Ben Franklin said the only thing in life that’s certain is death and taxes. While cryptocurrencies wouldn’t be created for another 240 years, the same remains true today. If you have income from crypto, you need to pay the tax man. Fortunately for you, we have compiled a list of the best crypto tax software to make the process as painless as possible. Yay…Taxes 🙄

It’s one thing to say, “you need to pay your taxes,” but a whole other process to actually do it, and many are left wondering where to start and how to proceed. With crypto, it isn’t easy. Moreover, collecting information on all of your trades and compiling them in your tax returns can be a daunting task.

Fret not, my fellow hodlers; as in this post, I will give you some info that should hopefully help you on your journey and give you seven crypto tax tools & software that could help simplify this process.

If you are eager for more tax tools, Guy also happens to have a video on his top picks for useful tax tools:

Before diving in, let’s take a look at some taxation regulations.

Page Contents 👉

- 1 Global Crypto Tax Treatment

- 2 Best Crypto Tax Software: Top 7 Crypto Tax Tools

- 2.1 Best Crypto Tax Software #1: CryptoTrader.Tax (Now called CoinLedger)

- 2.2 Best Crypto Tax Tool #2: Koinly

- 2.3 Best Crypto Tax Software #3: TaxBit

- 2.4 Top Crypto Tax Tool #4: CoinTracking

- 2.5 Top Crypto Tax Software #5: Accointing.com

- 2.6 Best Crypto Tax Software #6: BitcoinTaxes

- 2.7 Best Crypto Tax Tool #7: ZenLedger

- 2.8 Additional Thoughts

- 3 Top Crypto Tax Tools: Conclusion

- 4 Crypto Tax FAQs

Global Crypto Tax Treatment

If you’re in the U.S., the U.K., Japan, Canada, Australia, or many European countries, then crypto taxation is something you need to take seriously. These are some of the countries that already have tax regulations in place, and they expect their citizens to pay those taxes reliably.

Many of these countries are now also working with exchanges and chain analytic companies in order to track transactions, so if you think the tax man doesn’t know about the Bitcoin you sold this year, news flash, they definitely do. Big brother is always watching. If you buy or sell crypto on a major exchange, it is best to assume that the government is likely going to know about it.

Here’s a table that shows how cryptocurrencies are classified by these countries, and what taxes citizens are required to pay:

|

Country |

How Crypto is Classified |

Type of Tax Paid |

|

United States |

Property |

Capital Gains Tax |

|

Australia |

Property |

Capital Gains Tax |

|

Japan |

Property/miscellaneous Income |

Income Tax |

|

United Kingdom |

Property |

Capital Gains Tax Income Tax |

|

Canada |

Funds or Intangible Property/ Commodity |

Capital Gains |

As you can see, the tax laws for cryptocurrency and how to file crypto taxes can vary depending on the jurisdiction. That aside, there are many useful tools for calculating crypto taxation regardless of your location to help simplify the calculating and filing process.

Also, note that the capital gains tax is for the event of selling crypto assets. Crypto can also be taxed as income or business income if you are actively trading, staking, receiving airdrops, renting NFTs, lending etc.

Image via Shutterstock

There are so many ways to earn crypto income, many of which are taxed differently, so it may be a good idea to seek advice from a tax professional as it can be confusing. Here are just some of the different crypto-related activities that are subject to taxation in many countries:

- Selling for fiat at a profit or loss- take advantage of writing off those capital losses people! They can offset the tax paid on gains.

- Exchanging digital assets on a DEX or centralized exchange- Yup, this one is a bummer. Swapping an altcoin for some Bitcoin can also trigger a tax event.

- Receiving airdrops- Yup, apparently this is “income.”

- Sale of NFTs- This can trigger capital gains, or income tax depending on the nature of the income.

- Earning income from Blockchain and P2E games.

- Staking income.

- Providing liquidity or yield farming- Any APY earned may be considered income.

- Using CeFi lending platforms like Nexo, an exchange, or DeFi lending protocols like Compound Finance or Aave.

- Crypto mining.

- Using crypto debit cards.

- Earning rental/advertisement income from digital land or renting NFTs.

