by someone purchasing over half of the supply of coins and becoming a validator, with small-cap PoS networks being especially vulnerable.

There have also been criticisms against PoW in the form of mining becoming highly centralized as we have seen with the rise of “mining monopolies,” which inherently decreases the decentralization of the Bitcoin network. Other PoW projects such as Ravencoin, Firo, Epic Cash, and others have avoided this by running networks where mining can be done on simple home computing devices, with the technology being ASIC-resistant to prevent mining farms, as we see with Bitcoin.

Okay, enough beating up on PoW, let's turn the tables on PoS

We know that some of the biggest differences are that PoS is more cost-efficient and requires less energy usage while being highly flexible. As I introduced above, the flexibility of PoS systems is a double-edged sword as there is no certainty about the future tokenomics. We know that Bitcoin has a fixed supply, which is a strength, but then we see Ethereum is constantly undertaking upgrades and changing, so the Ethereum that we trust today, may not be an Ethereum that we trust in the future if the protocol changes.

In tech, there is something known as The Lindy Effect, or Lindy’s Law. It is a theorized phenomenon that the longer something survives, the higher the likelihood of it being around in the future. In the tech sector, this is around the 10-year mark, if a technology can survive a decade, it likely has staying power. Due to Ethereum’s constant protocol changes, it can no longer be considered the same as it was when it was PoS, making Bitcoin and Litecoin the two major digital assets that have reached this milestone.

Bitcoin, Gold, and the Lindy Effect. Image via coinzodiac.com

Centralization is a key criticism many PoW advocates have against the PoS consensus mechanism. PoS was designed to be capable of decentralization, but many projects have proven that it is prone to centralization. This is because validators with large stakes have a higher chance of being selected to create new blocks and validate transitions, giving them more influence over the network.

Larger validators have also been shown to have the capability of swaying votes in proposals for many projects as well. Not very decentralized if it only takes one or two validators to sway the vote of a project. We recently saw this happen with the Uniswap community's vote on whether or not to launch Uniswap on the Binance chain. The venture firm A16z was able to heavily influence the vote outcome in what should be been a decentralized governance system.

Image via fintechs.fi

Security risks are another concern of PoS. Risks such as the “Nothing-at-Stake” problem, where validators can vote for multiple conflicting blocks without any penalty can lead to network instability. There is also the “long-range attack” concern where attackers can use their old stakes to reorganize the blockchain and execute fraudulent transactions.

A high barrier to entry can also further lead to centralization problems, as some networks require validators to hold mass sums of the crypto to become a validator, with some projects requiring validators to hold a high 6-figures worth of crypto.

Then there are governance issues with PoS as well, with conflicts of interest, lack of transparency and accountability all being observed in PoS crypto projects when squabbles happen around how the protocol should be governed.

The idea that security in PoS systems is primarily bolstered due to actors having a stake in the network is not enough for some critics to trust this mechanism as money isn’t always a good enough motivator. How much do you think a company like Google would be willing to burn to take out a large competitor? Just something to keep in mind.

Why Do Cryptocurrencies Need Proof?

Cryptocurrencies use a system called “proof-of-work” or “proof-of-stake” as their consensus mechanisms to prevent fraud and ensure the integrity and security of the network. This requires users to demonstrate that they have put in some form of effort or stake in the network, which makes it difficult for malicious actors to manipulate the system. Proof is therefore necessary to maintain the security and trustworthiness of the cryptocurrency network.

PoW Adoption vs PoS Adoption

Proof-of-Work was the first consensus algorithm used in blockchain networks and is still widely adopted, with many of the largest and most popular blockchain networks using PoW to validate transactions.

However, Proof-of-Stake has been gaining popularity in recent years, with an increasing number of blockchain networks adopting the PoS consensus algorithm. Most of the newer projects are choosing to build using PoS over PoW, with some of the notable PoS networks including Cardano, Polkadot, Solana, Avalanche, NEAR, and Binance Smart Chain.

