Here at the Coin Bureau, we believe that the mettle of something good can be tested over and over again and not found wanting. That was the approach we took with OKX, an exchange that might have flown under lots of peoples' radars. Despite the number of “opponents” we've hurled at it, ranging from big names such as Coinbase, Binance, and Kraken, to smaller ones like Bitget and Bybit, it has, in each round, managed to stand its own ground.

In this OKX vs PrimeXBT issue, we're pitting it against PrimeXBT, another popular cryptocurrency exchange. Let's find out if PrimeXBT can be the one that has the ability to put a dent into OKX's battle-tested hide!

Page Contents 👉

- 1 OKX vs PrimeXBT: Summary

- 2 PrimeXBT vs OKX

- 3 PrimeXBT vs OKX: Products Offered

- 4 PrimeXBT vs OKX: User Friendliness

- 5 PrimeXBT Fees vs OKX Fees

- 6 PrimeXBT vs OKX: Security

- 7 PrimeXBT Overview

- 8 PrimeXBT Products

- 9 Types of Accounts and PrimeXBT Fees

- 10 Prime XBT Security

- 11 OKX Review

- 12 OKX vs PrimeXBT : Conclusion

- 13 FAQ

OKX vs PrimeXBT: Summary

| PrimeXBT | OKX | |

| Headquarters: | Seychelles | Seychelles |

| Year Established: | 2018 | 2016 |

| Regulation: | None | Virtual Asset Trading License HK SFC

VFAA compliant |

| Spot Cryptocurrencies Listed: | 40+ | 350+ |

| Native Token: | None | OKB |

| Maker/Taker Fees: | Trading Fee: 0.05% | Lowest: -0.005%/0.020%

Highest: 0.080%/0.1% |

| Security: | High | Very High |

| Beginner-Friendly: | Advanced trading concepts can be confusing for beginners. | Advanced trading concepts can be confusing for beginners.

Good platform to learn how to trade. |

| KYC/AML Verification: | No | None for limited trading. Users will need to KYC to reach higher volume trading limits |

| Fiat Currency Support: | Yes-Deposit only | Purchase crypto with 90+ fiat currencies |

| Deposit/Withdraw Method | Deposit – Purchase crypto via bank card or transfer via third-party companies.

Withdrawal-Crypto only |

Deposit- Buy crypto with 129+ supported services for bank transfers, card purchases, Apple Pay, etc. and Crypto.

Withdraw– Crypto only |

PrimeXBT vs OKX

Like Bitget, PrimeXBT is an exchange specialising in derivatives. You won't find it listed in the centralised crypto exchange chart on Coingecko, which is where OKX can be found. However, it is listed in the no. 10 spot on the derivatives page, just a few spots below Bitget Futures (no. 6) and way below OKX Futures (no. 10).

What differs PrimeXBT from the rest of the crypto exchanges covered previously is that PrimeXBT is not only in the crypto market, it also offers the ability to trade in forex, commodities, and stocks. This makes it an all-in-one one-stop trading shop for a trader looking to trade just about anything (except maybe their own grandmother).

Unlike OKX, PrimeXBT does not have its own token or blockchain. In fact, it more closely resembles a firm on Wall Street offering crypto trading services than a crypto exchange in the Wild West of Cryptoland. The company has 150 employees spread out amongst three offices while all trading activity is taken care of by Amazon's AWS servers in London and Frankfurt.

OKX, in comparison, is almost the exact opposite of PrimeXBT. Not only does it offer crypto trading, but it's also one of the few exchanges providing a taste test of Web3 applications through its own platform and with its next-generation Web3 crypto wallet. Anyone interested in dabbling a bit in Web3 will be able to easily navigate amongst the applications without the complexity of Web3 were they to try these applications natively on their own web pages.

Its native token, OKB, as previously mentioned, is used to pay for gas fees interacting on the OKC chain, which is built on the Cosmos blockchain. Token holders can also use OKX to get a discount on maker/taker fees.

We're definitely not comparing apples to apples here in this showdown, which makes it all the more interesting. Let's continue to see how they continue to stack up against each other in various areas.

PrimeXBT vs OKX: Products Offered

Aside from the different kinds of market access that PrimeXBT offers, the products on its platform aren't too dissimilar to what OKX has. It might even be a bit on the thin side but it has all the trading tools to make any trader happy. Below is a short list of what's on offer at PrimeXBT:

- Margin trading with up to 200x leverage on crypto, and up to 1,000x on other assets

- Ability to buy crypto via card or bank transfer

- Copy trading

- Trading contests

- Trading Academy to help newbies get started in the trading game.

They also offer a variety of trading tools such as long/short trading, Bitcoin leverage, and charts for crypto, forex, stocks, and commodities.

On the OKX platform, there's a whole lot more variety going on to whet any beginner's appetite. Their list includes:

- A variety of trading options such as spot, perpetual swaps, futures, margin, options, and trading bots.

- Ways to earn and grow your holdings with Savings, Shark Fin, ETH2.0 staking, Fixed Income, and staking for other assets.

- Loans

- Jumpstart – OKX's platform showcasing new, cutting-edge projects.

- Demo Trading – great for beginners new to the trading game. Advanced traders are also free to use it to test out new strategies.

- Access crypto via 90 fiat currencies

- Easily swap between different crypto pairs with the “Convert” feature

- Go to the “Explore” section to give DeFi and Web3 dApps a try

- NFT marketplace to some NFT trades

- Copy trading – the latest feature for OK clients

👉 Sign up to OKX and get a 40% discount on trading fees for life!

