If one thought that understanding Bitcoin and other cryptocurrencies was complicated, then Ripple is sure to challenge your perception of advanced blockchain technology.

So, what exactly is Ripple and where is it heading?

In order to answer that question we have to first lay the ground work with some fundamental characteristics that make it something completely different from Bitcoin. Sure, it is also a digital currency but it is also a payment protocol.

It is an underlying open source infrastructure that aims to facilitate the movement of money. It is distributed and real time payment protocol for anything of monetary value. In order to best understand Ripple, it helps to take a look at a business model that has been operating for years.

This is the money remittance industry.

Page Contents 👉

Similarities Between Ripple and a Remitter

When someone thinks of money remittances overseas, Western Union is probably one of the most notable companies in the field. They have been used by expats globally for a number of years.

What is most convenient about this company is the relatively decentralised nature of the operation. Unlike a Swift payment with traditional banks, when you make a payment at a Western Union branch, your money does not leave that branch.

For example, let us assume that you want to send something to a relative in another country. You would pop into your local Western Union and give them the cash and tell them where the recipient lives. You would also give them their full name.

Your branch would then let the branch in the location of the recipient know that the person had to be paid. Once that person was paid, there would be an informal agreement that your local Western Union owed the other one. It would either be settled in the future or be netted off with other payments.

It is also important to note that this is inherently based on trust. You trust your local branch, your friend trusts his and the branches have to trust each other as well.

Although a really novel way of thinking about it, this is the general concept of Ripple. Yet, there is much more that can be envisioned with this protocol.

A Distributed Protocol

Ripple aims to be a payment system where anybody can transfer anything of value across the world quickly and with minimal fees. The nature of the Ripple protocol aims to route a payment from one individual to another in the cheapest way possible.

The main difference between the Ripple protocol and the example of the money remitter above is that the two agents in the Ripple network don't really have to trust each other to complete the transaction.

The Ripple protocol allows for the two Agents to find a third party that trusts both of them in order to complete the transaction. Indeed, this does not have to be only one agent, there can be a chain of agents who trust one another.

The protocol will search the entire decentralised Ripple network to try and establish a chain of trust that can be used in this particular transaction.

What is really fascinating about the concept is that anything one ascribes value to can be transferred.

For example, this could include physical assets such as commodities. There is no restriction on what can be transferred as long as both agents connected to the Ripple network are willing to exchange these goods.

Enter XRP

The Ripple token (XRP) is a digital asset that is used on the network as a transaction fee. The cost of these transactions is approximately 0.00001 XRP. Once this has been paid, these are destroyed by the network in order to create a cost and prevent any transaction spamming of the ledger.

The genius of XRP is that it also allows for the facilitation of a transaction even if there is no chain of trust between participants.

In the example above with the remittance operator, if the Ripple network cannot establish this chain of trust then XRP tokens can be used in exchange. The payment gateway will provide a price for the transaction in XRP.

Although acting as a currency of last resort is one of the purposes of the XRP token, there are a number of other advantages that make transacting with XRP so much more efficient.

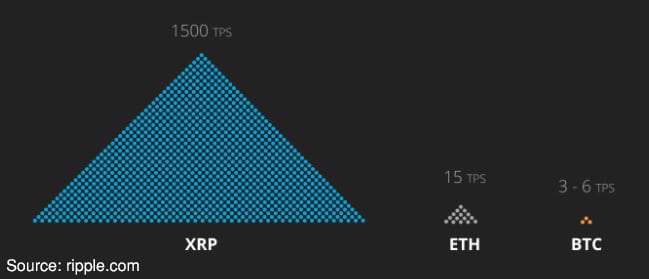

XRP transactions will settle in less than 4 seconds. Hence, when it is sent on the network, the ownership of the asset changes hands almost instantaneously. This is unlike Bitcoin transactions which tend to take a few hours currently. You can see a comparison in the image below of transactions per second.

Moreover, because Ripple is a digital asset with particular verifiable properties, it cannot be “faked” in any degree. This means that there is an inherent trust in the Ripple network. There were also only 100 billion XRP that were ever created. As per the Ripple Protocol, no more XRP can ever be produced or “mined”.

