Imagine having a test with questions on a 500-page book. This book does not have an index, it’s just a book filled with text and you need to find the answers. Needless to say, that it would take you a ton of time to even find one answer. You would have to scroll through everything without no way to sort through it. It can quickly be realized that if you could somehow sort this data or use a website to find the answers you would save both time and energy.

Now, to bring this example into the crypto world you need to see the book as a blockchain and you as a dapp developer. As we all know, everything on the Ethereum blockchain is visible for the public. For example, every transaction on Uniswap, which is built on Ethereum, is found there. It's also known that many developers want to build applications which leverage the data found on the blockchain to create research tools, for example. However, without a way to query data from the blockchain it would be impossible to get information out of it fast and efficiently. That’s why The Graph was created.

Page Contents 👉

The Beginning of The Graph

The idea of The Graph was born in late 2017 and introduced in the summer of 2018 by Yaniv Tal, Jannis Pohlmann, and Brandon Ramirez. The three of them had previously worked together on multiple startups focused on software development. They wanted to make it easier developers to build powerful software. In 2017 the trio was introduced to Ethereum which quickly sparked their interest and made them start building dapps.

Why they first got into Ethereum was because of the highly centralized manner of today's businesses and processes. Today we rely on mostly Amazon, Microsoft, and Google to store all of the data out there. Their combined market share of all cloud service is easily over 50%. This means there are a massive number of companies and individuals dependent on centralized entities in the form of using centralized APIs (Application Programming Interface). It also means that those centralized entities can choose who gets access to see or use this data. Usually those who pay get the data. An example of how this works; if I wanted to do some market analytics, a way to go would be for me to first pay Bloomberg for a subscription in order to access the data. At the same time, Bloomberg pays AWS (Amazon Web Service) for both data storage and query.

It's pure dominance out there, and the amount of money they make from this is unbelievable.

Now, why it’s important to understand this structure is because what the trio quickly realized about working on dapps was that without the possibility for indexing and querying data it would be impossible to create powerful, lag free applications. The centralized structure of how we today operate does have some advantages like speed, however, this trio didn’t want the same structure, which made them develop The Graph.

The project has raised capital multiple times to a total of roughly $25 million. It is backed by some big names including Coinbase Ventures and Multicoin Capital. The first public sale of GRT was held in October of 2020 but only 4% of the total supply was sold during that. We will get more into the token distribution later.

What Does The Graph WE Do and Why We Need It?

Continuing with using a book as an example to explain this, we all know books usually have indexes. If it’s a book used for research it can be sorted alphabetically or in some other logical way. This same applies to databases, they are sorted so that APIs know where to look for the data they need.

API's are nowadays centralized entities querying data, The Graph wants to change this.

Blockchains don’t sort themselves since they are a history of all transactions connected in the order they are completed. Therefore, if you were to look for information without knowing where it is you would have to start with block 1 until you find what you were looking for. This is both extremely time consuming and energy intensive. That’s why programs like Etherscan have copied the whole blockchain to be stored in their own database from where they can query data efficiently using their own centralized APIs.

You might be asking yourself why we need The Graph if everyone can just store the blockchain themselves and have own APIs. Well, the size of the blockchain grows all the time which makes it harder and harder for small developers to store it. The next option would be to use the databases of those who do store it like Etherscan, and this is actually what many do. However, this brings us back to the problem of centralization. If you use the database of a company, you become reliant on their ability to store and query the data. If for some reason they fail to do this then you’re done. Another problem with both of these options is that there’s much work if you need data from multiple companies. For example, you would maybe want to use data from both Uniswap and Decentraland, but if they store their data in different databases then it makes it trickier to you.

Currently, you can use The Graph to query data from Ethereum and IPFS (Interplanetary File System, the decentralized layer of Filecoin). The Graph is also in beta test mode on multiple blockchains, but we’ll get more into that when discussing the roadmap later on. For now, let’s look at how The Graph actually functions in a truly decentralized manner with proper incentives.

How Does It Work?

