According to cryptocurrency exchange Bitfinex, they are currently under what they describe as a “co-ordinated attack”, that is an attempt to create a “market disrupting event”. Specifically, many are claiming that they are unable to withdraw anything from the exchange. Some are even fearing a Mt. Gox type event is in progress, due to issues with falsing issuing units of Tether (USDT). Bitfinex has thus far denied the claims.

The following statements appeared on Twitter from the official Bitfinex Twitter account on November 19th:

Bitfinex is solvent and both fiat and crypto withdrawals are functioning as normal. We are seeing increasing FUD which we believe is a co-ordinated attack to create a market disrupting event 1/2

— Bitfinex (@bitfinex) November 19, 2017

Always ask for evidence before drawing conclusions. We are grateful to those who have defended against these reckless allegations. A formal announcement is forthcoming. 2/2

— Bitfinex (@bitfinex) November 19, 2017

A quick search on Reddit reveals that some people are indeed reporting issues. Some users are claiming that their withdrawals are stuck in a pending state and have been so for more than 24 hours. Still other users have expressed fears that the issues affecting withdrawals are somehow related to SegWit2X.

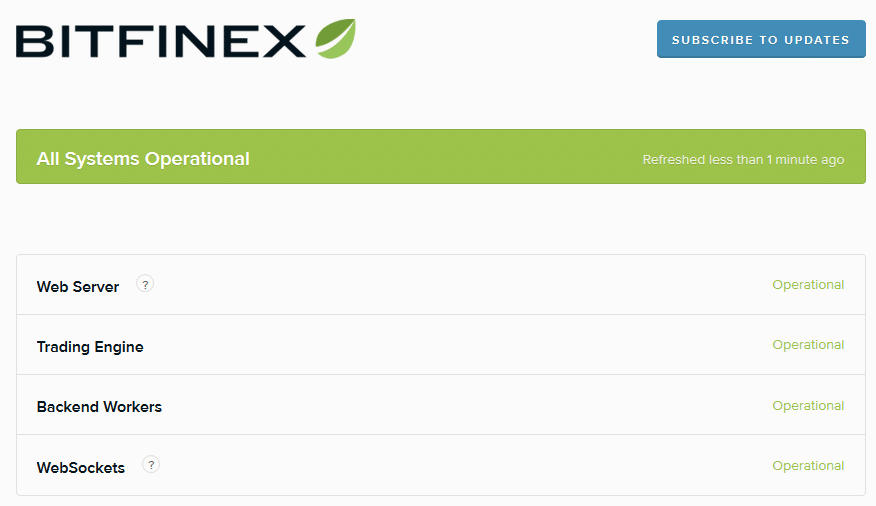

According to the official status page for Bitfinex, all services including withdrawals are working normally. Some Redditors have commented that withdrawals from Bitfinex taking more than 24 hours are par for the course. Others have noted that their support tickets have gone unanswered for days at a time.

Tether Blues

In an article that appeared on Trust Nodes, the accusations against Bitfinex being insolvent are tied to the cryptocurrency known as Tether. For those that don't know, Tether is a cryptocurrency that is backed by US Dollars. In a sense, one Tether is worth roughly one US Dollar, plus or minus a small amount. The accusation against Bitfinex in this case is that they are creating Tether units that are not backed by US Dollars in an attempt to use them to buy “real” cryptocurrency like Bitcoin. The article states that some are even claiming this event to be potentially as catastrophic as Mt Gox.

A large portion of the claims against Bitfinex are coming from Twitter user bitfinex'ed. The name bitfinex'ed being a combination of the name Bitfinex and the term Goxxed, which was used to describe someone who suffered a financial loss from the Mt Gox scandal. This individual recently tweeted the following:

30 million more fraudulent tethers, coming right up. November is officially the most tethers they have printed in one month. Imagine that, no legitimate banking, with a product that doesn't work. pic.twitter.com/WVdrGAvg3R

— Bitfinex’ed 🔥 (@Bitfinexed) November 17, 2017

Finally, the article links to a posting on Pastebin, which at first glance appears to be an e-mail or other communication, and details a theft of more than 100k Bitcoins from back in 2016. Apparently, a deal was struck between Bitfinex and bitfinex'ed, but the deal went south, and bitfinex'ed is out for revenge. At least this is what available information would suggest.

Is any of this reliable?

At this point, all we have are the statements and evidence presented by bitfinex'ed, and the claims that this is an intentional attack from Bitfinex. This by itself is not enough to declare that anything is going on, and could just turn out to be a disgruntled contractor out for revenge. Or, it could turn out to be true, and this could become a much larger scandal. Again, however, at this point there is simply not enough information to draw any concrete conclusions.

Featured Image via Fotolia