Much of the software in this article works for any number of countries. Users can import data from crypto exchanges or sync the software directly to their exchanges, wallets, DEXs, and DeFi protocols for automated ease. Good tax software can also auto-populate information, filling the appropriate tax forms so you don’t even need to know which number to plug in where. Think of these tools like TurboTax, but for cryptocurrency activity.

Once you’ve collected all your crypto records by exporting activity history from an exchange/platform then uploaded the files into the tax software, or allowed the automated integration to do the heavy lifting and gather all the info for you, you can:

- Hand it to your accountant so they can figure it out and file on your behalf.

- Use one of these crypto tax tools and file your taxes yourself.

- Allow one of the tools like Cryptotrader.tax, (rebranded now as CoinLedger) or CoinTracker to auto-fill tax forms to file yourself, or utilize their team of tax professionals who can help you file, or file on your behalf.

Some crypto transactions aren’t taxable though, and it’s good to know what these are so you don’t inadvertently end up paying too much in taxes. Examples include charitable donations, transferring crypto between wallets, and simply buying and holding cryptocurrencies in most countries.

In the U.S., tax authorities have stated that even if a return is accepted now, it is open to audit from the IRS and taxpayers could be asked to file an amended return years later and pay back taxes.

Best Crypto Tax Software: Top 7 Crypto Tax Tools

Crypto tax software can identify which transactions are taxable and which aren’t, saving you from making that determination yourself.

It does this through a series of questions and by analysing crypto transaction events. The tax tools will also try to help lower your tax bill by using capital loss deductions if you’ve had losses on your crypto trading and investing activities.

Here are the top 7 tools available to traders and investors to help you with your crypto tax software comparison.

Best Crypto Tax Software #1: CryptoTrader.Tax (Now called CoinLedger)

Just so we are on the same page, CryptoTrader.Tax rebranded to CoinLedger in 2022. As CryptoTrader.Tax has a fantastic reputation and is an excellent platform, I wanted to point out that it is still the same great company, just with a shiny new name.

Image via CoinLedger

While some of the crypto tax software later in this article can seem a bit complicated, that isn’t the case with CoinLedger. According to the website, CoinLedger will let you finish your crypto taxes in “the easiest and most reliable way.”

The tool supports integrations and imports from over 384 different exchanges, 19 DeFi platforms, 8 wallets including MetaMask, Trust Wallet, and Exodus, and covers cryptocurrencies and NFTs. This makes it simple to import your trades and easily calculate gains and losses for the entire year, covering things like simple swaps, and actions undertaken on supported DeFi protocols like Aave, Uniswap, Compound, PancakeSwap and more. It really doesn’t get much easier.

There are plenty of other useful features baked into the platform which make it a very straightforward method for anyone to calculate their tax liability from their cryptocurrency activities. One of these features is the automation of all the crypto tax reports and forms needed when filing.

Image via CoinLedger

By using CoinLedger throughout the year, traders can keep an eye on their profits and losses, and their tax liability. This can help in reducing capital gains and taxable events if that’s useful.

The CoinLedger team have put together this handy YouTube video on How CoinLedger Works if you want a visual walkthrough that puts all the bits and bobs together.

Traders can get started for free with the platform. The free version allows users to import all of their transaction history, view their net capital gains and losses with the crypto tax calculator, and track their portfolio. Payment is only required when users want to download and view their full crypto tax report.

