Perhaps the most underrated and under-utilized potential for cryptocurrency is leveraging the benefits of CeFi lending platforms. Why I believe many overlook the opportunities offered here is that the yields don’t match our expectations when crypto is the topic. Many get into crypto for those +100% earnings in a couple of weeks rather than earning 10% a year. However, remember that traditionally the stock market was viewed as the asset class with the highest returns at 7-9 % a year. That’s why we shouldn’t overlook the potential crypto earnings just lying around.

Another reason to seriously look into Cefi lending is that if you say you’re in it for the long run then why not earn that additional reward? I understand you don’t want to lend your asset if you're looking for a price to exit at since you don’t want to have your funds locked up. However, if you’ve bought Ethereum talking about how you’ll hodl for 10 years because you believe in it for the long run, then why not earn that 3-6 % extra per year while doing so.

⚠️Safety Notice⚠️- In light of the recent liquidity issues and bankruptcy faced by the lending platform Celsius, BlockFi, Voyager Digital, VAULD, and others, and the high risk of contagion that could result in further company failures during these difficult market conditions, we do not recommend users keep funds on any lending platforms or centralized exchanges until the markets recover. We suggest crypto holders self-custody during these uncertain times. The collapse of Celsius and BlockFi also raises concerns as to whether or not centralized lending platforms are even a sustainable way of learning yield, be sure to understand the risks.

In this article, I’ll go through the top 5 centralized (CeFi) lending platforms. I know some of you prefer DeFi platforms to centralized crypto platforms, but seriously, some of these Centralized Finance platforms are great and there are many benefits these platforms offer. Plus, I know some might appreciate the feeling of a more secure environment (not saying it is).

Quickly before starting, I want to point out that not all of these platforms are available globally, so you’ll have to check on that before using them. For example, I know that YouHodler and Swissborg are completely out of reach for US customers while Nexo has also recently announced its withdrawal from the US markets. Also, a few of these platforms have their own tokens and the tokens might also be out of reach for US customers.

But first, let's quickly cover what CeFi is.

Page Contents 👉

What is CeFi (Centralized Finance)?

Crypto users love shortening terms, I don't know why… Perhaps we are a lazy bunch. CeFi is short for Centralized Finance, the term “centralized” highlights the fact that there is a centralized authoritative body that has ultimate control over the platform, and all user funds. It's essentially centralized crypto. This is in contrast to DeFi which stands for Decentralized Finance. The term “decentralized” highlights the fact that there is no central authority, and everyone who participates in the DeFi platform keeps full control over their funds, and their crypto is not handed over to the centralized company for custodianship which is the case with CeFi.

You may also hear the term CeDeFi which is a bit of an oxymoron standing for Centralized Decentralized Finance. This term is sometimes used for crypto lending companies as they are centralized platforms that offer decentralized crypto products. Each of the companies mentioned in this article falls under the CeFi or CeDeFi category (interchangeably) as they are centralized entities offering crypto products that were traditionally only available on DeFi platforms. It is important to understand that they have ultimate control over customer accounts and funds, similar to how a bank technically has control over any customer bank accounts.

Nexo: Great CeFi Rates

Nexo is a subsidiary of Credissimo that was founded all the way back in 2007. The Nexo platform was deployed in 2018. To date, Nexo has paid over $200 million in interest, gathered over 2.5 million users in over 200 jurisdictions, and supports 27 different cryptocurrencies. Nexo offers both lending and borrowing as well as a payment card. Nexo also has its own native token called NEXO, and that has the highest market cap of those mentioned here.

**Notice**⚠️ In January 2023, Bulgarian authorities announced a raid on Nexo, with allegations of legal misconduct that are being actively investigated. We do not recommend users sign up for Nexo at this time until the investigation is complete and Nexo is cleared of all wrongdoings.

