Bybit is a cryptocurrency and derivatives trading exchange that launched its services at the end of 2018.

The exchange gives traders the ability to trade Cryptocurrency perpetual contracts with up to 100:1 leverage. In their short time in operation, the exchange has managed to build up sizable liquidity.

However, can such a new exchange really be trusted?

In this Bybit review, we will give you everything you need to know about the exchange. We will also give you some top tips when it comes to trading crypto futures.

Bybit Overview

Page Contents 👉

- 1 Bybit Overview

- 2 Is Bybit Safe?

- 3 Bybit Review: Leverage

- 4 Bybit Fees

- 5 Bybit Registration

- 6 Bybit Review: Deposits/Withdrawals

- 7 Bybit Trading Platform

- 8 Bybit’s Earn Program

- 9 Bybit Launchpad

- 10 Bybit NFTs

- 11 Inverse vs. USDT Contract

- 12 Market Analytics Data

- 13 Testnet

- 14 Bybit Mobile Apps

- 15 Bybit Customer Support

- 16 API

- 17 Bybit Reward's Hub

- 18 Bybit Referral / Affiliate Program

- 19 Trading Competitions

- 20 Bybit Top Benefits Reviewed

- 21 What can be Improved

- 22 Bybit FAQs

- 23 Bybit Review: Conclusion

- 24 Bybit Exchange

| HEADQUARTERS: | Dubai |

| YEAR ESTABLISHED: | 2018 |

| REGULATION: | Granted an in-principal license as a Virtual Asset Service Provider in Dubai |

| SPOT CRYPTOCURRENCIES LISTED: | 100+ |

| NATIVE TOKEN: | The Bybit exchange does not have a native token.

However, it has launched the BIT token for BitDAO. |

| MAKER/TAKER FEES: | Spot Trading – 0.1% maker/0.1% taker

Perpetual and Futures Contract- 0.01% maker/ 0.06% taker fees Options- 0.03% Maker/ 0.03% Taker Users with VIP status unlock fee discounts |

| SECURITY: | 2FA, Cold Storage of Assets, Multi-Sig wallets, Insurance Fund |

| BEGINNER-FRIENDLY: | Yes |

| KYC/AML VERIFICATION: | Required if you wish to withdraw more than 2 BTC a day |

| FIAT CURRENCY SUPPORT: | 20+ Fiat currencies supported via P2P exchange

Direct Fiat on-ramp supports only Argentine Peso (ARS) and Brazilian Real (BRL) |

| DEPOSIT/WITHDRAW METHODS: | Bank Transfer, Credit/Debit Card, Crypto Transfer, Third-party Fiat On-ramps |

Bybit is a cryptocurrency futures exchange that is currently headquartered in Dubai after moving from Singapore in 2022. The exchange operates under Bybit Fintech Limited, which is a company that is registered in the British Virgin Islands.

In their about us page, the exchange claims that they have a team which is comprised of experts in blockchain technology and finance. For example, their technology team has people who hail from Morgan Stanley, Tencent etc. You can check them out on LinkedIn.

The primary product offered on the exchange is perpetual futures products with 100:1 leverage. This means that they are trying to compete with established exchanges such as BitMEX and Deribit which have similar non-expiry futures products.

While there are many similarities between the exchanges, there are some unique features that Bybit have included that could make them attractive. We will touch on these features when we cover their trading technology.

The exchange is open to most traders around the world and the website has been translated into English, Simplified and Traditional Chinese, Korean, Japanese and recently Russian. However, there are some jurisdictions that they do not operate in and these include the likes of the USA, Syria, and the Canadian province of Quebec.

Is Bybit Safe?

This is one of the most important questions that any exchange user will have. This is especially true when it comes to a new exchange with no established security track record to turn to.

As such, when we look into the safety of an exchange, we are interested in their security policies as it pertains to their coin management, user security tools and, of course, risk management.

Bybit Review: Exchange Security

To counter the threat posed by hackers, Bybit operates a secure cold storage solution. This means that they store the bulk of their crypto reserves, and all of the clients' funds, in offline wallets that are stored in a secure “air-gapped” location.

There is only a small portion of their own coins that are kept in their “hot wallets” in order to service the needs of traders when it comes to withdrawals. Moreover, if they ever need to move funds from cold storage, they need to use a multi-signature address scheme.

Multi-signature means that the exchange will need more than one key in order to sign a transaction from one wallet to another. This prevents the risk posed by having a single individual manage all the funds on the exchange.

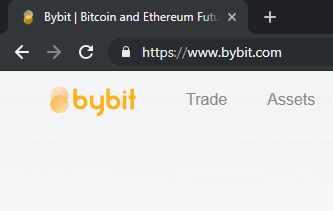

The Bybit site utilizes SSL-encrypted communication to prevent the risk of online snoops and phishing attacks, along with HTTPS secure communication as indicated by the lock icon in the image below.

Always check for the Padlock

As with most crypto exchanges and websites, looking for this lock icon can help ensure you are on a legitimate site and not a scam or phishing site set up to look like the original. If there is no lock icon or the site is not prefixed by “https” it could be an indication of a phishing site.

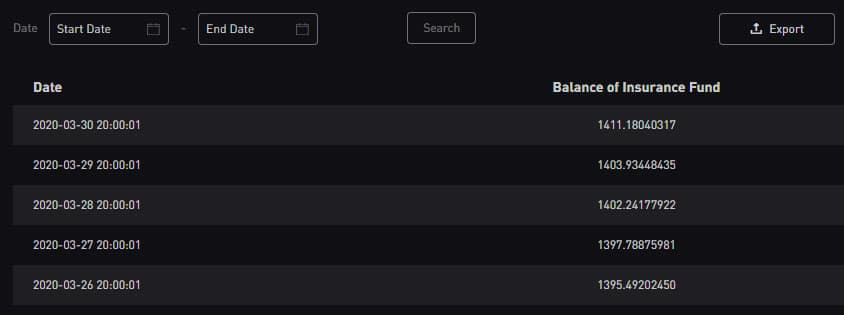

Bybit Review: Insurance Fund

In order to manage the risk posed by shortfalls in futures contract settlement, Bybit operates what they call their “insurance fund”.

Essentially, this fund will be used in the case that a trader gets liquidated at a level that is below their “bankruptcy price”. The latter is the price at which the trader’s initial margin has been completely depleted.

Amount of Bitcoin Currently in the Insurance Fund

Without the fund, there would be a shortfall whereby the counterparty to the trade would not be made whole. It is essentially an insurance policy that will protect traders in the case that Bybit is not able to liquidate the position at bankruptcy price or better.

