With Bitcoin being a Proof-of-Work (PoW) cryptocurrency, Bitcoin miners compete with one another to compute algorithms for the network.

The problem?

This competitive PoW model inherently necessitates miners consume astounding amounts of energy to facilitate Bitcoin’s public ledger.

Astounding’s no overstatement, either. Current estimates place the Bitcoin network’s annual electricity consumption as analogous to the annual consumption of Nigeria—a nation whose population tops 190 million citizens.

Let’s break the situation down further.

Page Contents 👉

Mining Bitcoin is extremely electrically inefficient

This week the crypto space was set abuzz by a Motherboard article provocatively titled “One Bitcoin Transaction Now Uses as Much Energy as Your House in a Week.”

In it, journalist Christopher Malmo laid out a pretty straightforward argument:

- Annual Bitcoin mining energy consumption is set to eclipse 24 terawatt-hours this year

- Currently there are just over 300,000 BTC transactions every day

- Crunch these two numbers together and you get ~240 kilowatt-hours (KWh) per BTC tx

Then, Malmo shifts into the second phase of his argument:

- American households consume approximately 900 KWh each month on average

- Divide this by the BTC tx energy demand

- The result is that one BTC tx could power an average U.S. home for a week

It’s a compelling narrative to say the least, and one that shines a spotlight on the Bitcoin mining community’s runaway demand for electricity.

We’ve already heard reports this week of miners using Bitcoin mining rigs to heat their homes during the harsh Siberian winters. A great source of heat, surely, but an extremely inefficient electrical activity.

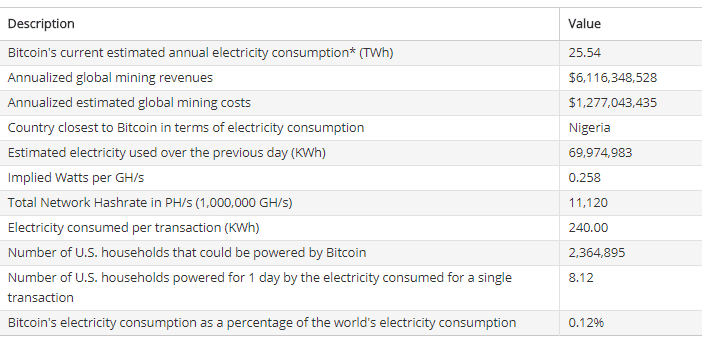

BTC consumption specs

Some of these figures are just astonishing.

See for yourself:

Source: Digicomist

The grand takeaway here is that Bitcoin miners are using more electricity annually than Nigeria—a nation of 190 million—in order to power a network with 300,000 daily users right now.

The incredible disparity here illuminates just how inefficient BTC mining really is.

This inefficiency could impede acceptance over the long-term

With the specter of climate change haunting the world more and more, it goes without saying that the globe in general will strongly trend toward more responsible energy practices in the mid- to long-term.

As it stands, Bitcoin is not a responsible energy practice. At least not in the grander, ecological sense.

If nothing changes with the current dynamic, then, mainstream acceptance and adoption of Bitcoin could be impeded accordingly.

In the very least, mainstream interest could shift to other cryptocurrencies that don’t—or won’t—have the same electrical impact as Bitcoin mining.

Consider the case of the #2 crypto, Ethereum.

This PoS dynamic could make Ethereum and other cryptocoins like it attractive alternatives going forward for users who are concerned with the electrical inefficiency of BTC mining.

Solutions? Renewable energy an obvious choice

The problem with Bitcoin mining right now is that it uses a lot of electricity. And the problem with using a lot of energy is that most of the world still uses fossil fuels to power their energy grids.

Ipso facto, BTC miners are largely relying on fossil fuels, the consumption of which is steadily wreaking havoc on the planet.

If BTC miners could source their energy from 100% renewable sources, then it wouldn’t really matter how much power they use. Fossil fuels would be taken out of the equation, making the practice sustainable.

Alternatively, Bitcoin could transition to a PoS system like Ethereum, though that seems highly unlikely for now.