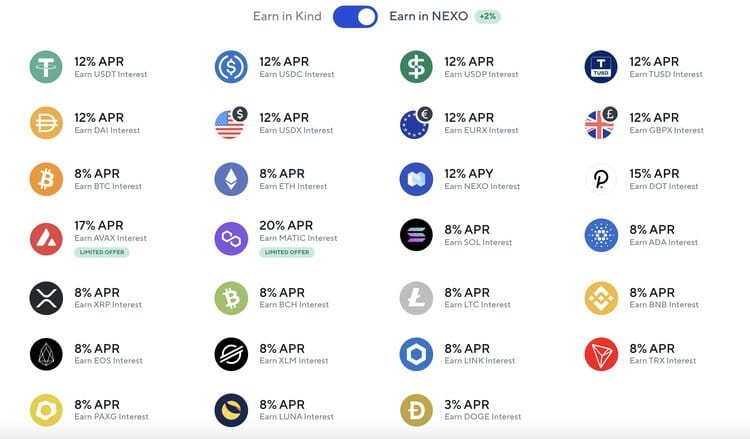

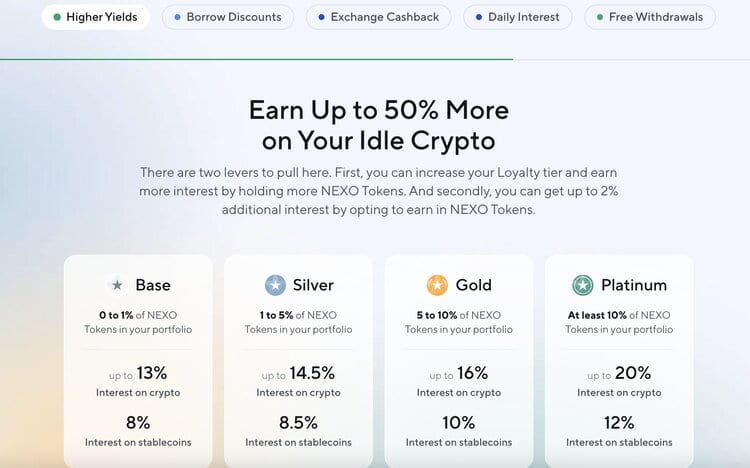

Starting with lending, Nexo has extremely good rates and for almost all tokens they’re higher than what most other platforms offer. For example, the interest on your Bitcoin and Ether can be as high as 8% if you opt for a fixed term and get paid in Nexo tokens. Other interest rates are also extremely high, DOT at up to 15%, and then AVAX and MATIC have limited time boosted rates 17% and 20% respectively.

For stablecoins, the rates are up to 12% but what really differentiates Nexo is that you can lend fiat money too. Currently, it’s possible to lend USD, EUR, and GBP, the rates are the same as for stablecoins. What’s also different with the Nexo CeFi platform is that the interest earned is paid daily while some platforms pay weekly. However, while some might enjoy this depending on where you live, I would not since it would be a huge burden to keep up with the taxes, so make sure to check what the reporting requirements in your country are and be sure to follow them.

When it comes to borrowing crypto, you’ll be happy to know that interest rates can be as low as 0% in certain situations, and they never exceed 13.9%. I couldn’t find exactly what the interest rates for different situations look like even though they have a borrowing calculator on their site, so be sure to use the calculator before jumping in so you know exactly what to expect.

What caught my eye in borrowing with Nexo is that they’ve deployed the possibility to apply for a loan against your NFTs. Currently, they support two collections, Crypto Punks and Bored Ape Yacht Club. When applying you can get up to 20% of the floor price. This is something many platforms haven’t yet done and I’m sure there will be good demand for this, especially now that the prices have gone sky-high. Still, when talking about NFTs be careful when lending against them since we have yet to see them tested in case of a bear market and even that 80% buffer might not be enough.

Other features on Nexo include the already mentioned payment card as well as an exchange. The Nexo card is issued in partnership with Mastercard so using it shouldn’t be a problem. The card earns you up to 2% cashback and additional benefits on the Nexo site. However, before ordering it I suggest reading this piece on Coin Bureau and watching this video, both of them are about the best crypto cards. The exchange on Nexo is decent but certainly not the best. Exchanges are a topic multiple times covered on the Coin Bureau YouTube channel so you can find more information there.

To wrap up Nexo, this platform has become the most popular and widely used lending platform on the market, and for good reason. After competitors Celsius and BlockFi faced liquidity issues, Nexo has proven itself to be the more secure, safe, and sustainable platform, while still providing some of the best rates and features in the industry.

Crypto.com: Crypto Loans and More

Crypto.com has become a go-to platform for users with various different crypto needs. This powerhouse platform supports just about everything crypto-related such as trading, an NFT marketplace, a self-custodial DeFi wallet, their own blockchain network, one of the most popular crypto cards, an attractive Earn program, and of course, crypto loans.