These funds are replenished with the initial margin that liquidated traders have at the outset of their trade. The difference between the price at which the trader is liquidated and the bankruptcy price is how much will be sent to, or taken from, the insurance fund.

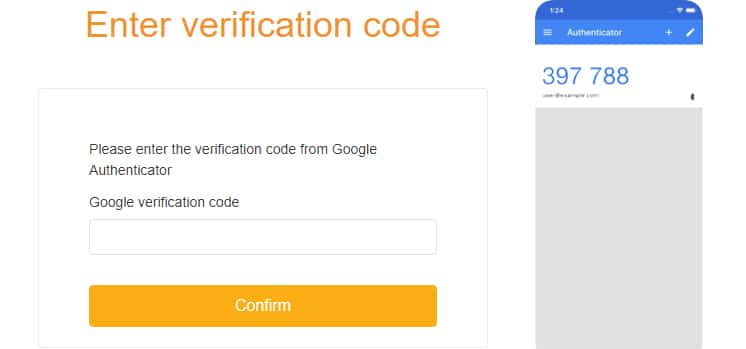

Two Factor Authentication

While exchange side protection is one thing, in most cases the biggest threat to a trader's security is themselves. That is why Bybit has included a number of tools that will help protect your account from a hacker with your password.

2FA with Google Authenticator Application

One of the most important tools that they have included is two-factor authentication. This means that you will have to use your phone in order to authenticate your account or send transactions. You have to enable google authenticator before you are allowed to withdraw any coins.

Bybit Review: Leverage

Given that Bybit is a leveraged exchange, it means that they allow crypto margin trades. Traders will only have to put up a small percentage of the initial position as collateral for their trades.

This means that if you have the leverage of 100x, you will be required to put up a margin of 1% of the initial notional amount of the trade. So, if the notional on a 10BTC contract is $36,000, you will have to put up $360 in initial margin.

What is surprising about the perpetual contracts on Bybit is their size. Each contract is only worth 1USD which is much smaller than the contracts on other exchanges. Below is all the other specifics of their BTCUSD contract.

BTCUSD Contract Specifics at Bybit

They have pretty much the same terms on their ETHUSD contracts. You can find more information about the different contracts on the Bybit Market Overview Page. This is different from other exchanges such as BitMEX which, contrary to Bybit, does not offer a 100x leverage product for ETH yet.

Bybit also offers futures contracts on Ripple (XRP) and EOS. However, these contracts have lower leverage levels with a max leverage of 25x. This is actually quite interesting as we have not seen EOS futures contracts at other exchanges. This could give Bybit a competitive advantage.

While Bybit does offer 100x leverage on their contracts, this is not constant. If you are a large trader and are entering sizable positions then they will bring down the leverage that you can achieve on your contract.

This protects the exchange from the risk posed by large positions. Below is the table of the BTCUSD risk limits. You can find the ETHUSD, EOSUSD and XRPUSD risk limits on their Risk Limit Levels page.

| Position Value | Maintenance Margin | Initial Margin | Max Leverage |

| 150 BTC | 0.5% | 1.00% | 100 |

| 450 BTC | 0.5% | 2.00% | 50 |

| 750 BTC | 2.5% | 3.00% | 33 |

| 1,050 BTC | 3.5% | 4.00% | 25 |

| 1,350 BTC | 4.5% | 5.00% | 20 |

| 1,500 BTC | 5.0% | 5.50% | 18 |

As you can see, the maintenance margin is constant at 0.5% for all contract sizes. However, for larger positions, they will increase the minimum initial margin requirement such that there is a much greater shortfall between the liquidation level and the bankruptcy level.

Liquidation

Liquidation is what happens when you have nearly depleted your initial margin and the mark price hits the “liquidation price”. In this instance, the trader will be liquidated with the rest of their margin, if any, being sent to the Bybit insurance fund.

While there are many traders who may be upset by a liquidation, it is an important risk management tool in a futures exchange and is a part of margin trading. However, Bybit has a number of tools that will help traders avoid the risk of liquidation. These include the following:

- Dual Price Mechanism: In order to prevent the risk of market manipulation on the exchange, Bybit uses a dual price mechanism as the contract reference price. This is composed of the “Mark Price” which triggers liquidation and the “Last Traded Price” which is used to calculate the price at which the position is closed. The former is a global Bitcoin price whereas the latter is the current Bybit market price. Using external pricing inputs reduces singular exchange manipulation.

- Auto Margin Replenishment: If you want to make sure that your position will always have adequate levels of margin then you can set it to auto-replenish. This means that whenever your margin is close to being depleted, it will draw on your funds to keep your position open

- Stop Loss: This forms part of the order options that we talk about below. Having effective stop losses on your positions will ensure that it never gets down to the liquidation level.

Bybit Fees

Trading fees are an important criterion for us because of obvious reasons. This is especially true when it comes to a futures exchange where you are paying fees on positions that are much larger than your margin.

Bybit operates what is called a “maker-taker” fee model. This means that they will charge traders a fee if they take liquidity off their books and they will give them a rebate if they provide liquidity to the exchange.

Below are the fees that you will pay for the futures contracts on the exchange. They are the same as BitMEX for BTC but slightly above for ETH (as they propose higher leverage for it) and are below other exchanges such as Huobi.

| Contract | Maker Rebate | Taker Fees | Funding Rate | Funding Rate Interval |

| BTCUSD | -0.0250% | 0.0750% | -0.0447% | every 8 hours |

| ETHUSD | -0.0250% | 0.0750% | -0.0447% | every 8 hours |

| EOSUSD | -0.0250% | 0.0750% | 0.0100% | every 8 hours |

| XRPUSD | -0.0250% | 0.0750% | 0.0100% | every 8 hours |

| BTCUSDT | -0.0250% | 0.0750% | 0.0100% | every 8 hours |

The other fees that you will see when you open the trade is the funding rate. This is analogous to an “overnight” rate and it is a financing charge. Given that margin trading is based on “borrowing” positions, you will either pay a financing charge or be receiving it. However, contrary to the transaction fees, these fees are directly exchanged between traders and not Bybit.

The funding rate is determined by market conditions and interest rates. This means that it is not fixed and will vary on a daily basis. You will be able to see the funding rate that will apply under the position details when you open your trade.

In terms of deposit/withdrawal fees, Bybit does not charge you anything on this. However, when you are withdrawing your coins you may incur a miner or “network” fee due to blockchain mining. This is usually quite small though.

Finally, you have a relatively small $5 fee that you will have to pay on any Asset exchange orders for exchanging physical crypto at spot. We explain that below.