PrimeXBT vs OKX: User Friendliness

Before we begin, I'd like to say upfront that PrimeXBT is really not designed for beginner traders. Their bread-and-butter is in earning trading fees from experienced traders, as you can see from the amount of leverage they offer. Other exchanges such as Kraken and Swissborg offer more beginner-friendly platforms, so feel free to check those out if that's where your level is at.

Caution: Margin trading, especially with high leverage, is an extremely risky activity resulting in traders getting rekt'ed more often than not so please approach it with the greatest caution.

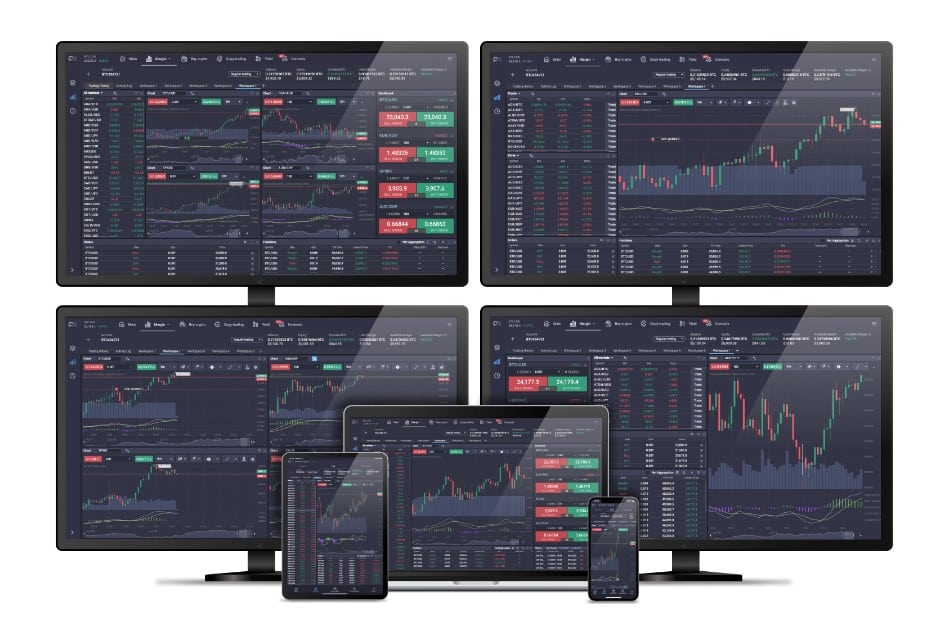

If you're familiar with the layout of a trading chart, then you'll have no problem navigating either PrimeXBT or OKX's trading platforms. Both feature great UI/UX and offer the convenience of trading apps. In this instance, PrimeXBT has a small edge over OKX as their app even won an award for being the best crypto trading app!

What also makes PrimeXBT stand out from most of the other crypto exchanges is that it doesn't integrate with TradingView, which may be familiar to most crypto traders these days. Instead, they developed their own interface complete with their own set of trading tools and indicators for traders to use. This makes their screen highly customizable, which can be a delight. Some of the functions that traders can do are adding or removing widgets, colour-coding the chart according to their preference, or even changing the spacing or shuffling panels around to create a highly individual experience.

The Main Trading Platform on PrimeXBT

The trading platform on PrimeXBT may not look as flashy as what OKX has, but it serves its loyal followers well, even if it does seem slightly dated. This is what OKX's platform looks like:

A Look at the OKX Trading Interface

One thing I really like about OKX is the top 10 movers which, in a bull market, allows me to quickly see at a glance if there are any buying opportunities that are still available. Sometimes, it's not too late to join the party!

The “Buy and Convert” feature is a really easy way to trade crypto as it involves exchanging one crypto for another, without the need for a trading chart. This is for those who are not too price-sensitive and are simply looking for a convenient way to swap some crypto.

Easily Buy Crypto on OKX

PrimeXBT Fees vs OKX Fees

Trading platforms like PrimeXBT and OKX are all about trading volume. In that sense, neither will want to be caught with high fees as that is a sure sign to drive business to the other competitors.

PrimeXBT takes a simple approach to fees by limiting it to only two types: trade fee and overnight fee. Entering a position gets the former while the latter is for any positions held overnight. Here's what is being charged:

- 0.05% for Cryptocurrencies

- 0.0001% for Forex, Indices, and Commodities

Note ✍️: PrimeXBT also has dynamic financing fees. Check out the fees section to confirm the exact fees on the day.

When it comes to withdrawals on PrimeXBT, it's a slightly different story. Fees vary based on crypto assets as you can see from below.

- 0.0005 BTC

- 0.002 ETH

Fees even vary based on the network used in addition to the type of asset involved.

For ERC-20:

- 10 USDT

- 10 USDC

- 5 COV

For BEP-20:

- 0.8 USDT

- 0.8 USDC

- 2 COV

High-roller discounts are available for institutional traders and those who trade more than 300+ BTC worth of volume in 30 days.