Image via Crypto.com

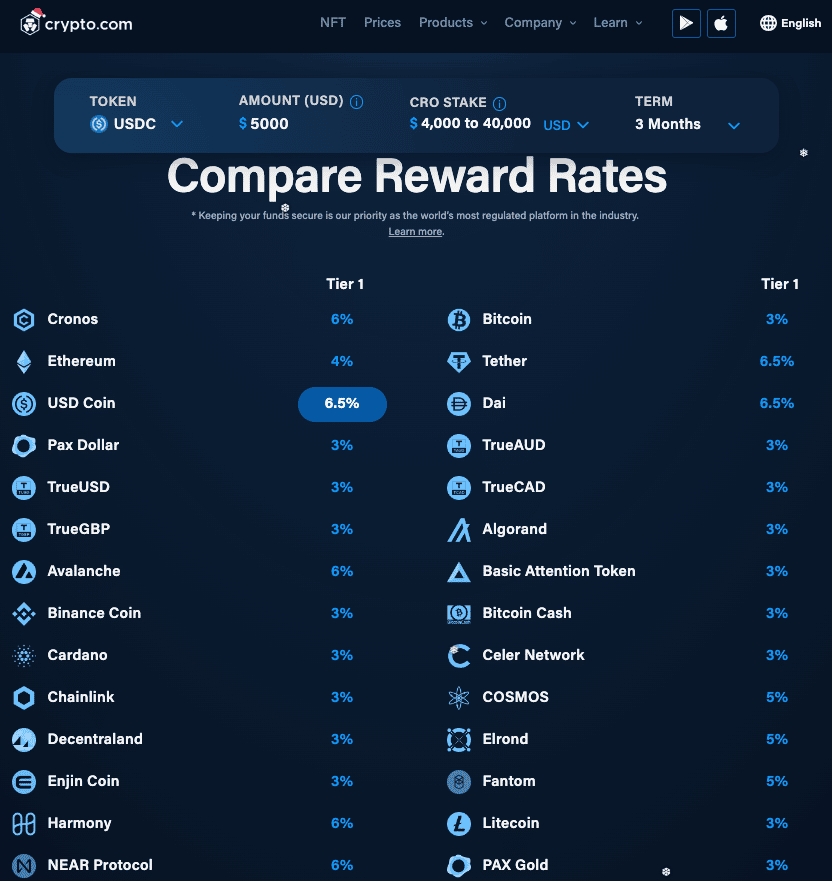

With Crypto.com, users can earn interest on their crypto holdings up to 12.5% APY through the Earn program, and take out crypto-collateralized loans up to 50% LTV. Interest rates will heavily depend on how many of the platform's CRO tokens a user stakes and the TVL selected. Here is a look at the repayment rates for crypto loans:

Image via Crypto.com

Users who take out crypto loans on Crypto.com can pay the loans back on their own schedule and can deposit 20+ crypto assets as collateral, borrowing PAX, TUSD, USDC, or USDT without credit checks, statement deadlines, or late fees.

As far as the Earn program goes, Crypto.com users can earn passive income on 37+ crypto assets, making this one of the best earn programs available, with up to 6.5% p.a on USDC stablecoin, and some of the highest returns on multiple altcoins depending on how much CRO the user stakes.

Here is a look at some of the returns available:

Image via Crypto.com

You can learn more about Crypto.com and find out why they are considered one of the top crypto platforms in the industry in our Crypto.com Review.

YouHodler: Unique CeFi Provider

YouHodler was founded in 2018 and differentiates itself by supporting a multitude of different currencies that others don’t. Another difference is that they have a few unique features, however, with the downside that a few features like a payment card aren’t on the list.

As with all the others let’s start with lending. YouHodler offers competitive interest rates with 12 % on most stablecoins, 4.8 % on BTC, and 5.5 % on ETH. On top of that they have rates on coins like YFI (4.5%) and Sushi (7%). Altogether YouHodler supports 39 different cryptocurrencies. The interest is paid weekly in the same currency you deposited, nothing new here.

The borrowing side is also fairly similar to others excluding one major difference. On other sites, the amount you can borrow on your collateral is around 50% while YouHodler allows as high as up to 90% and you can use all of the top 20 coins as collateral.