If you want to find out why there is so much hype surrounding Bybit lately and why they are one of the fastest growing exchanges in the industry, you can win up to $4030 in USDT rewards and take advantage of their $0 Spot trading fee promotion using our Bybit Sign-Up Link

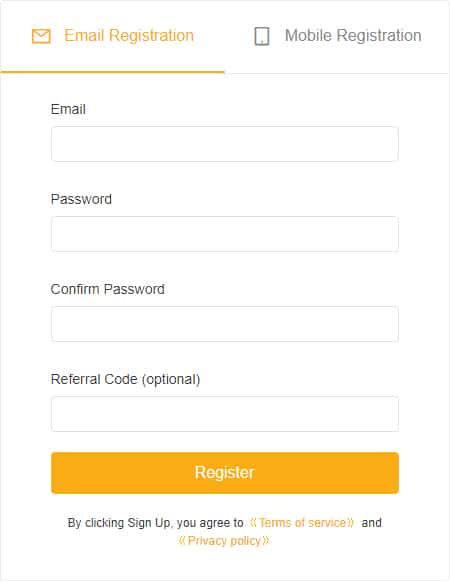

Bybit Registration

If you have decided that you would like to give Bybit a go then you will have to create an account. In order to do this, they will require either an email or phone number, and a password. If you have been given a referral code then you can use this (more on this below).

Once you have registered, Bybit will send you a confirmation code that you will need to use to confirm your email/phone number. This is only valid for 5 minutes so make sure that you do it right after creating the account.

Once you have confirmed your account and logged back in then you could be offered a deposit bonus. These are a great way to augment your trading funds initially. We give you all these details further below.

Bybit Review: Deposits/Withdrawals

Bybit is a crypto only exchange. This means that you cannot fund your account in fiat currency as there is no fiat gateway for fiat on or off-ramps. While this may be annoying for some, you can easily convert your fiat currency into Bitcoin on a number of exchanges such as Bitstamp or Kraken.

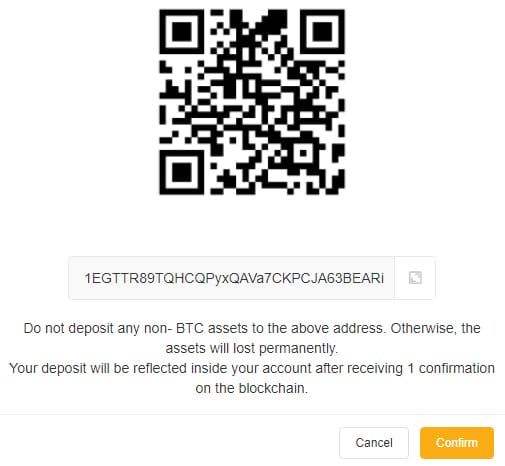

In order to deposit crypto, you will need to generate a wallet address and initiate a transaction into the wallet. You can do this by heading over to your “Assets” section in the header. This will present your wallet balances where you will select “deposit” and it will bring up the BTC / ETH address.

Generating your wallet deposit address

Once you have the address, you can initiate the transaction. It will not be instantaneous as the transaction still has to be propagated through the network and confirmed by the Miners.

Withdrawals are just as easy…

You will hit the withdrawal button on the applicable asset. It will ask for your wallet address as well as to confirm the transaction through 2FA. You will also be given information on the miner fee that will be applied to the transaction.

Bybit processes withdrawal 3 times a day at 0800, 1600, 2400 (all in UTC time). There are withdrawal limits that are set on the accounts although these are not too restrictive. Below are the min/max limits:

- Bitcoin: 0.002BTC / 10BTC

- Ethereum: 0.02ETH / 200ETH

- Ripple: 20XRP / 100,000XRP

- Eos: 0.2EOS / 10,000EOS

In order to make sure that they always have funds available on their hot wallet, Bybit also has limits on daily withdrawals in total from the exchange. These are set to 100BTC and 10,000ETH. If this limit is reached, you will have to wait for Bybit to replenish it from their cold wallet.

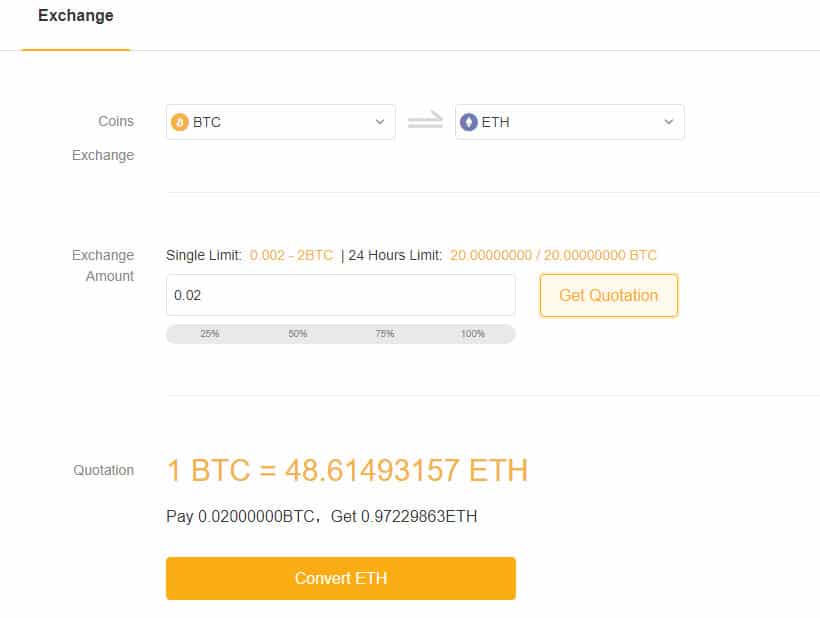

Asset Exchange

This is a new feature that was recently added to Bybit which basically allows traders to exchange their current physical crypto holdings in the spot market.

Essentially, traders currently have four different cryptocurrencies that they are allowed to trade. Asset Exchange will allow traders to take advantage of quick price changes in the market to exchange one coin for another.

Asset Swap Feature at Bybit (Converting BTC)

When they are conducting an Asset Swap, they are not doing so directly with Bybit or with the other traders on an “order book”. Their order is essentially getting routed out to other spot crypto exchanges to be executed.

This will ensure fairness as they will be getting the best market price that Bybit can garner. There are limits that apply to the Asset Swap feature which you can find on their website.

Bybit Trading Platform

One of the most important things for the margin trader is to have an effective trading platform with advanced technology. This is especially true when you are trading with a great degree of leverage.

So, how does Bybit stack up?

The trading platform seems to be relatively well laid out and intuitive. At the top, you can toggle between your wallets and account management. You can also switch between the BTC and ETH futures markets.

Looking at the standard interface, you have the chart and market depth on the left (you can toggle between them). Then in the middle, you have the order book and the last trades. On the right, you have the order forms as well as the contract details.

