We had previously brought you the news of the controversial Litecoin Cash hardfork that attracted comments from some leading cryptocurrency figures.

There were many in the community that claimed that the coin was trying to create confusion around the Litecoin name. Indeed the founder of Litecoin, Charlie Lee, also came out against any cryptocurrency forks that attempted to fly on the coattails of an established coin.

Nevertheless, the Litecoin Cash team progressed and at block 1,371,111, Litecoin Cash was forked and a new coin (LCC) was born. Once these coins were forked, investors could also have traded them on one of the only cryptocurrency exchanges excepting them.

Yobit, a Russian exchange, was the main destination of the new coins and volatility picked up substantially.

Page Contents 👉

Litecoin Rally Pre Fork

For those investors who had bought Litecoin prior to the fork, they would have picked up the rally pre-fork. The price of Litecoin had reversed the earlier declines and rallied from a low of $150 to over $243 in the span of a week.

While some of this could be attributed to the fact that users wanted to get their hands of LTC in anticipation of the LCC fork, there was some other important news that was lifting the price.

For example, there was news that Litecoin would get its own payment processor, Litepay. This would allow businesses and merchants to start accepting the cryptocurrency which is much faster and cheaper to use than Bitcoin.

Litecoin Cash Lists

The moment after the fork occurred, LCC started making their way onto Yobit exchange. It first listed at $1.2 per LCC token in the early hours of Monday morning.

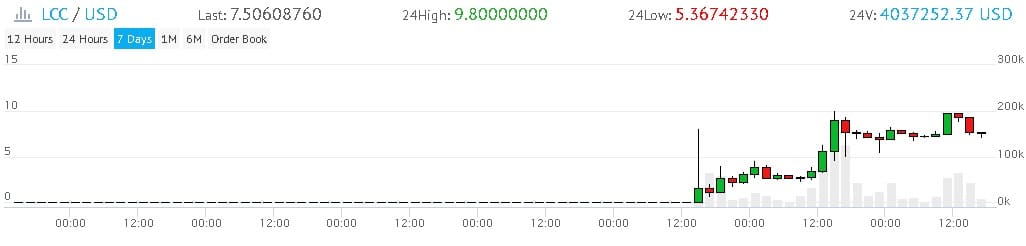

However, trading since then has been quite erratic and the token has rallied by as much as 690% to reach upwards of $9.28. This has since corrected slightly and LCC is now sitting at about $7.34. You can see the recent price swings in the below chart.

Litecoin Cash Price Action. Source: yobit.net

As you can see, the 24 hour volume on this pair is about $4m which places the LCC volume above that of Bytecoin, Decred, and Electroneum. All of these are established cryptocurrencies that are in the top 50 on Coin Market Cap.

Who is Driving Demand?

While this is no doubt a great deal of volume for a brand new coin, it is less clear who exactly is behind it. Most of the established exchanges have not supported the hardfork which means that users who held their funds on exchange did not get the new coins.

Even if users did hold their LTC in a hardware wallet or cold storage, the instructions for claiming the forked coins were quite involved. It would have required the users to transfer their private keys from one wallet to the next.

Hence, it is indeed possible that the this LCC rally could be a Pump-and-Dump scheme by some larger whales in the market. It would be wise for those who do hold LCC or are considering buying them to wait until it has more exchange support.

2018 is Forking Mad

2018 has already been quite a popular year for a number of cryptocurrency forks. There have been numerous Bitcoin forks that were announced as soon as the new year rolled in.

There is also the much anticipated fork of Zclassic and Bitcoin into a new coin called Bitcoin Private. This also led to a massive rally in the price of Zclassic in recent weeks. Unfortunately, there were also withdrawal delays at Cryptopia Exchange which has mired the fork.

While price speculation of recently forked coins is interesting, what does the future hold?

For this, one need not look any further than the largest fork of 2017. The fork of Bitcoin that led to Bitcoin Cash had similar levels of volatility and uncertainty for BCH immediately after the fork. However, prices have stabilized and use of the coins has picked up substantially.

Litecoin cash holders could take comfort from their Bitcoin cash brethren and HODL till a clearer market develops.

Featured Image via Fotolia