When a project uses The Graph, it creates an API of their project. These are called called subgraphs. These subgraphs are then available for other projects to query data from in order to run their application. A project can make use of one or many subgraphs and a subgraph can further consist of smaller subgraphs inside of each other. An example of two subgraphs you can find and query data from are Uniswap and Compound. As you can probably imagine both of these provide vital data for project developers. Just think of all the trading data on Uniswap, with volumes, prices, trading pairs, and a lot more. To find data from these subgraphs The Graph has created an explorer you can use. Using this you can query data with The Graphs own programming language called GraphQL.

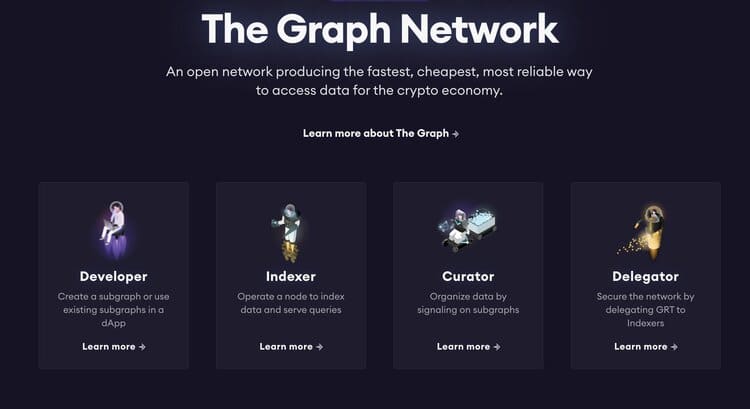

Here's a list of four of the key participants in the network. Image via The Graph

How the architecture around The Graph is built is essentially on four different kinds of network participants: delegators, indexers, curators, and consumers.

Indexers

Indexers are node operators in the network who stake GRT. The minimum amount staked to become an indexer is currently 100k GRT (roughly $96k at the time of writing). They are responsible for providing indexing and query services. To be sure that an indexer does the work appropriately the staked GRT is subjected to a thawing period, and slashing is also possible. If an Indexer acts maliciously, providing false information, or if the indexing is done wrong, then a portion of the staked GRT is slashed.

On top of the 100k of GRT to stake you also need some hardware to become an Indexer. You can learn more by visiting this link to The Graph's guide

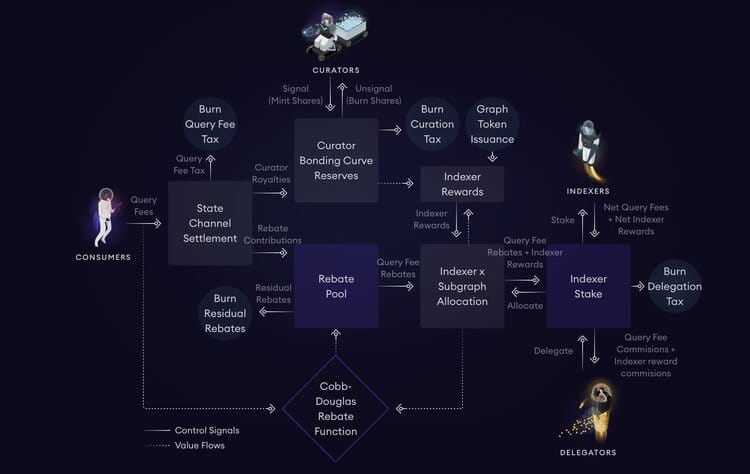

As incentives, indexers earn query fees and indexing fees, along with rewards from a rebate pool that distributes funds proportionately to the amount of work completed. This is calculated using the Cobbs-Douglas Rebate Function. The funds from the rebate pool come from the annualized inflation rate of 3%. The fees Indexers charge are set by themselves which creates a marketplace of indexers trying to sell their services. This marketplace also keeps the fees in check so that no one can overcharge, since with too unreasonable prices no one wants your services.

Consumers

Consumers are the ones paying for the services provided by indexers. Consumers are often end users like developers, web services, or middlemen. They naturally play an important role since they are responsible for the demand side of the supply/demand equation.