Now, while some might think this is great, I find it a bit scary. That’s because cryptocurrencies are extremely volatile, and your collateral might easily drop in value and leave you with a huge amount of debt compared to what’s left of your collateral. Speaking of collateral, YouHodler also offers the possibility to provide NFTs as collateral but that needs to be applied for separately. Now I don’t know which collections are supported but my guess would be that those blue-chip NFTs like BAYC and Punks are among them.

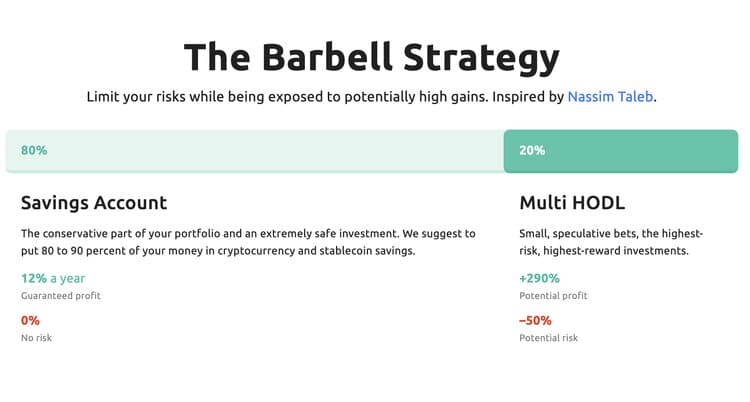

The two features not offered on other platforms are Turbocharge and Multi-Hodl. These are essentially borrowing, and lending combined with steroids. When using this what happens is that you put your coins as collateral and take a loan with which you’ll buy more crypto which will again be used as collateral for a new loan, and so on (everything is done automatically of course).

What should immediately go through your mind is the extremely high risk of this and as a personal opinion, I wouldn’t suggest this to anyone. The potential gains are nice, but you can lose a lot of money with this which is why YouHodler itself doesn’t suggest allocating more than 20% to this and the rest in traditional savings (traditional meaning the normal crypto lending).

Swissborg: CeFi and Crypto Exchange

As with YouHodler, Swissborg is vastly different from the previous platforms mentioned. This centralized finance platform is the only place I could consider using as my exchange and the yield earning possibilities are an extra bonus to use in earning additional rewards on my portfolio. Swissborg was founded in 2017 and has since gathered over 1 million users with over $1.6 billion on the platform. Different from the other platforms Swissborg doesn’t offer borrowing, but how are the yields?

Well, I have good news and bad news. The yields are great IF you have the genesis premium plan which boosts your earnings by 2x, I’ll get to the plans later. If you have the genesis premium, you’ll be earning almost 9% on stablecoins and for big boys BTC and ETH roughly 1% and 5.6% respectively. Now you might be wondering what else you can earn interest on and sadly there’s not much to wonder about since including those mentioned above Swissborg only supports earning on 9 different cryptocurrencies. The highest yield here is that of the Swissborg native token CHSB and currently, the rate is sitting at 24%.

Why I said I might be open to using Swissborg as my exchange is because with the genesis premium you get low fees of only 0-0.25%. On top of that Swissborg offers some analytics tools as well as good portfolio statistics. They also allow trading with many more cryptocurrencies than they offer yields on, so you don’t need to be worried about that.

Now to the disappointing part. I’ve been writing about the wonderful things in Swissborg for those who have the Genesis premium, but the truth is that I don’t think many will go for it. In order to get it you need 50 000 GHSB tokens which will cost you over $30k in today's prices.

Another possibility you can go for is the community premium which only requires 2000 GHSB tokens (≈ $1200). With the community premium you get 1.5x yield boost and 0.75% trading fees. Now depending on the size of your portfolio, this could be worth it since the GHSB has been able to get you a 115% gain in 1-year excluding the high staking rewards on top of that, but it’s up for you to do your own research and decide.

We have a dedicated Swissborg Review if you want to know more about it.