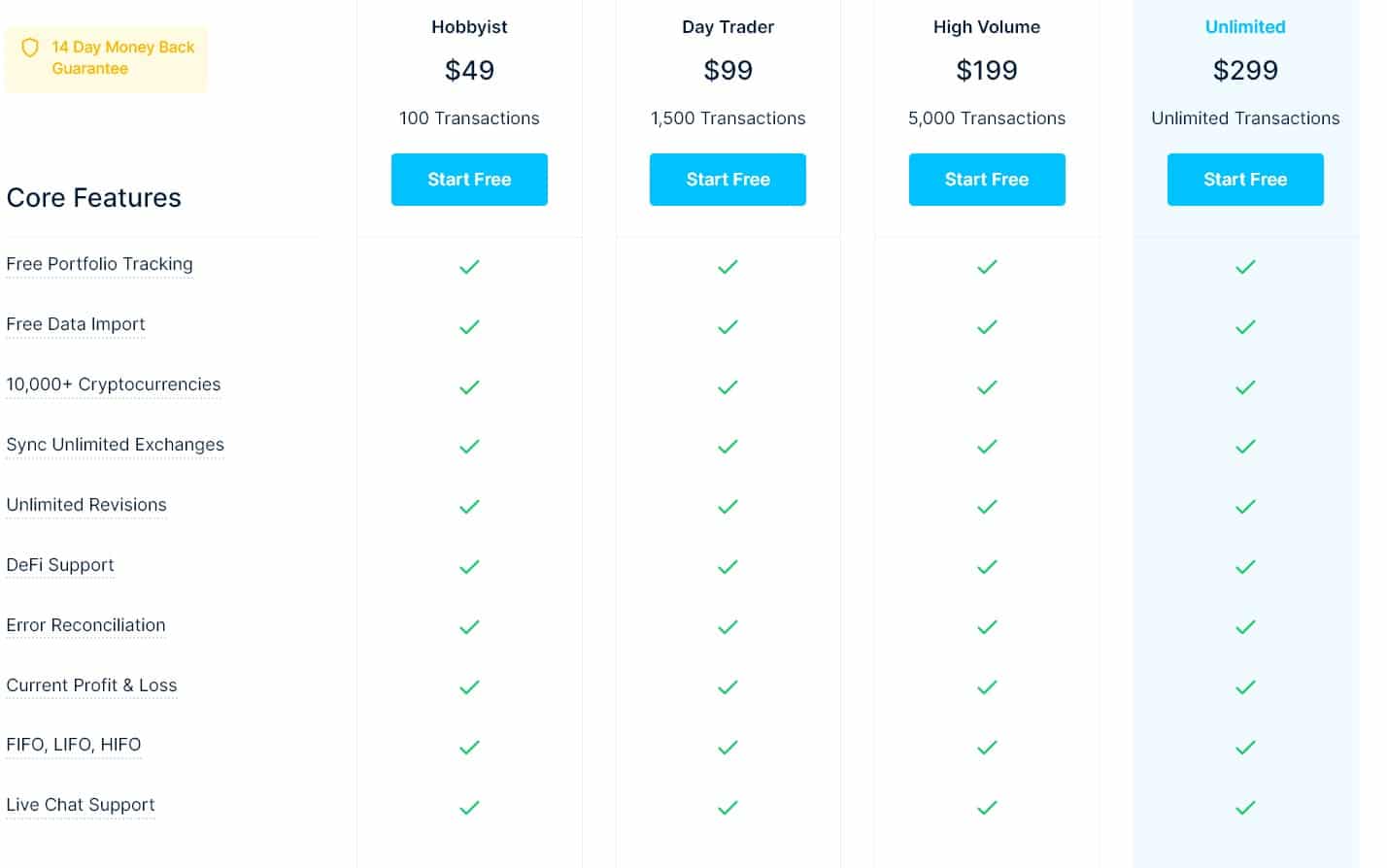

Above the free version, the fees depend on how many transactions you’ve made over the course of the calendar year and are as follows:

- Hobbyist $49- 100 transactions

- Day Trader $99- 1,500 transactions

- High Volume $199- 5,000 transactions

- Unlimited $299- Unlimited transactions

Here is a look at the features included in the different plans:

Image via CoinLedger

The paid versions include integrations with the following tax software:

- TurboTax

- TaxACT

- H&R Block

- TaxSlayer

And the tax reports that can be generated are as follows:

- IRS Form 8949

- Income Report

- Capital Gains Report

- End of Year Positions

- Audit Trail Report

- Tax Loss Harvesting

This is a crypto tax solution that makes it simple to manage your taxes and it does it at a reasonable price. Plus, it will reduce or eliminate much of the stress associated with crypto taxes and provide reliable and accurate tax reports.