Delegators

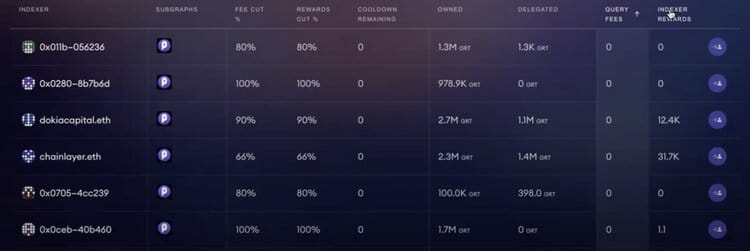

Delegators are “normal” GRT holders that can stake their tokens by delegating them to one or many chosen indexers. When doing this you earn a portion of both the indexing fee as well as the query fee. However, the amount you earn is chosen by the indexers which means you as a delegator need to look into where you can gain fair percentages.

This is an example of what you might see when choosing which indexer to delegate to. Image via The Graph.

When delegating, you are subjected to a so-called tax of 0.5% which means that if you delegate 1000 GRT then 5 will be burnt. Another factor you need to think about is that if you choose an untrustworthy indexer and need to undelegate your tokens then you are subjected to a 28-day lock-up period in which doing anything with your tokens is impossible. There are also other factors you need to take into account which is why I strongly suggest you visit The Graphs' website to read more about delegators and what you need to consider, you can find the page here.

Curators

Curators signal to indexers which subgraphs are worth indexing. The way the curators signal indexers to certain subgraphs is by depositing GRT into a bonding curve. If they wish to withdraw those tokens, they are subjected to a tax similar to the one delegators pay. For doing this they earn a proportion of the query fees generated from that subgraph. This way expanding the ecosystem is incentivized. Curators are also incentivized to find relevant subgraphs early to generate as much revenue as possible. Therefore, curators are often developers who signal to their own subgraph in order to be added to the ecosystem. Curators can also be other people highly knowledgeable about the whole ecosystem. They can use the explorer to find information about subgraphs and then assess whether it’s worth indexing.

Fishermen & Arbitrators

As I mentioned, indexers can be penalized for malicious behavior. That’s why there’s a need for someone who reports these issues as well as someone who decides on whether or not it really can be considered malicious behavior. Fishermen are those who verify that the indexers response to queries is correct, if not they report it to the Arbitrators who decide whether or not to slash the indexers staked GRT. These are important since although there are policies and threats like the thawing period and slashing meant to prevent malicious behavior there can still occur some. That’s why we need participants who can report it as well as follow through on the threat of slashing.

Here's a picture of how it all works, it can get quite complicated so I suggest you readthis and thispost from The Graph if you want to learn more. Image via The Graph.

If you need more help with understanding how The Graph works I suggest you watch Finematics YouTube video about it, you can find it here. It helped me a lot!

Tokenomics

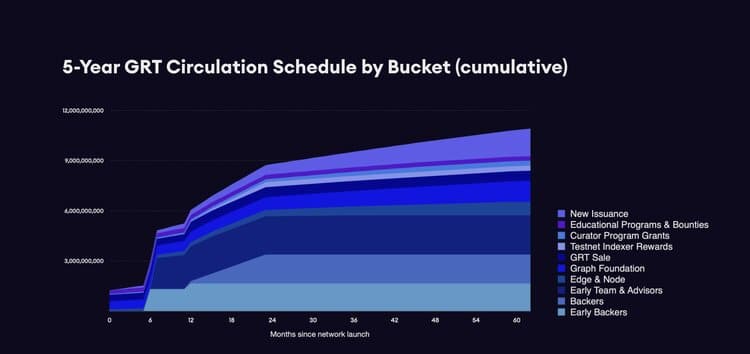

GRT is an ERC-20 token with an initial supply of 10 billion. It is subjected to a previously mentioned inflation rate of 3% but given the structure of the network GRT could become deflationary. This is because from query fees 1% is always burned, also the taxes implemented in the network result in token burning, and lastly all the unclaimed rewards from the rebate pool are burned. I couldn't find any data on how much activity we would actually need in order for GRT to become deflationary but at least the possibility is there. However, a 3% inflation isn’t that bad either, remember that Ethereum too had an inflation rate far greater than 3% before the EIP-1559 while still providing good returns.