Wirex: CeFi for the Masses

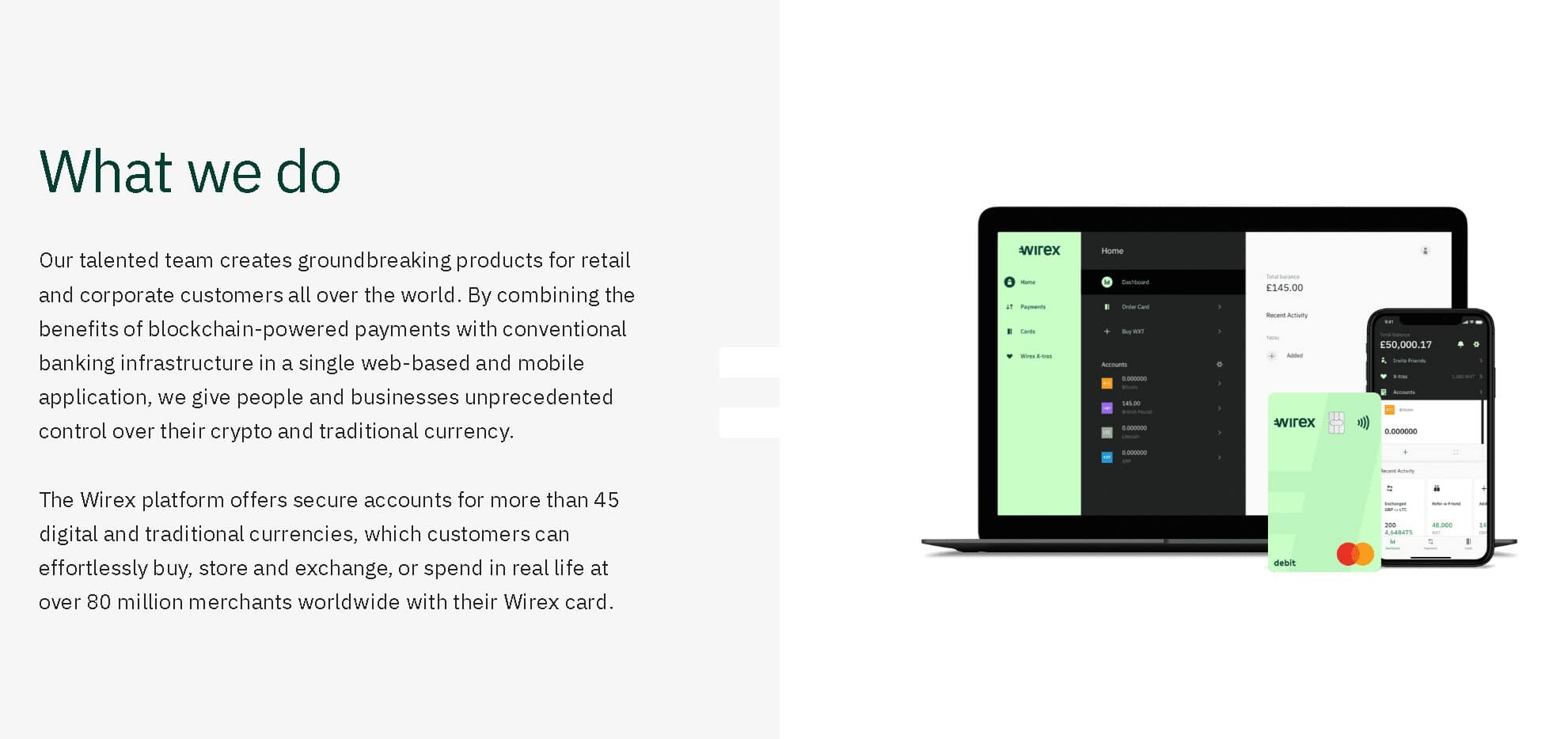

Founded all the way back in 2016, Wirex is a good all-in-one crypto platform for those looking to buy, sell, hodl, borrow, and spend crypto. Wirex was founded by three members with over 40 years of experience working in the Fintech industry and is based in the UK, with additional locations in the United States, Ukraine, Ireland, and Singapore.

Wirex has a simple mission, and that is to make traditional money and cryptocurrency equal and accessible to everyone. Wirex launched one of the first crypto debit cards and supports over 45 digital and traditional currencies, allowing users to buy, store, exchange, or spend at over 80 million merchants worldwide.