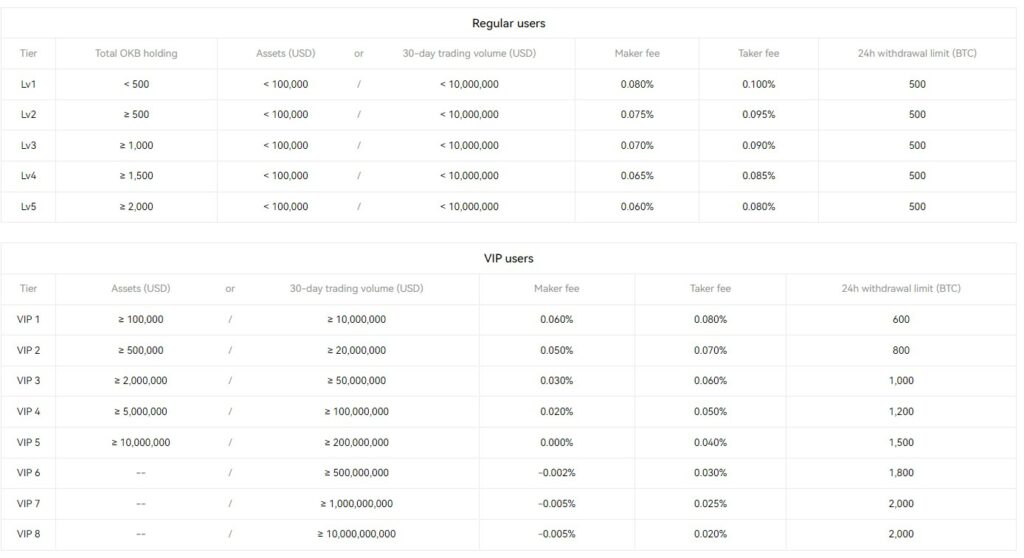

In contrast, OKX fees follow a tiered system and also distinguish between regular and VIP traders. To get to that level, you'd need to be trading at a minimum of USD100k to qualify for a 0.06% maker fee and 0.08% for taker fees.

Image via OKX

Since January 2023, OKX added the functionality of fiat withdrawals which is certainly a much-lauded addition by traders. Buying crypto through OKX results in some pretty hefty fees, half of it probably going to the third-party payment providers charging for the service.

PrimeXBT vs OKX: Security

Security is always the no. 1 factor to consider when deciding which crypto exchange to use. All it takes is one misstep to destroy years of reputation. Therefore, any exchange worth its salt would pay special attention to this aspect. Neither PrimeXBT nor OKX dares to be exceptions.

PrimeXBT uses Cloudflare's technology to protect itself against DDoS attacks while their in-house security team conduct regular tests and implements measures to safeguard the platform. OKX is no slouch either. In fact, they can proudly proclaim that they’ve not suffered any kind of security breach since 2017.

Both platforms diligently follow industry best practices by storing most of their crypto in cold storage. OKX also uses both online and offline storage and multiple backups with location-separated QR codes for key personnel. Multi-sig authorisation for any movement of funds is a must for both platforms, thereby preventing the “one bad apple” scenario that allows compromisation to occur.

Other security measures taken by OKX include:

- A limit of 1000 BTC for each cold wallet, used once only.

- The encryption of private keys are stored in an offline computer using AES technology. Only the offline ones are accessible via QR codes, in paper form, and are stored in bank vaults around the world, all requiring physical access.

Even if an unfortunate incident were to occur, OKX has the ability to reimburse users from a special risk reserve fund set aside precisely for this purpose. This would surely go a long way to reassure OKX customers that they can safely trade on their platform.

Customers can also do the following to secure their own account:

- Login Password

- Email Verification

- 2FA for login

- Google Authenticator

- Mobile Verification

- Secondary password for withdrawals

- Anti-phishing code

PrimeXBT Overview

What is PrimeXBT?

Unlike OKX and the other crypto exchanges we've covered previously, PrimeXBT is a CFD exchange, where the buyer pays the difference between the current value of an asset and its value when the contract was made. Therefore, aside from crypto, it also offers other markets such as commodities, stocks and indices all in one place. It's a popular exchange for experienced traders looking for very high leverage.

On their web page, they are officially registered in Seychelles with offices in St Vincent and the Grenadines. Switzerland is the next potential location for expansion but it could take a while, what with legal compliances etc. However, a few million traders in more than 150 countries have access to its services.

What also makes it stand out from other crypto exchanges is that it has more than 12 liquidity providers, thus making it easy for people to get money onto its platform. Its average daily trading volume stands at around 1 billion on average.

Cryptocurrencies Offered

Since the exchange got started from the depths of the TradFi market, adding crypto to its offering indicates its interest in expanding into this part of the financial world. Recently, another well-known trading institution, Interactive Brokers, also did something similar. I take it as a good sign that traditional exchanges are also elbowing their way into the crypto space. At the very least, it will drive more traders, bringing liquidity along with them.