User Interface of the Bybit Trading Platform

Scrolling down from the main interface you have other important trading information. This includes things such as the current market activity and your assets.

Something that we really liked about their interface is that it is customizable and modular. You can detach some of the modules, resize them, and move them around such that they are in your chosen position.

For those seasoned traders among you, you will have noticed that Bybit uses Tradingview charting technology. This third-party charting package is well-known in the industry for having the most functionality and features.

With Tradingview charts, the budding technical analysts among you can easily lay your studies and follow the important trendlines. It is also in use on a number of other platforms so it is relatively easy for you to adapt if you do move somewhere else.

You will also notice that in your current position/order bar, you have the “ADL ranking” indicator. This will show you where you currently are positioned for potential deleveraging in the case that the ADL is triggered. As mentioned above, this is done to manage risk.

Something that Bybit appears to be quite proud of is their order-matching engine. They claim that this trading engine is able to execute a total of 100,000 transactions per second per contract. So for every new asset they will add, their matching engine will have a dedicated 100,000 transactions per second for that asset only.

Why does this matter?

Well, faster order execution means that there the risk of slippage and trading errors is greatly reduced. Moreover, with an asset that moves as quickly as Bitcoin, it is really important to be able to match both sides of the order book almost instantaneously.

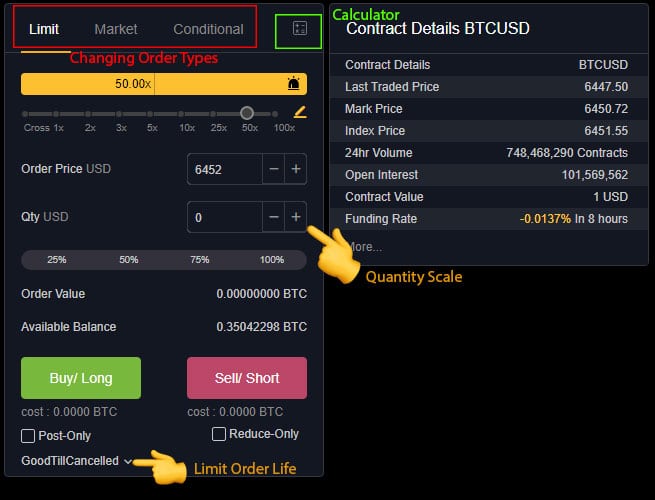

Order Functionality

Bybit has a pretty advanced order functionality on the platform. This is great as it allows you to not only customise your entry levels but also allows you to manage your risk on the exit levels.

Bybit Order Functionality

When you are placing your order, you will see the following order form. At the top of the form, you can switch between the order types. Below that you adjust the leverage, price and quantity. There is also information on the contract specifics.

There are three order types that you can place on the Bybit platform. These are outlined below:

- Market Order: This is an order that is placed at the prevailing market price. It will place the order at the “bid” if it is a sell or at the “ask” if it is a buy.

- Limit Order: This is an order that is placed at a chosen level that may be away from the market. The order is open for the order life which we cover below.

- Conditional Order: This is an order that will become either a market or limit order once certain price levels are reached. When placing the trade, you will define the trigger price along with the direction, quantity, and leverage.

As mentioned, with the Limit order and the Conditional limit order, the order will have a certain order life. This is for how long the order will remain open until it is “killed”. There are three order life options at Bybit:

- Good-Till-Cancelled (GTC): This is an order that will remain open until you decide to close it.

- Immediate-or-Cancel (IOC):: This order is designed to be filled immediately and at the best price. If there are any portions that are unfilled then this portion will be cancelled. This means that this order type allows for partial order execution.

- Fill or Kill (FOK): This order is designed to be filled at the best price in entirety or not at all. This is quite similar to the IOC order except that it does not allow the execution of any partial orders.

On top of all these orders, you also have some optionality around how these orders are executed. For example, with your Limit and Conditional orders, you can set them as “Post Only”. This will ensure that when the order it will be done as a “market maker” and you will receive the maker fee.

On top of this, you have the option of making your limit order a “Reduce Only” order. This basically means that the order will only execute if it was going to reduce your position. If the order were to increase the position, it would be amended down or cancelled.

You also have a similar order parameter on the Conditional order. This is called “Close on Trigger” and it can be used in conjunction with your conditional stop losses. It will ensure your stops reduce your position and don't increase it.

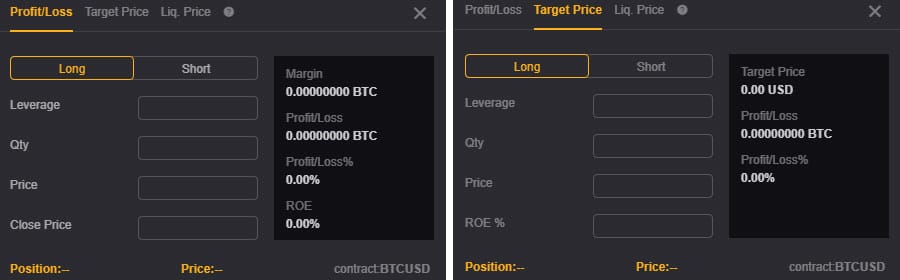

One more handy tool that you may want to check out is their position calculator. You may have seen similar tools at other exchanges like BitMEX et al.

Position Calculator at Bybit

This lets you calculate your Profit / Loss and ROE on target levels. It can also be used to determine your liquidation levels.

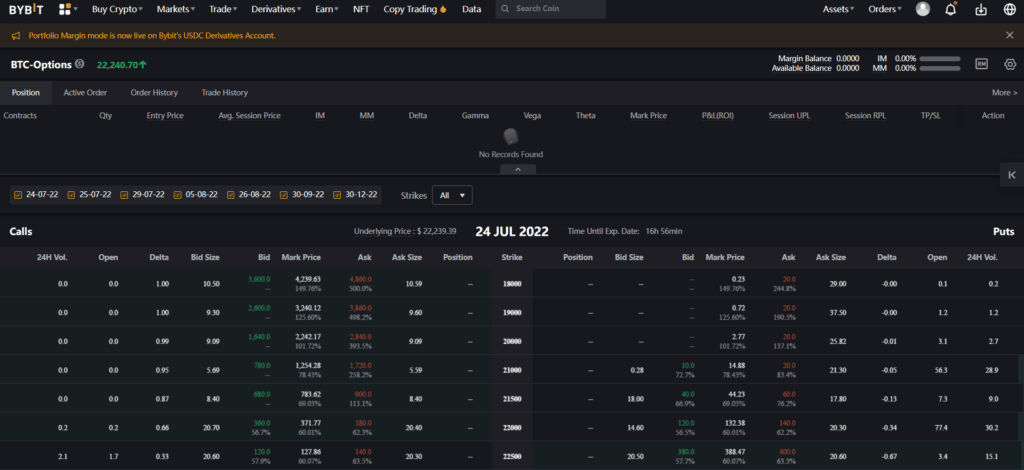

Bybit Options

The last time we covered Bybit, we mentioned the lack of options contracts on the platform. Well, it seems like Bybit listened, because the exchange now allows users to trade USDC options for BTC on the platform.