Image via Wirex

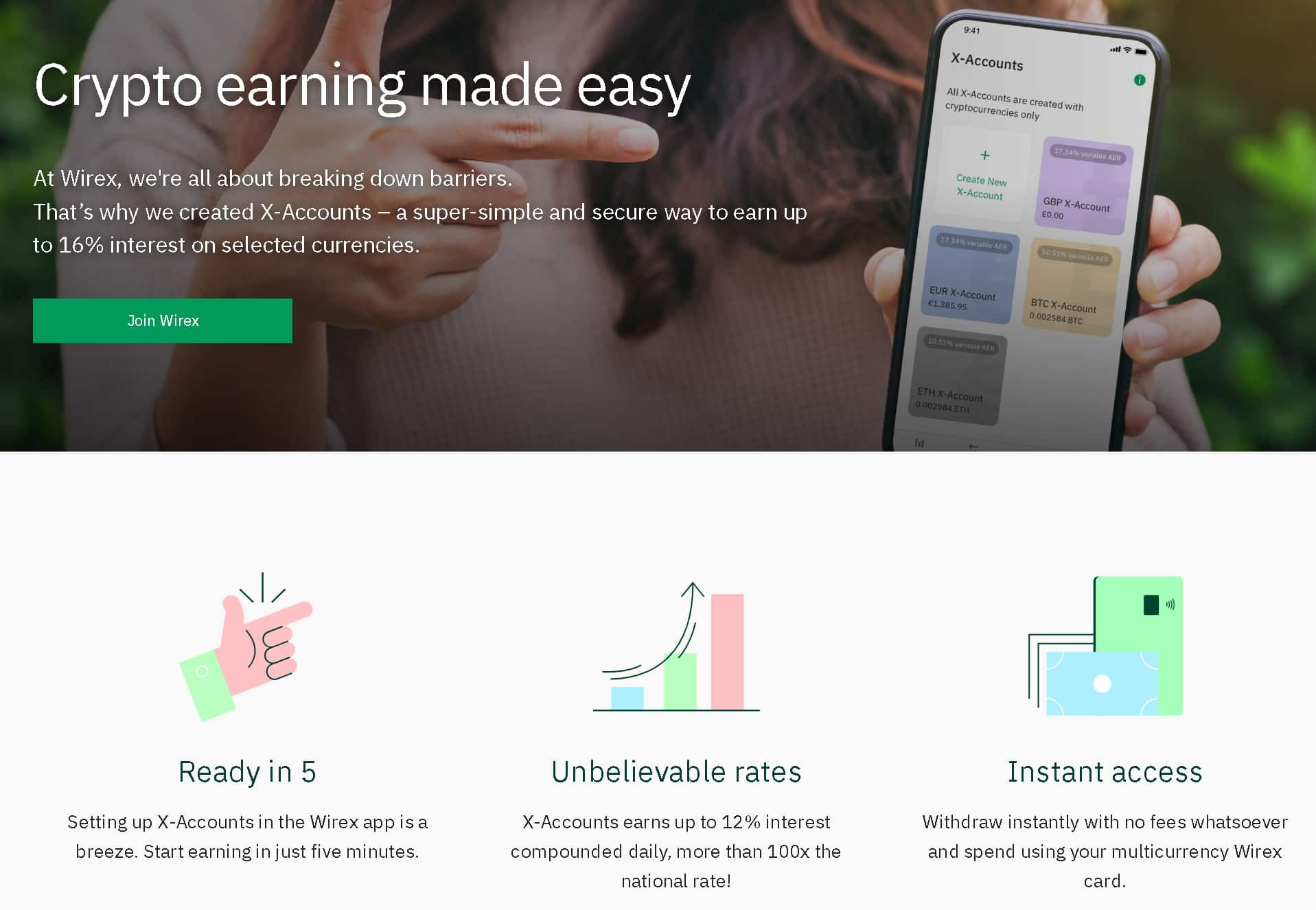

In addition to their crypto debit card which offers up to 8% cashback on spending and zero exchange fees on FX, the platform also offers what they call X-Accounts. This feature is a simple and secure way to earn up to 12% interest by simply holding a variety of cryptocurrencies and stablecoins. Wirex offers among the highest APYs available for those looking to earn some passive income on their hodl stash.

Wirex X-Accounts Are a Great Way to Earn APY. Image via Wirex

Following the success of the widely popular crypto card and X-Accounts, Wirex decided to up their game and now offers borrowing services as well. Through Wirex Credit, users can instantly take out a credit line against their crypto so there is no need to sell those moon bags if you need short-term access to funds. Customers can choose to borrow against their BTC, ETH, or Wirex's native WXT token. Here are the benefits of Wirex Credit at a glance:

- Borrow up to 80% of the value of your holdings

- Pay just 10% APR- Interest is calculated daily, so you only pay on the days you have an open credit line. Some currencies can be borrowed with as low as 0% interest.