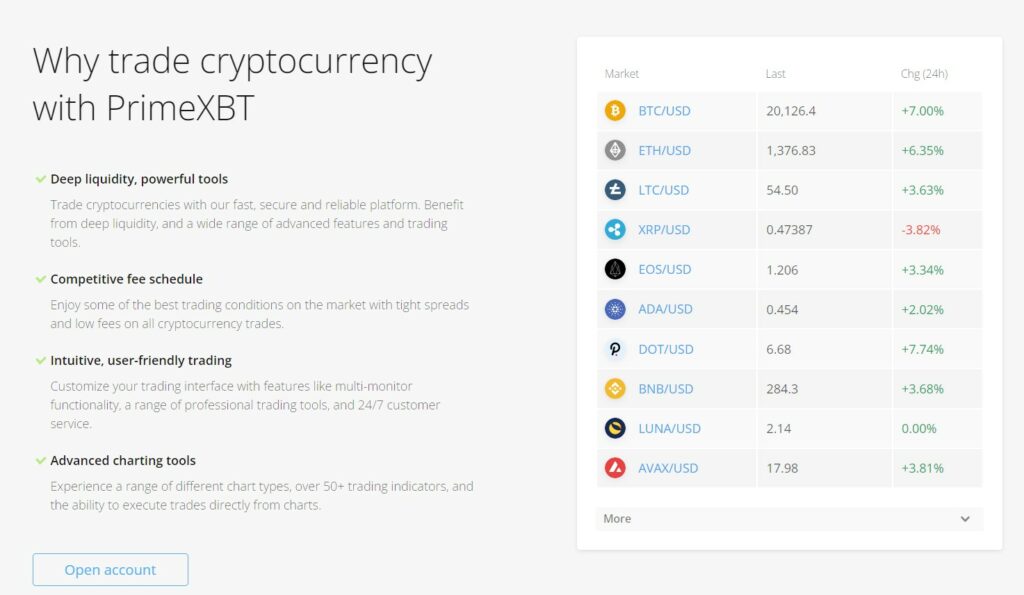

Being new to the crypto trading game, it doesn't have the most attractive offerings as they don't do spot trading, only CFDs, which, to be fair, is a preferred tradeable instrument for certain traders. The range of cryptocurrencies supported is also a handful compared to OKX. These include the main ones like BTC, ETH, LTC, XRP, DOT, and more.

What gives it an edge is that crypto traders can have access to non-crypto markets and that it's convenient for adding liquidity as you can do bank transfers, not just buying crypto with credit card.

Image via PrimeXBT

PrimeXBT Products

Let's take a bird's-eye view of the products available on PrimeXBT. For more detailed coverage of the platform, please check out our PrimeXBT review.

Trading Platform

One big feather in PrimeXBT's cap is the number of awards they've garnered for their trading platform and app. Granted, these awards are given by Forex Awards, an association that likely doesn't deal much in crypto. Still, it's worth something.

Image via PrimeXBT

The trading platform itself offers quite a number of advanced features and innovative trading tools that would appease even the pickiest of the technical traders out there. As mentioned previously, they provide a highly-customisable layout combined with multiple order types to support the multitudes of trading markets available on their platform.

In addition, PrimeXBT's award-winning mobile app allows traders seamless trading between both devices wherever there is Internet access available. The amount of accolades is backed by many positive reviews online together with its army of loyal users.

Image via PrimeXBT

PrimeXBT Copy Trading

One of the most popular trading trends in recent years is copy trading. This is partly due to the influx of new traders, (no) thanks to Covid lockdowns and the gradual adoption of crypto. Most of the people who got into the crypto space were through trading, unlike me, who got involved due to crypto scams. It's one thing to learn on your own but if you can learn through watching others, that might help solidify your trading knowledge.

For the experienced trader that doesn't mind being copied, they can also earn some side income while trading without having to do any extra work. Sounds like a good deal, right? In the era of specialisation and diversification, one specialist can easily learn from another. For example, someone who specialises in trading stocks can copy a crypto trader or vice versa.

PrimeXBT's Copy Trading product is powered by Covesting, whom they previously worked together in providing the Earn product that looks to have been discontinued.

Image via PrimeXBT

If you would like to learn more about copy trading, check out Gate.io as they are one of the top crypto copy trading leaders in the space. Read more about it in our Gate.io review.

PrimeXBT Trading Contests

Traders are known for their somewhat braggadocio demeanour. I attribute this to the mostly testosterone males roaming in this field. One-uppance is sweetest when you can publicly declare your smarts amongst the smartest. The best place to do this is in trading contests.

Of course, everyone is very practical and any trading contest would have some juicy prizes ripe for the winners. Usually, trading contests involve real money such as the kind you'd find in KuCoin and Binance. In PrimeXBT's version, however, these contests are given a devilish twist by having traders compete in a demo account with virtual funds with the winners getting real rewards like USDT cash prizes.

Image via PRimeXBT

Not only can users participate in the trading contest set up by PrimeXBT, they can also design their own for the trading community. How cool is that!

Launch a Trading Contest for Your Community with PrimeXBT

I daresay this product contributes a fair bit to the platform's popularity as it is not something often seen elsewhere, making it PrimeXBT's unique selling point. What makes PrimeXBT really powerful is that its popularity is also backed up by the ability to trade multiple asset classes on a high-performance trading engine and super-customisable interface. Traders can get a satisfyingly meaty bite out of this platform.

👉 Sign up to PrimeXBT and enjoy copy trading and trading contests!

Types of Accounts and PrimeXBT Fees

Keeping things simple is PrimeXBT's approach to account type and fees. Only one kind of account for everyone and a flat 0.05% trading fee for all crypto assets and 0.0001% for forex, stocks, and commodities. Margin trading also incurs overnight fees.

When it comes to crypto withdrawal fees, it is quite a different story as these vary according to asset and in some cases, the type of network used to make the transfer. For the latest information on the kinds of withdrawal fees charged, please check out their Fees page.

Prime XBT Security

Having been in the exchange space for a number of years and not suffering any major losses, it's reasonable to assume that they have a solid security plan in place. Here are just a handful of the security measures they have in place:

- 2FA for secure account access

- Mandatory whitelisting of Bitcoin addresses

- All passwords are cryptographically hashed

- Cloudflare for potential DDoS attacks

- Cold storage of funds with multi-signature access from multiple staff members.