Bybit Options Interface

Options are a type of derivatives contract that allows the buyer the option to buy or sell an underlying asset at a specified price and date. Buyers must pay a premium to acquire the call or put option in order to have this right. Call options provide the buyer with the right to buy the underlying asset from the seller of the option, whereas ‘put options’ provide the buyer with the right to sell the underlying asset to the seller of the option. Option sellers receive a premium from the option buyer for the contract.

Bybit offers European-style cash-settled options. European-style options can be exercised only at expiration and there is no actual physical delivery of the underlying asset required. Bybit’s European options will automatically be exercised when an option expires. The options are settled in USDC.

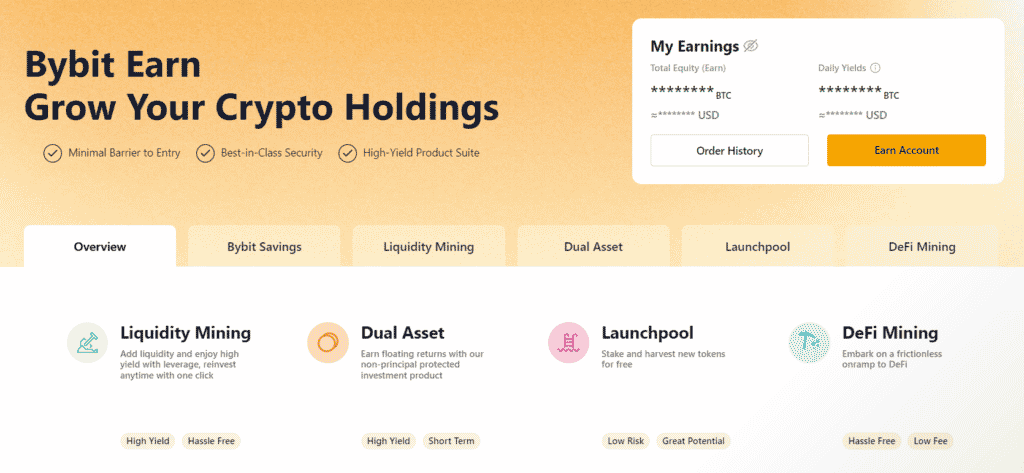

Bybit’s Earn Program

Bybit Earn Overview

Bybit allows its users to earn passive income on their idle assets through a variety of products available on its “Earn” program. However, do note that users need to complete at least level 1 KYC on the exchange to use the ‘Bybit earn’ program. The products available on its ‘Earn’ program are-

Bybit Savings – Bybit’s savings program allows users to lock up their assets on the platform for a period of time to earn interest on the asset. There are two types of savings programs available- flexible and fixed term. Flexible term savings offer lower rates of interest on locked-up assets but allow the user to withdraw them at any time. Fixed-term savings, on the other hand, offer relatively higher rates of interest but mandate the user to lock the assets for a fixed number of days, commonly 30 days or 60 days.

Bybit Liquidity Mining – Bybit’s liquidity mining program allows users to provide liquidity to AMM pools, where the liquidity provider earns swap fees from users swapping assets in the pool. Liquidity mining generally offers a higher rate of return in comparison to the savings program. Users can also add leverage to increase their share of the pool and maximize their yield. However, adding leverage exposes the user to liquidation risks.

Bybit Dual Asset – Users of the Dual Asset program have the chance to profit from better returns in low-volatility markets. In order to achieve this, users must forecast the movement of a specific cryptocurrency asset, like BTC or ETH, within a predetermined timeframe and deposit their preferred cryptocurrency to lock in the higher yield. Depending on how the settlement price compares to the benchmark price, the user will receive one of the two assets in the asset pair at maturity.

Bybit Launchpool – The Bybit launchpool allows users to earn free tokens from partnered projects by staking the exchange’s native BIT token during the event. These tokens can be unstaked at any time.

Bybit Defi Mining – Bybit’s Defi mining program allows users to earn yield from various Defi platforms such as Curve by staking the assets via Bybit. This allows users to participate in Defi without worrying about wallet management. Bybit’s Defi mining programs are generally for a period of 7 days.

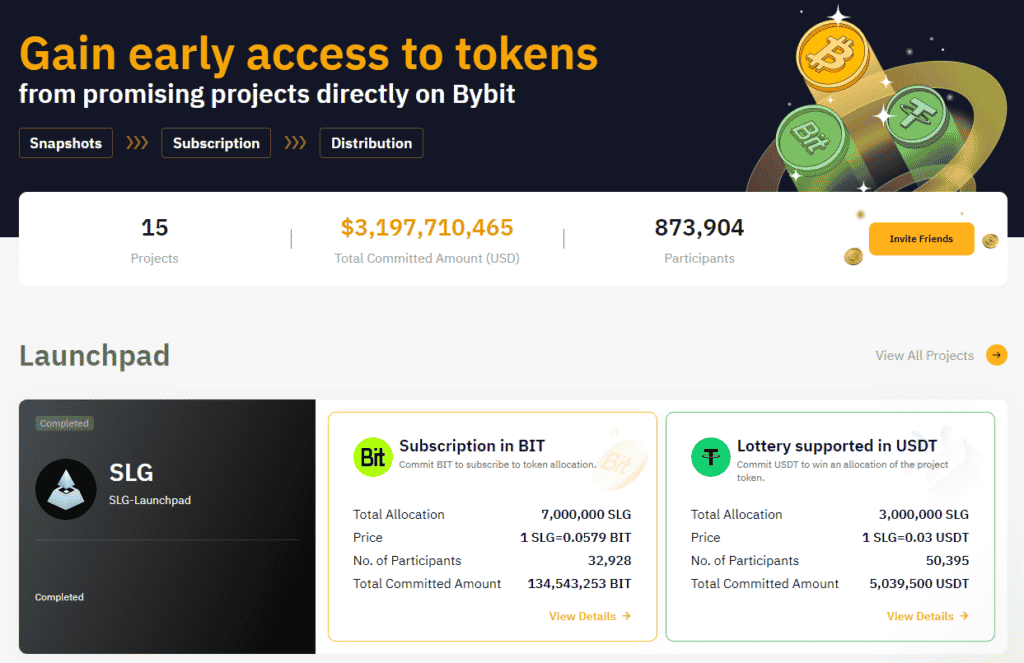

Bybit Launchpad

The Bybit launchpad is a token launch platform that enables users to gain early access to pre-listing coins by enabling them to purchase these tokens at an attractive introductory price.

