Members of China’s active cryptocurrency community continue to have their work cut out as the nation’s regulators crack down on all cryptocurrency related activities. In September, Chinese regulators closed in on firms and individuals raising funds via token sales.

The People's Bank of China declared initial coin offerings (ICOs) illegal and called for an immediate end to the practice. This was soon followed up by the decision to shut down Bitcoin exchanges, with Chinese authorities announcing that all Bitcoin exchanges in Beijing and Shanghai were ordered to submit plans for winding down their operations by September 20.

Experts on the inner workings of the Chinese political system expected things to change in the autumn as the Chinese Communist Party (CCP) held its 19th Party Congress in Beijing from October 18 to 25. The twice-per-decade event involves the election of the party’s top leadership and also sets the party’s national policy goals.

It was expected that the strict policies enacted prior to the congress would be repealed after the Congress and replaced with less restrictive policies. It was also expected that the Congress would result in as increase in state regulation across the entire industry.

This has yet to take place, and before the shift in policy, China was the dominant nation in the world of cryptocurrencies. Prior to September, the Chinese Yuan dominated Bitcoin trading markets as did Chinese exchanges such as OKCoin, Huobi Pro, and BTC China. By outlawing ICOs and exchanges the authorities brought this dominance to a swift end and it seems the focus has now turned to mining.

Crackdown Rumours

Earlier this week, reports began to circulate that mining activity was next to be sanctioned as a result of its excessive hydroelectric power consumption. A document circulated by a subsidiary of the State Grid Corporation based in the Sichuan province warned small hydropower stations to cease support for mining pool operations. This was worrisome as the Sichuan province houses many large Bitcoin mining facilities due to the region’s large water supply which generates an abundance of cheap hydroelectric power.

The Sichuan Electric Power Company declared that China’s State Grid was close to banning all Bitcoin mining in the Sichuan province. A document produced by the company announced that “Bitcoin mining is an illegal activity”.

The document was later confirmed to have come from the Dan Ba country branch in Sichuan and local executives have since moved to clarify their statements. Whilst they admit that the report is partially true, officials at the Dan Ba country branch stress that the release was an internal document that had no real relation to any comprehensive regulation backed by the state and also included a number of unverified claims.

A Dan Ba official explained the situation to Chinese publication Caixin

Our power sector is just a business unit, not a state agency, nor does it have the power to characterize whether the production of Bitcoin is illegal or not and there may be a lot of ambiguity in the presentation of the document

Chinese news outlet CnLedger also moved to clear up the rumours and announced that

The head of that company has clarified that they made mistakes on the statement, as they are not a government administrative department, and have no rights to determine whether Bitcoin mining is illegal

It is now thought that the government has no intent of banning Bitcoin mining or any activity surrounding cryptocurrency mining in the region as of yet. In fact, the entire situation may represent something of a power struggle between the regions hydropower stations and Bitcoin mining operations.

Miners Cause Friction

Even though the early reports have turned out to be mere rumours, the entire affair has called into question the country’s ability to sustain Bitcoin mining operations. Up until now, a number of stakeholders have taken advantage of the regions natural resources with the Sichuan Electric Power Company acting as the most important entity in the region.

Sichuan Electric as the national supplier in the Chengdu area of south-western China enabled local hydro stations to make money by providing miners with cheap electricity. This electricity was often surplus to requirements as during the region’s rainy season these state-subsidized hydropower plants often generate an excess of power.

However, some of the grid-connected power stations have chosen to bypass the state power company and instead sell electricity directly to miners who are often located next to the power plants. Around 6 of the region’s 9 stations were suspected of channelling power from small hydropower plants in order to support mining operations against electricity contract requirements.

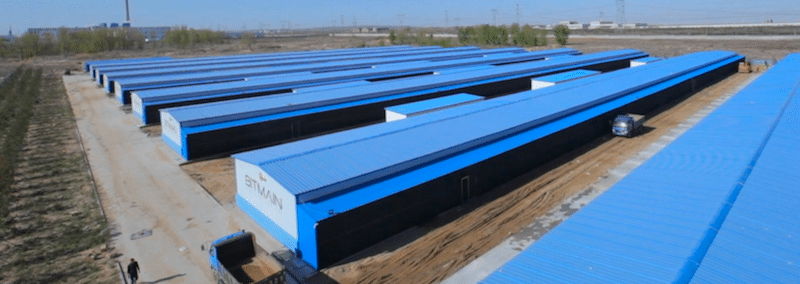

Image via Bitmain

This has led to friction between the Sichuan Electric Power Company and some smaller miners, who temporarily base themselves in Sichuan. Larger mining operations such as Bitmain have agreed to purchase cheap electricity directly from the State grid and enter into contractual agreements with local governments in order to guarantee preferential market prices.

There is also a belief that in regions with abundant hydropower resources such as Sichuan and Yunnan, the state is focussed on moving towards large dam projects and limiting the activities of smaller hydroelectric plants. As a result, the rumblings emerging from the Sichuan Electric Power Company may be more closely related to a general shift in electric power policy than to an additional crackdown on Bitcoin mining in the country.

Exit Plans

Bitcoin mining tends to take place in regions that can offer cheap labour and low-cost electricity, and as a result hashpower has become centralized in these regions. In addition, miners have pooled their resources into large mining farms as they sought to benefit from competitive advantage. Currently, Chinese miners account for over 70% of all Bitcoin hashpower while India, the country in second place accounts for just 4% of hashpower. The USA, Iceland, and Venezuela account for just 5% of total hashpower between them.

Therefore, any ban on hydroelectric plants selling to miners or any significant change in power regulation policy would result in the end of cheap Bitcoin mining in China. Miners would be forced to find new, cheap sources of power and this could result in a complete relocation of mining activity away from the Asian nation.

However, this could also prove beneficial to the Bitcoin network as mining activities would be spread around a number of geographic locations as the playing field had effectively been levelled for miners around the globe.

These latest rumours will only increase the motivation of China’s mining community to try and seek alternative locations. There has been some feeling that Chinese miners were looking to jump ship and the revelation that a considerable number of mining companies have applied to place mining equipment in Russia only backs up this sentiment.

Recent regulatory shifts have resulted in a number of crypto projects relocating to Hong Kong and Japan. The current uncertainty surrounding hydroelectric power legislation may well result in the major Chinese mining pools moving their operations overseas.