On their Security page, they also state that they run a full risk check after each order that is executed. This is in addition to other regular tests and checks performed by their security team.

One thing worth noting is that they put somewhat of a reliance on Amazon's AWS security infrastructure too since that's where the trades are executed on. I'd say this is a double-edged sword and requires a fair amount of trust in both the exchange and AWS.

OKX Review

OKX is one of the more reputable exchanges in the crypto space. Based in Seychelles, the exchange is part of the OK Group, founded by Xingming Xu in 2013. In 2017, it was established as a subsidiary of OKCoin.

The target audience of the platform is aimed at both traders and non-traders alike. This is seen in its product mix and friendly UI/UX design. Those in the trading game would appreciate the clean and easy-to-navigate interface coupled with the variety of trading options such as spot, derivatives, margin, futures, perpetual swaps, and options markets. The general public interested in earning some yield from holding tokens can take advantage of the range of Earn products while exploring the Metaverse, NFTs, DeFi and GameFi dApps through the OKX Wallet. However, due to the regulatory environment surrounding crypto in the US, OKX has also rescinded the ability for US clients to participate in their Earn program.

The trading interface comes in two versions: a basic for traders new to the game and an advanced version for experienced traders. There is also a cool feature known as the Demo Trading feature that can be used as a sandbox or testing ground, depending on your trading experience.

OKX also offers a Learn section where users can go to learn more about general crypto knowledge and trading ideas. The section also has a few posts on industry analysis to get an overall view of what is happening in the market.

Fiat and Cryptocurrencies Available on OKX

More than 90+ fiat currencies worldwide are available on OKX. These can be swapped for 350+ crypto assets through the spot, margin, and derivatives markets via 500 trading pairs.

OKX Products

As this is a general overview of what OKX offers, what is mentioned is just a glimpse of the products. If you would like to find out more about each of the products, be sure to check out our dedicated OKX review.

OKX Trading Platform

The trading section on the OKX exchange has three sections:

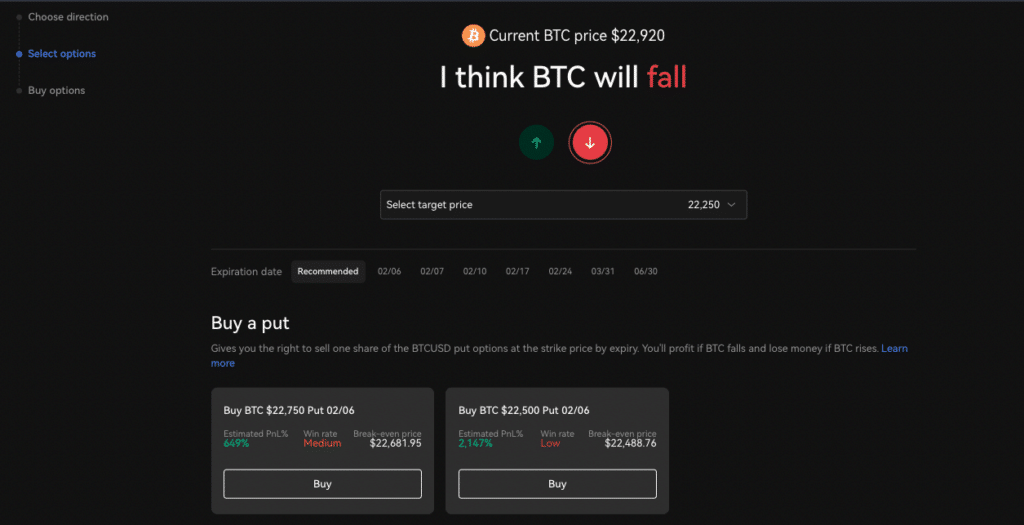

Basic trading has the Spot market and a simplified version of Options. On the trading platform, there is a wide range of timeframes to choose from, with the longest duration of up to 3 months for those who want to see the really big picture. If you want to give Options a try, there are only three steps involved: Choose direction, Select options, and Buy options. Let it be known that options trading is more like gambling. Try not to get stuck in it too much if you can.

Guess which way the price will go and put your best guess down!

The Derivatives and Margin Trading section is where you can do Perpetual Swaps, Margins, Futures, and a more complicated version of Options. Each of them has its own trading interface with little difference from each other and is easy to navigate.

- Perpetual Swaps and Futures allow you to execute Stop, Trailing Stop, Trigger, and Advanced limit orders.

- Margin allows you to execute Stop, Trailing Stop, and Trigger orders.

All of them also offer the standard Limit and Market orders as part of the trading choices.

Another popular feature on OKX is Trading Bots. Currently, more than 900k+ traders use its auto-trading functions and also have the ability to create their own bots via plug-and-play solutions. The standard bots provided by the platform have their own stats and trading history, which traders can check before making a decision.

Here is what's available to choose from:

- Grid bot

- DCA bot

- Recurring buy bot

- Arbitrage bots

- Smart Portfolio rebalancing bot

- Slicing bots

If you'd like to learn more about how these trading bots work, please check out our article on OKX Trading Bots.

Image via OKX

For those who get a headache just by looking at the trading chart, the Convert feature can be your new best friend as it allows you to swap between crypto and stablecoins. It’s the easiest way to get in the game with zero fees and no slippage.

OKX Earn

Not everyone is suited to be a trader but it would be unfair to restrict the opportunity to reap gains from the increase in crypto prices to only trading alone. This is why Earn products are also very popular. Aside from those that allow one to stake their tokens to participate in the Proof-of-Stake consensus mechanism, centralised entities like OKX also offer a few ways for you to lend your crypto tokens to others and get rewarded for it. Let's see how these work on OKX. For a more detailed dive-in, feel free to browse our OKX Earn article for more information.