Bybit Launchpad

To participate in Bybit’s launchpad, users are mandated to complete at least level 1 KYC verification on the platform and maintain a daily average wallet balance of 50 BIT or 100 USDT in their spot wallet for five consecutive days before the subscription period.

Once all these eligibility conditions are satisfied, there are typically two ways in which users can purchase launchpad tokens. The first would be to stake your BIT tokens in the BIT pool and gain an allocation in line with the weight of your BIT stake in the pool. This method guarantees an allocation for participants.

The second way in which users can gain an allocation would be to stake USDT and gain an entry into a lottery for the allocation. Users can gain 1 lottery ticket for every 100 USDT that they commit. The USDT pool typically offers a chance to purchase the tokens at a lower price than the BIT pool.

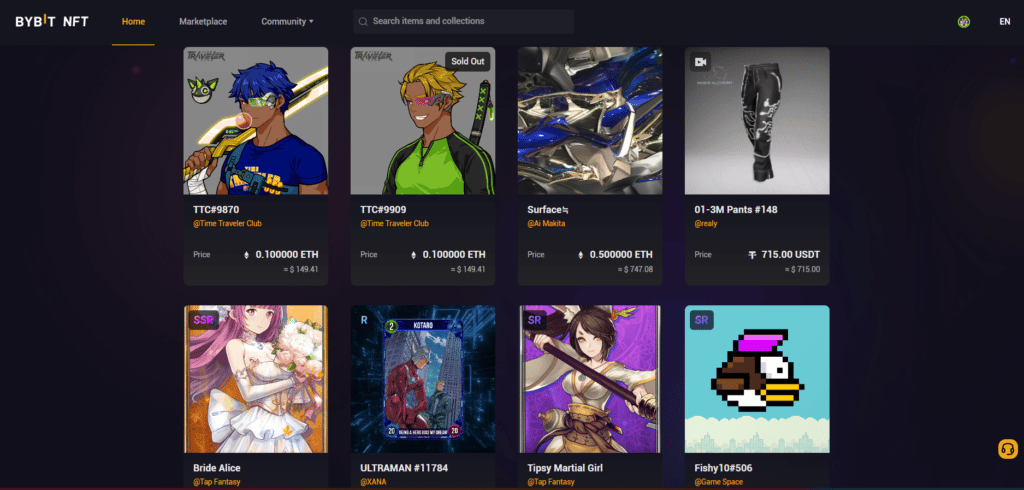

Bybit NFTs

Bybit NFT Marketplace

Like most top centralized crypto exchanges, Bybit has ventured into the NFT space by launching its own NFT marketplace. Bybit’s NFT marketplace often partners with GameFi NFT projects and individual artists to launch an exclusive sale, users can purchase these assets via the marketplace. Currently, NFTs can only be listed for a fixed price, but an auction mechanism is expected to be released soon. Payments on the marketplace can be made in either ETH, USDT, XTZ or BIT, depending on which token the listing mandates the payment be made in.

Inverse vs. USDT Contract

Before you can trade on Bybit you have to understand a very important distinction between the two types of perpetual contracts they have on offer. They differ according to what margin is used.

For the USDT contract, the underlying margin used is Tether. You can think of this as analogous to a contract that has USD as a base currency (given that Tether is a stablecoin). So, the dollar value of your collateral will remain the same.

However, when it comes to the inverse contract, the underlying cryptocurrency itself is used as margin. So, if you are trading BTC/ETH/EOS/XRP as the base currency then your margin will be in this as well. So for example, for ETHUSD contracts you will have ETH as the margin.

The inverse contract is slightly riskier than the USDT contract. This is because not only do you have exposure to the actual market but you will also have exposure through your underlying collateral. So, keeping with our example, if you are long Ethereum and the price falls not only will your position deteriorate but you will also see the USD value of your collateral falling.

If you are going to be trading anything other than Bitcoin then it will have to be an inverse perpetual. You will also have to make sure that you have the coin in question before you can actually trade it.

It is also important to note that although the margin required is in the coin in question, it is still quoted in USD. Each inverse perpetual contract is 1 USD in value. This is a pretty neat feature as it allows you to trade contracts for as little as 1 USD. This is in contrast to the USDT contract that is written on 1 BTC.

Isolated & Cross Margin

Something else that you may notice when you are trading BTCUSDT on the Bybit platform is that you have two options around how the margin is apportioned in the account. These are isolated and cross margin.

When you select Isolated margin, the margin that you have on the trade is applicable to only that position. It does not take into account the equity levels and positions PnL that you have on other orders for the same trading pair. So, even if you are in profit on some other trade, it has no bearing on whether you are likely to get liquidated (and vice versa).

However, when you have selected to cross margin it means that all available balances will be combined in order to prevent a liquidation. So, if you have other positions that are open for the corresponding trading pair then these will be included in a calculation of margin levels before liquidation occurs.

Which is better?

Honestly, we would suggest that you rather use Isolated Margin. Not only does it allow you to adjust the margin but it also means that you have full control of your risk on a particular position. If you are trading the inverse perpetual swaps then the isolated margin is set by default.

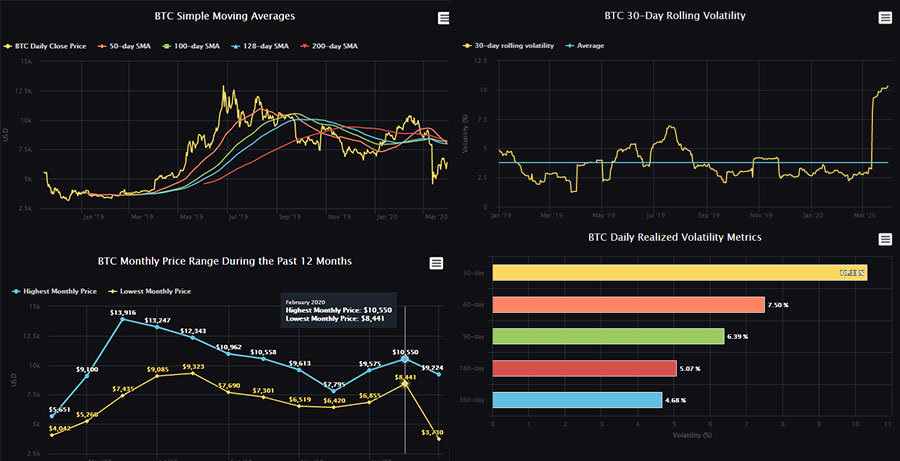

Market Analytics Data

Something else that we found pretty neat was their market data section and particularly their advanced data section. This contained some really handy graphs and charts that could help inform your trading.

