Pantera Capital has issued a report claiming the Fed tightening monetary policy combined with moves in debt markets could fuel a new monster rally in Bitcoin.

The past two years have seen massive fortunes made in cryptocurrencies and equities as the money printing spurred by the COVID pandemic has lifted nearly every asset class. However, warnings are now being issued over a coming crash due to signs from the global debt markets.

Despite central bankers holding overnight lending rates at historic lows the Treasury markets have seen yields rising quite dramatically, highlighting the potential flaws in the monetary system.

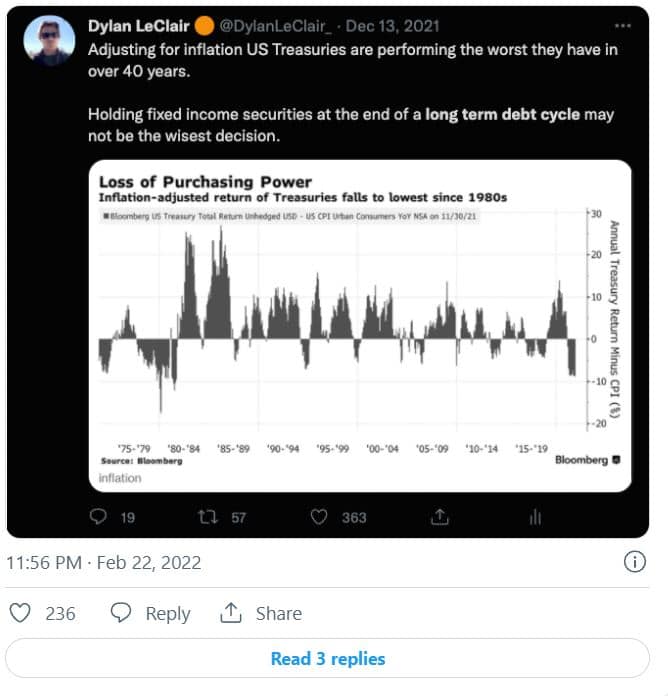

According to markets analyst Dylan LeClair:

“Since November yields have been rising dramatically — bond investors begun to realize that w/ inflation at 40-year highs, they are sitting in contracts programmed to decline in purchasing power.”

Image via Twitter

Naturally investors in fixed income see the coming storm, and they’ve been moving out of Treasuries, sending yields increasingly higher. Worse yet, even with yields on the rise, the real rate, or the yield investors receive from their bonds after inflation, is running at negative 5.52%. That’s the lowest it’s been in 50 years.

Bitcoin has seen a correlation with financial markets, and is also down some 45% from its highs, but analysts at Pantera Capital feel that is about to shift. They note that historically these periods of correlation between Bitcoin and the traditional financial markets last just 70 days on average, and that we’re at the tail end of the latest 70-day correlation.

“And so we think over the next number of weeks, crypto is basically going to decouple from traditional markets and begin to trade on its own again.”

Dan Morehead, the CEO of Pantera Capital posted the following chart on Twitter, suggesting that Bitcoin “seems cheap” and “doesn’t look overvalued” based on the fact that currently its “four-year-on-year return is at the lowest end of its historical range”.

Morehead concluded by saying:

“We are quite bullish on the market, and we think prices are at a relatively inexpensive place.”