Savings – Similar to a savings scheme in a bank, depositors can earn anywhere from 1.00% to 207% (KNC!), and can access their funds for any-time withdrawal. The interest is earned on an hourly basis.

Dual Investment – Restricted to only BTC, ETH, and USDT, one can “Buy Low” and “Sell High”. This feature has a lock-up period and there is a possibility of losing what you put in if the market fluctuates too much.

Fixed Income – The interest from this section is more than what you get in Savings, but it's only restricted to OKB, BTC, ETH, and USDT. It also involves a fixed duration, after which the pool will be closed to new deposits. At the moment, they are not accepting any new deposits so keep a look out on this page if you're interested.

Shark Fin – A new feature on OKX that just launched in early Feb, it allows you to bet on the price of an asset at the end of 7 days. If your bet falls within a certain range and the results mirror this, you can get a higher yield. If not, you'll get less for betting wrong. At least you'll still get something!

Staking – The staking version in OKX is time-dependent. The longer you stake your assets, the higher the yield percentage. What makes it interesting is that each pool has a cap on how much can be staked. The other point of interest is that the ones with the highest yields aren't necessarily the ones to get sold out first.

Flash Deals – For those looking to scratch the occasional gambling itch, Flash Deals could be the one to satisfy that itch. Basically, you have the opportunity to get some really dodgy-looking coins and stake them to earn some ridiculous APYs (52% for BTC up to 300% for MARS!). You'll need to get your eyes glued to the page as they come and go quite sporadically. Be ready to withdraw before the pool disappears!

OKX Flash Deals

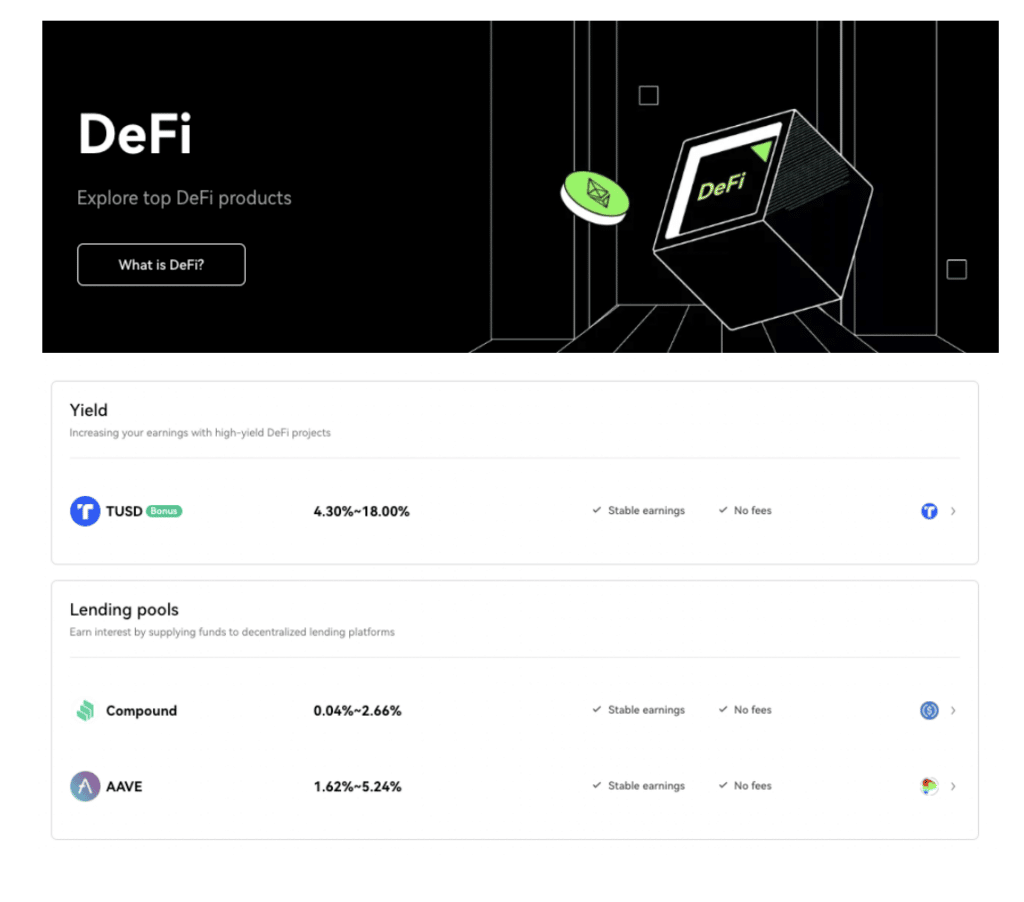

DeFi – This section is definitely designed with first-time DeFi users in mind. Usually, any interaction with a dApp involves self-custodial wallets and various networks, which can be a real headache. What OKX did was to integrate the dApps into their platform by pasting the same UI and feel as other OKX products over these dApps. To the uninitiated, it looks just like an OKX product, greatly lowering the barrier of entry and satisfying the curious-minded.

The dApps found on the OKX platform fall into a few categories: Yield, Lending Pools, Decentralised Exchange featuring Sushiswap, and Staking.

Some DeFi dApps for those interested

ETH2.0 – stake your ETH in exchange for bETH on their platform and earn up to 5.09% interest.