You can also pull up some of these charts and download the data. This could either be as an image, vector file or as a csv. Here you can see an example of us doing that with the rolling volatility chart.

Some of the Charts For Bybit Data

Here is a list of the data that you are able to download as well as what it means:

- Price Moving Averages: This has the price of Bitcoin along with the number of moving average indicators of different time frames.

- Monthly Price Range Takes a look at monthly highs and lows in the price. It allows you to observe the range the asset traded in.

- Rolling Volatility The realised volatility over the past 30 days compared to the average for the period. Gives you a sense of how much the price swung in a given period.

- BTC Daily Realised Volatility Looking at what the realised volatility was like over a certain period of time

There is also a host of other data that you can examine in these tabs. That includes information on the specific index price, funding data and the insurance fund. You should also note the weights that are used to calculate the spot price.

Testnet

For those traders that would like to try the platform out in demo mode, they can make use of the Bybit testnet. Demo accounts are a great way to get a sense of how the orders work before depositing funds.

You can access their testnet on testnet.bybit.com. In order to fund your account, you will have to get coins from the testnet faucet. They have outlined exactly how this is done in this handy BTC Testnet Guide.

We must admit that we were quite surprised at the amount of work that was required in order to access these testnet funds. When you unlock these funds, you are only getting minor amounts of Bitcoin as the faucet has a release rate of 0.01BTC per hour.

Other platforms such as IQ Option provide demo funds the moment that you open the account. These come with no strings attached and give you a realistic balance to trade with ($10,000).

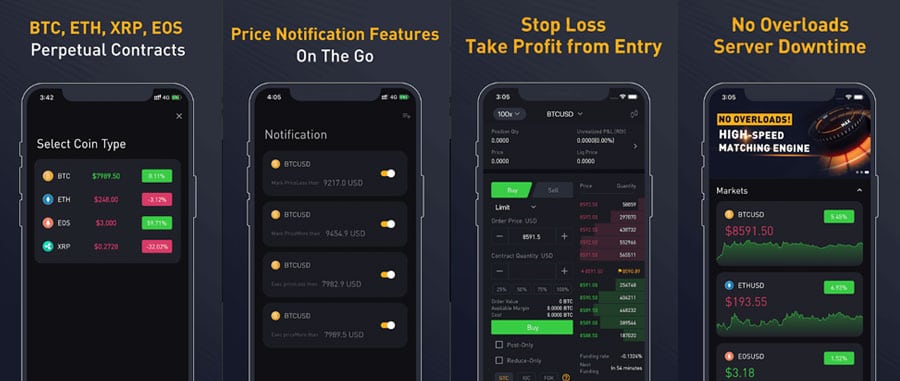

Bybit Mobile Apps

For those traders that are on the go, you will no doubt want to keep track of your open positions. This is why Bybit has developed their mobile application. It's available in iOS and Android and appears to be quite functional.

In fact, it has most of the same functionality as the desktop version. You have advanced charting and order management all easily accessible through the navigation pane. You can also set a whole host of price levels to be sent as push notifications.

You also have those advanced order forms that you see on the main exchange. This is not something that we have seen at other exchanges and brokers. Most of the time the order functionality is stripped down – so top marks here.

Bybit Mobile App Screenshots

The app is listed in both the App Store store as well as Google Play. There are over 10,000 installs with overall positive reviews across both app stores.

So, should you consider the Bybit App?

Well, it is no doubt quite functional but we always prefer to use web and PC-based trading. This is because you can never really replicate the effectiveness of PC trading on a mobile device. You can't easily study charts and monitor numerous markets at the same time. You should ideally only be using it at times when you are away from your desk and need to monitor your positions.

Bybit Customer Support

The customer support offered on Bybit is quite good and there aren't too many glaringly negative reviews online regarding quality and response times for support. We did try to reach out to their customer support lines to get an idea of typical response times and found responses came in at acceptable time intervals and the support received was helpful.

In terms of support options, you have a zendesk live chat function that is available on their platform. This is available 24/7 and is offered in all the languages that they have translated their website into.

Zendesk Live chat function

You can also reach out to them via email at support@bybit.com for customer support or it@bybit.com if your query is more technical in nature. Unfortunately, there is no phone support or direct telephone line into the exchange.

We tested out the live chat function and we were able to get a support agent almost immediately. Email support took a bit longer but was similarly helpful.

Of course, if your question is more routine in nature and not specific to your account then you can always make use of their extensive help section. This includes their FAQ resources as well as other helpful guides that could help your trading.

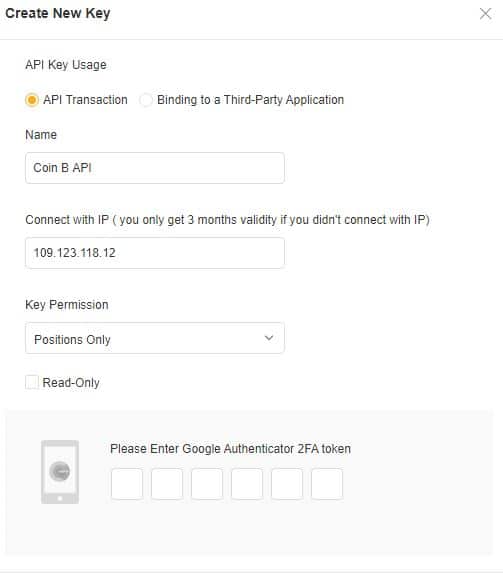

API

Those developers among you will be happy to know that Bybit has a pretty robust API. This will allow you to code algorithms and bots in order to manage the trading programmatically.

You can get all of the technical documents about how to interact with the API from their GitHub. If you would like to make use of the API then you will have to generate an API key. This can be done in the “API management” section of the exchange.

Generating the Bybit API Key

Here, you can generate a new key that will be used to access the API. You will also have to decide what permissions you want to give the API (read, write or withdraw). Read allows you to monitor prices, write allows you to place trades and withdraw will allow your bot to process a withdrawal (not advisable).

You may also want to bind the API to your IP address. This will prevent anyone from placing trades in your account should your API key be compromised. Either way, you will want to be very careful when dealing with your API key.

For example, we would advise against the use of third-party trading bots. Many of these have questionable returns and when they have access to your API keys they can manipulate markets to their own advantage.

Bybit Reward's Hub

These are actually some pretty neat sweeteners that Bybit has thrown into the mix.