The Tip of The Ice Berg

The potential for Ripple to considerably impact on the nature of the global financial system cannot be understated.

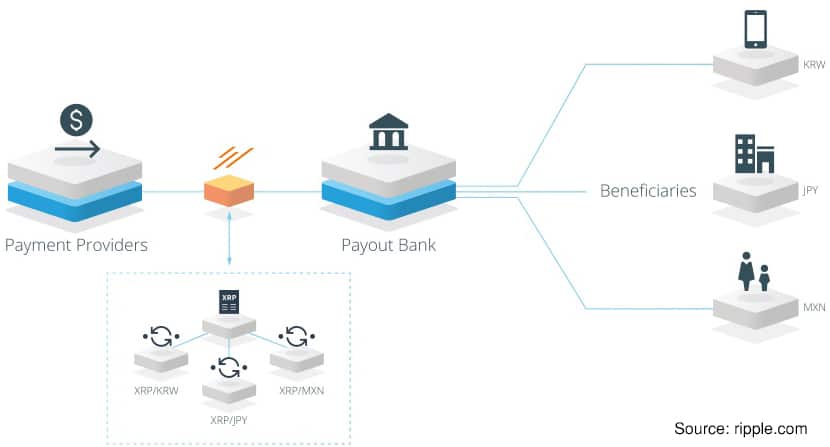

For example, one concept that Ripple is trying to disrupt is that of “Nostro Banks”. These are essentially bank accounts that are held by other banks in a foreign currency. They are kept there in order to facilitate foreign exchange payments.

Ripple views this as a wasted resource that they want to free up. They aim to be a global marketplace for these accounts so that the banks and foreign exchange participants can offer up this “float” for use by others.

It will also allow the money to be sent from a local provider which means that international businesses will not have to deal with costly and slow SWIFT payments.

Ripple also aims to shake up the largest market in the world, that of the foreign exchange market. With over $5 trillion dollars being transacted every day, this is indeed a worthwhile target.

They are aiming to achieve this with the creation of the XRP payment channel. This was announced recently by the company as they released a number of new features that improve their Ledger and XRP Interledger Protocol.

This will allow transaction throughput to increase to tens of thousands of transactions per second which brings eventual scalability to the level of Visa. This will allow people to send money across borders as quickly as they are able to swipe a credit card.

Ripple has also started to make a number of important relationships with companies such as banks and money remittance companies. These players are increasingly aware of tremendous potential in the blockchain.

What makes Ripple so different from other crypto currencies such as Bitcoin is that it does not aim to create a completely decentralised world where banks and financial institutions are not needed.

The developers behind Ripple understand that financial institutions and governments will always be a part of our life. However, they want to work with global institutions to make business as smooth, effortless and quick as possible.

Buying XRP

As the third most valuable cryptocurrency, Ripple XRP is now available on a number of different cryptocurrency exchanges for purchase. For example, you can get it on the Kraken exchange as a fiat gateway where you can buy the tokens with USD.

You can also trade XRP as a derivative Future or CFD product. This allows you to trade the token with leverage that can enhance returns and losses. If you were going to be trading it as a future then you can use the XRP Futures on the Bitmex exchange. Alternatively, if you would like to use a CFD product then you can use a broker like IQ Option.

Once you have got your hands on some XRP you have to find the most appropriate storage options. While leaving a small amount of XRP on the exchange is fine, cryptocurrency best practices will have you storing most of your coins offline.

Storing XRP

There are number of Ripple XRP storage options that are available to you. Perhaps the most secure option is to make use of a cryptocurrency hardware wallet such as the Ledger Nano. This will allow you to store your tokens and easily send / receive them without exposing your private keys to the internet or your local PC environment.

Probably one of the most rudimentary storage options is through the use of a Ripple paper wallet. With this, you will generate a Ripple XRP address that you can then send tokens to. You will need to write down the private key and public address. Once you have sent your tokens to the address you have to use your private key in any Ripple client to send the tokens again.