OKX Loans

Borrowers have two options for loans on OKX, known as Flexible and Fixed loans. The APY and duration vary depending on the type of loan chosen. Aside from this, you can also choose between single-collateral or multi-collateral loans. To find out more, check out our OKX Loans review.

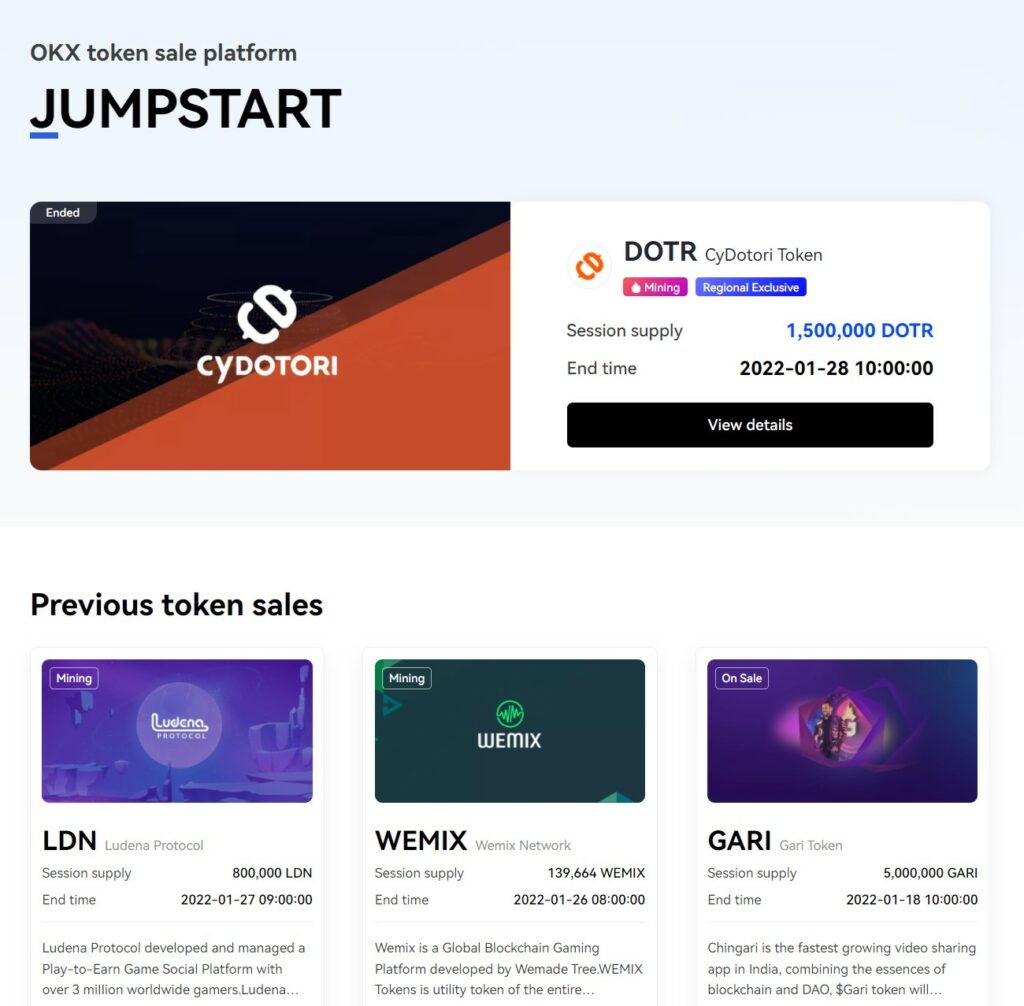

OKX Jumpstart

One thing that can also help drive interest in a platform is if it can be the place where “the next great thing” gets to be discovered. All it takes is one super-popular project and suddenly everyone will flock to it out of FOMO. It's rare for this to happen but it doesn't stop people from trying. At the very least, one needs to lay the groundwork for it to happen, and that's where the Jumpstart program comes in.

This section is where new projects are handpicked by the OKX team to be featured and awaiting discovery (to be the next 100x token). Just like how other similar programs work on Binance and KuCoin, joining the party involves staking the platform's OKB token to get the new project's token, pro-rated to their staked amount. Thus far, Raydium on the Solana blockchain is the most successful one to date.

Be warned: investing in these start-up projects is risky so read up all you can before investing AND keep a close eye on them after.

Image via OKX

OKX Wallet

No purview into the Web3 world is complete without a non-custodial wallet. To this end, OKX has also ticked that box with their own OKX wallet. Users can access loads of dApps in DeFi, Metaverse, NFTs and GameFi projects by connecting the wallet to them. It reduces the complications normally associated with Web3 and bypasses the pain points, such as no support if they get stuck. It's a smart way to get more newbies on board as the rocky bits get smoothed out.

OKX a Leader in Web3 Innovation. Image via OKX

This tactic made such an impression on us that we did a dedicated OKX Wallet review to talk about it even more.

Types of Accounts and OKX Fees

Trading fees are the bread-and-butter for exchanges. Its charges can be an indication of the strategic direction of the exchange. To this end, it's clear that OKX is very much in the trading business, aiming for high volumes. One is given a choice when opening an account at OKX, as an individual or as a company. For the whales, there is also a third choice of joining the VIP program. The trading fees associated with each account type are evidence of this strategy.