- Credit line allows users to borrow NXDUSD, USDC, USDT or DAI

- Instant approval of the credit line, funds are made available straight away and can be spent on the Wirex card

Wirex customers feel confident in their platform of choice, as it has a long-standing history and a good security record. Wirex follows industry best practices when it comes to security and boasts the following security features:

Image via Wirex

If you’re looking to borrow, hodl, spend, earn, or just incorporate crypto more into your daily life, Wirex is a platform worth checking out.

Crypto Lending FAQs

Where does the yield come from?

Some or all of the crypto deposits that users deposit on the platform are managed and lent out by the crypto company. Users are able to take out loans which are funds provided by customer deposits. The interest rates to borrow are higher than the interest rates offered on deposits so the extra money is passed on to customers who deposit (AKA lend) in the form of a yield. All the lending and borrowing is taken care of by the company so all customers have to do is deposit funds and the platform takes care of the rest.

How does Bitcoin lending work?

Many of these platforms provide the option to lend and borrow more than just Bitcoin but we will use Bitcoin as an example. Crypto lending works similarly to traditional lending from a bank, the only difference being that any crypto user can become a lender by depositing funds, no longer making this just a banker's way to make money.

Cryptocurrency-backed loans use digital currency as collateral, similar to a securities based loan, or say, a mortgage, where the loan is backed by the value of a home. So if I have one Bitcoin, I can deposit it onto a crypto lending platform where it is “locked up” and I can borrow an amount less than the value of the Bitcoin. Like a regular loan, customers pay back the funds over a specified period and they were able to access funds without having to sell their Bitcoin which is a win-win.

When getting a crypto-backed loan, depending on the platform, customers can put up a multitude of different crypto assets up for collateral and borrow up to 70% of the value of their holdings depending on the platform. The funds that the customer looking to borrow can be other cryptocurrencies, stablecoins, or even US dollars that can be wired to a bank account.

Are crypto loans safe?

There are always risks involved in financial products. From a lending perspective, there is always the risk of major macroeconomic events causing mass liquidations of loans, when borrowers are not able to pay back their loans. This is a risk in both traditional and crypto finance, we saw an extreme case of this in traditional finance in the 2008 financial crisis.

From a borrower's perspective, using crypto as collateral is riskier than traditional secured loans due to the extreme fluctuations of cryptocurrencies. There is a risk that the crypto put up for collateral can drop significantly in value over a short time, leading your loan-to-value ratio to fall outside of the appropriate ratios and result in the liquidation of your collateral. Crypto lending companies will notify you when your loan-to-value (LTV) ratio is reaching these levels and from there you will need to choose to sell some of your collateral or put up more funds to bring the LTV back in line.

Crypto lending is also a hot topic for regulators and we have seen crackdowns on platforms like BlockFi, Voyager and Celsius so regulatory changes also pose a risk to these CeFi lending platforms. We have also seen two of the most popular crypto lending platforms BlockFi and Celsius become insolvent and file for bankruptcy in 2021 as a result of poor money management, resulting in customers losing access to their funds. This lead to many in the crypto industry feeling that keeping funds on a centralized platform to earn yield is not worth the risk at this time.

Top CeFi Platforms: Conclusion

Before getting to the actual conclusion, I just wanted to quickly add that all of these platforms are available as mobile applications and some of them are even mobile-first built. Therefore, if you can’t seem to have access to some features, you should check if it’s available in their mobile app.

Another thing I want to remind everyone about is that the rates stated here do fluctuate based on supply/demand. Those high rates for DOT might quickly fade if more people lend them. Also, the total amount you receive does take a hit if the underlying asset falls in value so don't trust all the calculations you do to a full 100% since your earnings will fluctuate.

Now, when it comes to which you should use there’s no definitive answer that I can give you. All of them come with their own pros and cons, therefore it’s your job to weigh which centralized crypto platform is right for you. For example, as mentioned earlier I’m a fan of simplicity which is why I’m up to sacrificing small gains in order to make the tax burden easier.

Then if not only picking from these options is hard, there are several more options to take into consideration for great exchange platforms. These include the likes of Binance and KuCoin, which both offer competitive earn features. And to make it just a tiny bit harder, you also have the whole DeFi space to explore, but that’s a topic for another day.