To get an idea of just how parabolic meme coin Shiba Inu (SHIB) has been, blockchain sleuths have been quick to point out just how large some of the early investors' returns are.

One wallet that's turned a few heads is one that that originally invested in SHIB in August of 2020. As reported by Morning Brew, we may be looking at the greatest trade in the history of all investing.

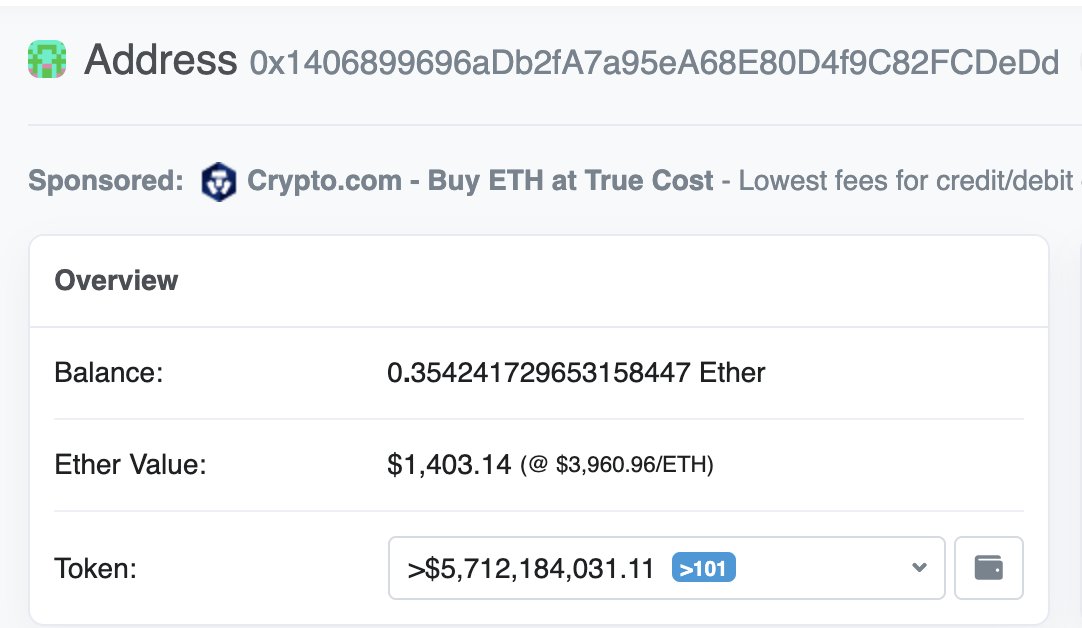

The Ethereum network shows the address of 0x1406899696aDb2fA7a95eA68E80D4f9C82FCDeDd purchasing roughly $8,000 worth of SHIB with some ETH when it was trading at around $0.0000000001 a coin. At the time, this was only about a month into SHIB's existence, with only a few thousand dollars in daily volume being traded.

With SHIB now trading at around $0.00007828, this early meme coin investor has netted more than $5.7 billion in profit.

As amazing as the returns are, many traders will be quick to point out that the market for SHIB is very unlikely to have the liquidity to handle $5 billion in sell orders. At the time of writing, the address holds roughly 20% of the circulating supply of SHIB. How much of the profits the investor is able to take out of the system remains to be seen.

Shiba Inu currently has a market cap of roughly $42,932,673,908, which is almost double that of Deutsche Bank. At the time of writing, it has become a bigger crypto than Dogecoin (DOGE), and also briefly overtook smart contract platform Polkadot (DOT).

Scott Minerd of Guggenheim Investments, who manages over $325 billion in assets under management, said last week that he regretted not putting some capital into SHIB.

“Back in February or March, if you’d invested a thousand dollars into Shiba Coin, you would have $2.1 million today…I wish I’d invested a hundred thousand,” Minerd said. Perplexed by SHIB's rise to prominence, he admitted that he didn't “fully understand” the crypto market,

“The one thing I learned as a bond trader years ago when you don’t understand what’s happening, get out of the market.”