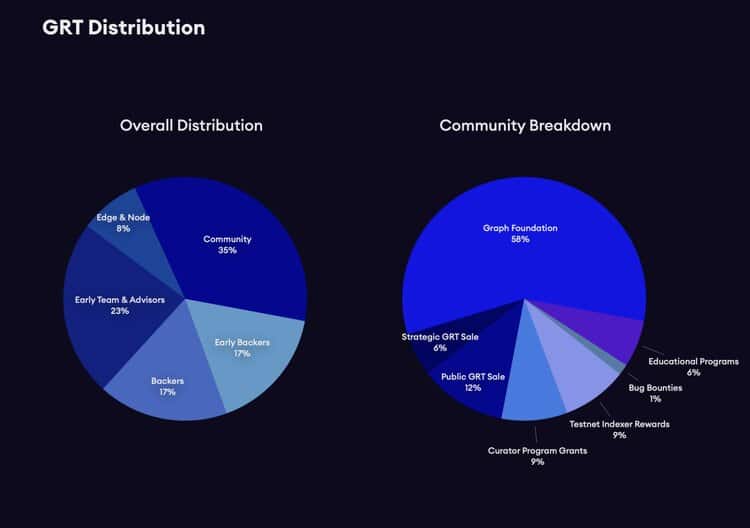

From the picture above you’ll see the GRT distribution. Since only a small portion is for the public, you can probably already guess that the vesting schedule we’re going to see won’t be pretty.

You can read more about the token distribution here

You were right. The aggressive flood of coins hitting the market in the beginning is just frightening. If you don’t know why I’ll briefly explain. Since all of these early backers are subjected to a lock-up they can’t do anything with their tokens for now. However, once the lock-up period is over they are likely sitting on 20-100x unrealized gains. Now, consider yourself in that position, you’re likely going to sell at least some of your holdings. This will result in massive sell pressure that will most definitely impact the price negatively. However, The Graph is an impressive project which hopefully can attract enough demand to offset the massive supply flood. So, let’s take a look at some news and updates for The Graph which could trigger huge demand growth.

Roadmap

As with most fully launched projects The Graph doesn’t have a clear roadmap. It’s now up to the development teams to put forward upgrade proposals to grow the network and make it more efficient. The development side of The Graph has previously been highly centralized and it’s now being addressed. Not so long ago The Graph’s development had been in the hands of the initial team behind The Graph. Then the project rebranded to Edge & Node, as well as the Graph foundation. However, in the past 6 months two new development teams have joined the Network to further decentralize the project and help scaling it, these teams are: StreamingFast and Figment.

Since Guy last covered The Graph on the Coin Bureau YouTube channel there has been an impressive number of projects deploying subgraphs. These include the likes of Audius and Livepeer. More and more projects see the benefit of joining The Graph and all the over 2000 curators seeking to capitalize on the opportunities presented here. The current total amount of subgraphs is more than 22,000 and the network has over 7000 delegators and 160 indexers. However, while projects joining The Graph is great there’s also another big move going on – I’m talking about The Graph expanding to other blockchains.

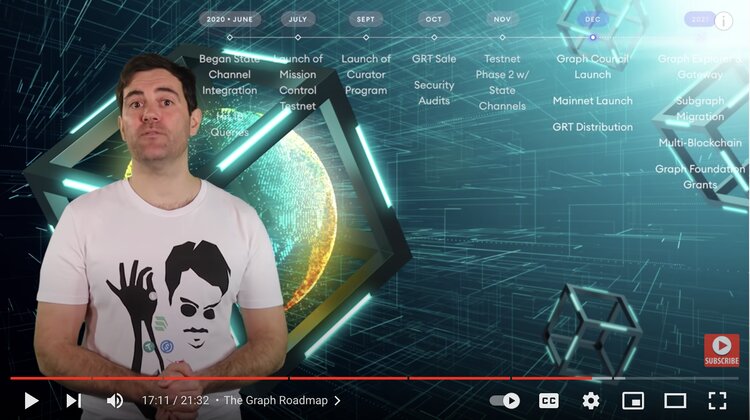

I highly recommend watching this. Image via Coin Bureau YouTube

Arguably one of the biggest things for The Graph is their expansion to other projects. As I previously mentioned there are many blockchains in beta test mode including both layer 1 and layer 2 projects like Polygon, Polkadot, Solana, and Fantom. Now imagine the growth this will add when already now, based on past statements from The Graph, daily query volumes ought to be closer to 1 billion a month.