One of the reasons for the growing adoption of PoS is the fact that it offers several advantages over PoW, such as lower energy consumption, greater scalability, and reduced hardware costs. Additionally, PoS networks can be more easily upgraded, as changes to the consensus mechanism can be implemented through software updates, rather than requiring a hard fork.

Though many advocates for PoW argue that the advantages of PoS are not worth sacrificing security and decentralization over. PoW is considerably more battle-tested and proven, as it has been used in the first and largest blockchain network, Bitcoin, for over a decade. PoW is also more resistant to security threats and has fewer attack vectors than PoS.

Final Verdict, Which is better: Proof-of-Stake or Proof-of-Work?

As you can see, both mechanisms have their strengths and weaknesses, this is akin to asking, “what is better, a car or an airplane?” It all depends on the use case, a car isn’t great for travelling across the ocean, and imagine if we all had to fly airplanes to our local grocery stores to get groceries.

Image via Shutterstock

While Proof-of-Work generally offers better security and decentralization, it also comes with some heavy trade-offs, mainly its computing power and lack of scalability with transactions being less efficient.

While Proof-of-Stake can be far more efficient in terms of scalability and transaction fees, PoS systems suffer from increased centralization risks and the algorithm has not been verified as secure as PoW.

Perhaps the most worrying aspect of PoS is the number of censored transactions we have seen as we saw as high as 73% of Ethereum transactions being censored due to not being OFAC compliant. Censorship and centralization are the very antitheses of what cryptocurrency was created for, and many PoS cryptocurrencies fall under this umbrella.

“Ethereum's Censorship Problem” Image via Coindesk

The jury's still out on which mechanism is best, and both mechanisms are still evolving and advancing, as technology always does. It is likely that both will remain in existence for a long time to come as layer two solutions and new PoS variations such as Delegated Proof-of-Stake, Leased Proof-of-Stake, Proof-of-History, and others are adopted and advanced further. As new technology develops, so will the way we use it.

Here I will sum up the pros and cons of each and you can decide for yourself if Proof-of-Work or Proof-of-Stake is best.

| Proof-of-Work | Proof-of-Stake | |

| Pros | Proven security track record & Promotes decentralization | Lower energy consumption than PoW |

| Better protection against Sybil and 51% attacks depending on the project | Highly Efficient transactions & can support low transaction fees | |

| Encourages renewable energy and sourcing the lowest cost energy for mining | Highly scalable | |

| Provides high levels of certainty from predictability & Difficulty adjustment ensures network operates at consistent rate | Can reduce mining centralization due to reduced hardware requirements | |

| Can provide fairer distribution of coins for miners | More easily upgradeable and adaptable | |

| Many coin projects can be mined from home with simple computers | ||

| Cons | High energy consumption for most networks | Large stakeholders can lead to centralization |

| Less scalable than PoS & often slower transaction throughput and settlement times | Transactions can be more easily censored | |

| Can become less decentralized as mining centralizes | Security risks from chain reorganizations & more attack vectors to exploit than PoW | |

| Hardware requirements can cause high barrier to entry for miners | Monetary incentives to behave honestly may not be enough for security | |

| Difficult to implement changes and upgrades to the network | Votes can be swayed to favour higher stake holders, creating an oligarchy-style governance system | |

| Some networks are vulnerable to 51% attacks | Hasn’t yet been fully tested and proven at large scale like PoW | |

| More susceptible to 51% attacks on small market cap projects |

Consensus Mechanisms FAQs

Is ETH Proof-of-Work or Proof-of-Stake?

Ethereum started as Proof-of-Work then transitioned to Proof-of-Stake in 2022 in an event known as “The Merge”

Why is PoW better than PoS?

Generally speaking, PoW is more secure, battle-tested, and promotes decentralization more than PoS. There are a few exceptions to this rule.

Why is PoS better than PoW?

Generally speaking, PoS is more scalable than PoW and has more efficient transactions, with lower energy consumption and lower transaction fees. Again, there are exceptions to this rule depending on the crypto network.