Essentially, there is a number of opportunities for new users to earn some free BTC to trade with. For example, if your first deposit on the platform is over 0.05BTC then you will get an added $5. If it is over 0.5BTC then they will throw you $50. If you deposit more than 1BTC in total you will get an additional $20.

There is also an opportunity for you to do simple tasks to earn a little more BTC. For example, if you merely register and join their social media channels then you will earn $5. Simply use their Take Profit and Stop Loss orders and you bag another $5. Trade for more than 10 days and you earn another $5. Heck, even taking a short customer survey can get you $5.

These additional funds could be a great way for you to augment your account balance. Also, if you were already planning on joining Bybit and trading there, these can be viewed as free trading funds.

Of course, there are “house rules” that come with this bonus. For example, you cannot withdraw these funds and they can only be used as margin in your account. Moreover, when you withdraw these profits you forfeit your bonus.

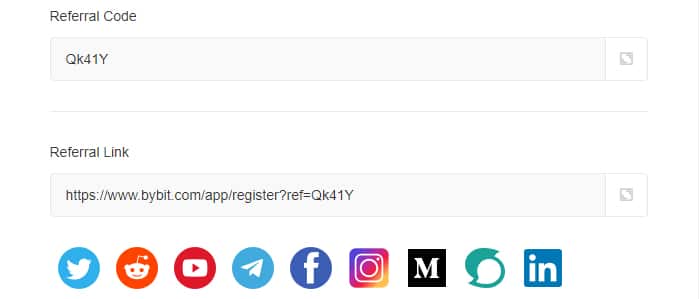

Bybit Referral / Affiliate Program

If you have been using Bybit and have been relatively impressed with the product then you can always refer others to the platform.

There are two ways in which you can do this. Perhaps the easiest to start is through the referral program. For each referred user you send that deposits 0.2BTC with Bybit, you will get a $10 trading bonus.

If you want to take part in the referral program then you will need to get your code. You can either do this as a unique code that your referrals will use on signup or you can give them your referral link. You can share this link online or on your social media channels.

Getting Your ByBit Referral Link

This can be relatively attractive if you can refer friends making a small amount of one-time deposits, but if you are looking to refer many more traders who usually do large trading volumes then you are perhaps better suited to signup for the Bybit affiliate program.

This will reward you with a percentage of trading profits that are generated by your traders. This is set at up to 30% of the trading commission that your referrals generate. This is more than the 20% commission that they give at BitMEX.

Moreover, this affiliate structure has different tiers to it. Not only will you get 30% of the commissions that your direct referral generates but you will also get 10% on their affiliate commissions.

You cannot take part in both the referral program and the affiliate program so you have to choose wisely between the two.

Trading Competitions

One more thing that we found really quite interesting about the Bybit exchange is their trading competitions. These are held on an ad-hoc basis and they allow traders to go head to head.

A number of these have already been held this year but one of the most exciting that we have seen was their “are you a master” trading competition. This ran from April to May and Bybit was giving away up to $6,200 in BTC to traders.

Another really interesting competition that was run in August of 2019 was their EOS global trading competition. This involved several teams battling it out for up to $60k in prizes. Team captains were chosen and they could build a team of between 10 – 200 members.

Of course, Bybit is not just holding these competitions to be charitable. These competitions encourage trading volume on their platform which gets them fees. So you should take that into account when funding to trade on these.

Bybit Top Benefits Reviewed

Bybit is an excellent exchange for non-US customers looking to trade in derivatives. It offers one of the best derivatives trading experiences in the industry. Some of the top benefits Bybit offers are:

Wide Range of Assets and Services – Since 2018, Bybit has grown into one of the top exchanges that provides users with access to a wide range of assets as well as services. Bybit has over 300 assets in the spot market and 200+ contracts in the derivatives market. It also offers users services such as trading bots, spot markets, derivatives such as option, perpetuals and futures, and more.

High Leverage and Risk Management – The exchange allows users to trade with up to 100x leverage on select assets, but it also has a variety of tools that ensure risk is properly contained. Some of the tools include Bybit’s insurance fund, auto deleveraging, cross and isolated margin accounts, a range of order options, etc.

Good Customer Support – Bybit has 24/7 customer service available for users to get any issues addressed.

Testnet Available – Bybit offers users a testnet environment to make test trades and familiarise themselves with the products offered by the exchange sans risk.

What can be Improved

The last time we covered Bybit, we mentioned that the exchange lacked sufficient trading pairs and derivative products such as options. We also spoke about how acquiring testnet tokens was cumbersome.

Well, maybe Bybit read our piece because currently, Bybit offers all of the features that they lacked. If we absolutely had to speak on one area of improvement, it would be the social media response of the platform. Bybit’s discord channel is relatively inactive and users’ queries sometimes go unanswered

Bybit FAQs

Who Owns Bybit?

The co-founder and CEO of Bybit is Ben Zhou. He is a public figure who is respected in the crypto industry and prior to Bybit, he ran a retail forex brokerage for nearly a decade.

What is Bybit?

Bybit is a cryptocurrency and derivatives trading exchange established in 2018. It offers a professional-grade, high-performance matching engine, making it a popular trading platform with over 2 million users. The exchange is known and respected in the crypto community for advanced trading options, good customer support, and its dedication to crypto education and KYC-free trading.

Is Bybit Legit?

Bybit is about as legitimate as an unregulated “off-shore” crypto exchange can be. Thanks to the robust security measures in place, and the fact that this exchange has been operating since 2018, Bybit is one of the most highly trusted exchanges outside the top 5.

Is Bybit Available in the US?

Unfortunately not. Residents from the United States and Sanctioned countries are not permitted to use Bybit.

What is Inverse Perpetual on Bybit?

Inverse Perpetual Contracts allow traders to use BTC and other coins as the base currency. An Inverse Perpetual Contract is different from a USDT Perpetual Contract in the calculation of margin, Profit and Loss (P&L) and risk exposure. You can learn more in Bybit's Introduction to Inverse Perpetual Contracts article.

Bybit Review: Conclusion

We have found Bybit to be a user-friendly exchange with strong technology, reasonable fees and a relatively intuitive user interface. We are also glad to see that they have also developed an insurance fund to manage market risk.

They are well positioned to offer an alternative to the status quo in the crypto derivatives trading market. In fact, the order book liquidity on Bybit has recently exceeded that of Deribit.

While there were things that we thought warranted improvement, these are relatively easy to implement. The exchange is still growing and new products and features are being rolled out. There are no doubt many improvements and exciting announcements in their pipeline.

So, should you use Bybit?

We encourage you to do your own research but on the face of it, Bybit appears to be an attractive exchange that ticks most of our boxes. You can learn more about Bybit and how it stacks up against other exchanges in our Bybit vs KuCoin review.

Featured Image via Bybit