The other type of fee that could also have quite an effect on users is the fee for purchasing crypto. This mainly depends on the service provider chosen. Generally speaking, the most expensive fee you can rack up in an exchange is to buy crypto using credit cards. Think of all the third parties having a finger or thumb in that pie and you can easily see why that's so. One advantage that OKX has is SEPA transfers, which are used mostly in the European market, providing options for cost-friendly deposits.

OKX Security

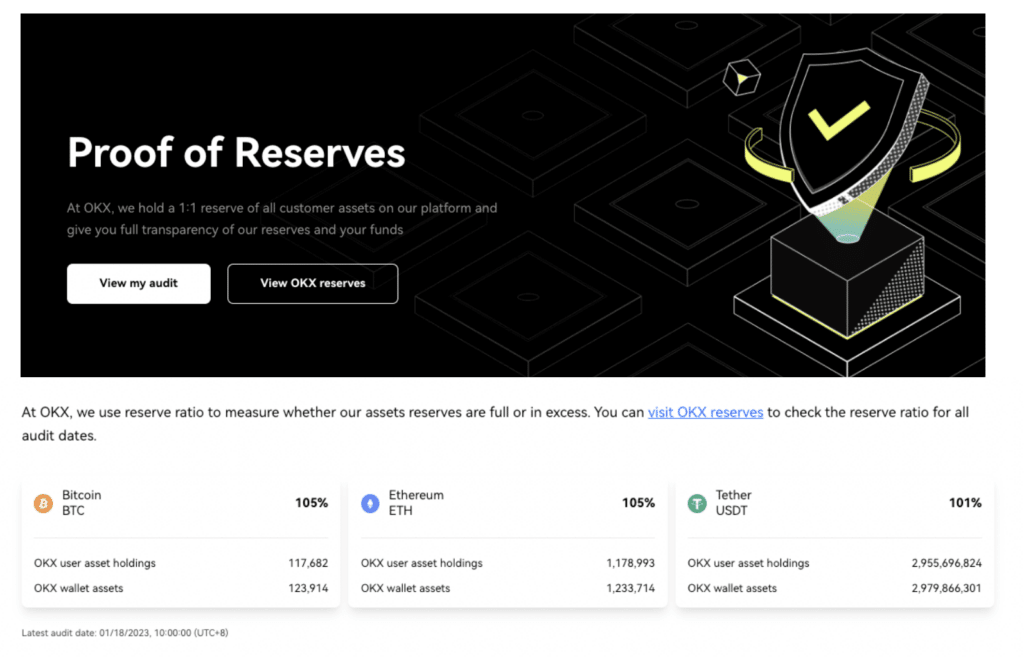

One thing that distinguishes OKX from PrimeXBT is its inclusion in the list of top Crypto exchanges in terms of Proof of Reserves (PoR) by CER. This is by no means any kind of a snub against PrimeXBT, but only to illustrate the underlying focus of each exchange. Given the damage done by the FTX collapse, all of crypto is in a heightened sense of alertness when it comes to what is actually held by the crypto exchanges.

To address this concern, OKX has gotten an audit report done on their own PoR handiwork. The last audit date was on Nov 22nd last year, which is recent enough, as the system currently lacks up-to-the-minute reporting.

On its PoR webpage, OKX lists a holding of 105% of BTC and ETH each and 101% of USDT. Users can also verify the safety of their own funds, whether held on the exchange or in the wallet, on the same page.

Check your funds with OKX's Proof of Reserves

Aside from funds safety that can be traced on-chain, the platform has also undertaken their own security measures, some of which are listed below:

- Mix of online and offline storage. The latter are air-gapped cold wallets that are never connected to the internet, thus reducing attack vectors for hackers and malware.

- Key personnel around the world need to come together to have access to the funds via multi-signature protocols.

- The funds are stored in various bank vaults worldwide.

- An insurance fund, known as OKX Risk Shield, that's worth about $700 million has been set up to make users whole in the unlikely event of a breach in security.

OKX vs PrimeXBT : Conclusion

As mentioned before, this is not exactly an apples-to-apples comparison, mainly because these two platforms are aimed at traders with differing interests. OKX is great for those who are focused more on the crypto end and have some passing interest in Web3 and DeFi. PrimeXBT is mainly for the TradFi traders who have a passing interest in crypto. You could almost say they are from opposite ends of the financial spectrum coming to meet somewhere in the middle. Depending on where your starting point is, feel free to choose the one that best serves your needs.

FAQ

Is OKX better than Coinbase?

Coinbase is a heavily-regulated exchange in the US that offers limited exposure to the DeFi space. This is apparent in its latest move with the Base layer integration with Optimism. OKX has already had one foot in the door with its own native OKB token on its own blockchain. Both move in the EVM/Ethereum space. In terms of offerings, OKX has more variety than Coinbase due to its regulated identity.

Is OKX a good crypto exchange?

It's one of the more reputable ones out there aiming for diversity in product offerings and working hard at being the one-stop shop for all things crypto. Its foray into Web3 is commendable while the basic trading products are sufficient to satisfy the needs of most crypto traders. It also conducts Proof of Reserves on its crypto assets which is a lot more than what you can say about some exchanges these days.

Is PrimeXBT better than KuCoin?

Just like its comparison with OKX, these are two completely different animals roaming in a small sliver of shared space known as crypto. KuCoin is for the crypto moonboys who like to trade in some of the craziest-looking tokens and get high on the at-times extremely volatile nature of crypto price fluctuations. PrimeXBT is for traders who prefer the CFD trade instrument and have a firmer foot in the traditional asset classes.