On top of these upgrades, those of you who have watched Guy’s video on The Graph might remember that there were some structural changes coming. One of this was making The Graph Explorer a dapp, and that’s exactly what was done. On top of that, Subgraph Studio was created and it allows anyone to test creating a subgraph and also to deploy it.

If you didn’t already, I strongly suggest you watch the afore mentioned video since the roadmap part there basically mentions everything that has happened since Guy last covered the project. All of those steps on the roadmap has been met leading to where we are now, and now it’s up for the community to vote on upgrade proposals to help The Graph grow.

Is There Any Price Potential?

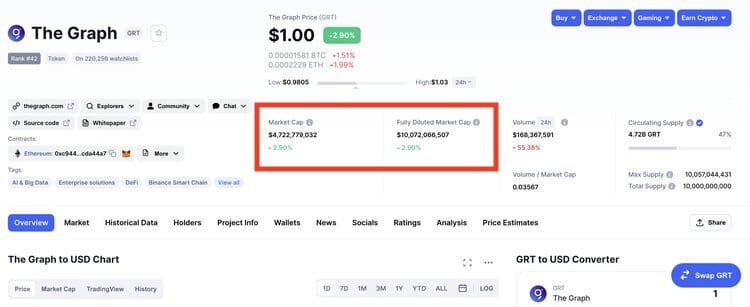

Sadly, I’m going to have to go with a firm no. I don’t believe that The Graph will be able to outperform other cryptocurrencies in the medium term. This is all because of their vesting schedule. An important part to know is that if you go to CoinMarketCap and look at The Graph you’ll see their market cap at roughly $4.5 billion. However, that’s just the market cap of the circulating supply, it doesn’t take into account all the tokens subjected to a lock-up period. The fully diluted market cap you can see closer to $10 billion. This means that just by staying at the same price the market cap would double when those locked up tokens become unlocked. Growing 10x from $10 billion is a lot harder than growing 10x from $4.5 billion, you don’t have to be a rocket scientist to see that.

Here's proof if you don't believe me. Image via CoinMarketCap

There’s no question about whether or not The Graph network and the project itself will grow. We need a service like this to make dapp developing easier and more efficient. The Graph plays a vital role in main stream crypto development and if we could ignore the awful tokenomics I would call The Graph a no brainer that deserves a place in each portfolio. But that’s not the case. We’ll have to take a second look at the project when the vesting schedule is beyond its worst phases.

However, what you can do if you think The Graph is amazing, is delegating. Delegating has rewards of roughly 15% per year and 3% when counting the inflation and unlocks. This means that by delegating you will get a return of 3%, plus the return of potential price action. This could be a good choice if you’re a long-term believer in The Graph since after the vesting schedule is finished and the selling pressure eases those delegated GRT as well as the rewards you’ve earned might just take off. However, I want to again remind you to visit The Graph’s website and read about the risks about delegating before doing anything.

Conclusion

Smart contracts are without a doubt one of the most significant features of cryptocurrencies and blockchain. It allows us to build decentralized applications aimed at replacing the middleman who’s currently ripping off regular people. Smart contracts are also the key argument for Ethereum overtaking Bitcoin. Many see cryptocurrencies like Ethereum as strong assets with a real use case which they're happy to invest in. However, to truly become decentralized and to provide developers an easy approach to building dapps we need the solution that The Graph offers. The Graph eliminates the last centralized entity and allows everyone to take advantage of the open nature of blockchains. Even I could go to The Graph Explorer and search for whatever I like.

The Graph could (partly already has) prove to be the missing piece to the puzzle of making crypto easier to approach from all angels, developer, consumer, and even regulator. It will be interesting to see how The Graph will succeed in launching on other blockchains and how much growth they can achieve. However, for that growth to be massive enough to offset the horrible vesting schedule it would have to be absolutely crazy. That’s why I believe we’re better off watching from the sideline The Graph help the blockchain and cryptocurrency industry, grow rather than putting our money into it.