Best Crypto Tax Tool #2: Koinly

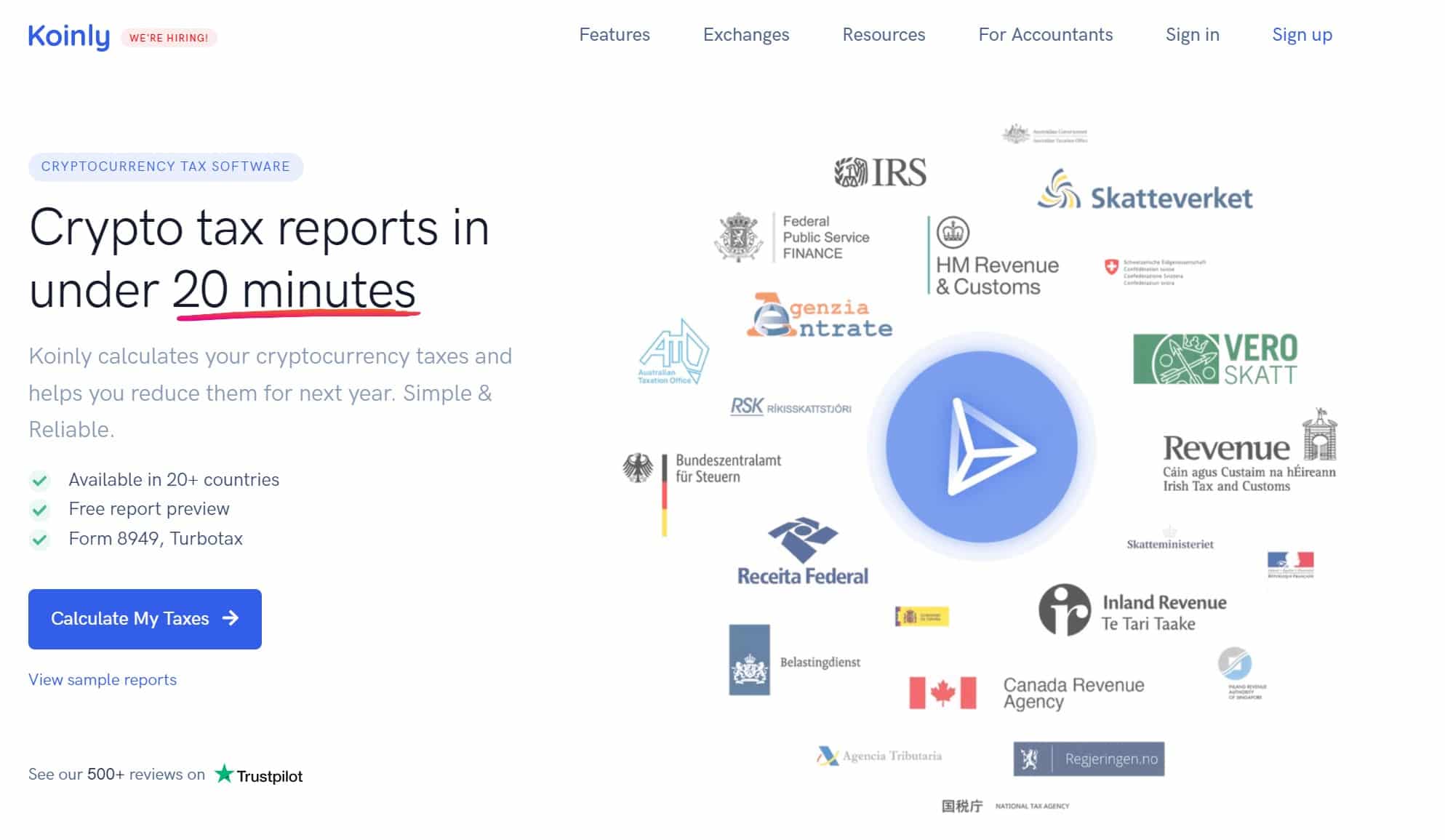

Koinly combines crypto accounting and tax all in one software package. The UI is one of the best in the crypto tax field, and in addition to handling tax reporting for the U.S., Australia, and Canada it also supports tax reporting for more than 20 other countries.

Image via Koinly

These aren’t just generic files being generated either, Koinly was developed in close collaboration with tax firms around the world and is trusted by CPAs worldwide. The platform provides reports such as Form 8949 and Schedule D in pdf format that users can submit directly to their tax authorities.

Koinly has an API that allows it to connect to:

- Over 350 Exchanges

- Over 50 wallets

- Over 6,000 blockchains

- Over 20 DeFi and crypto services

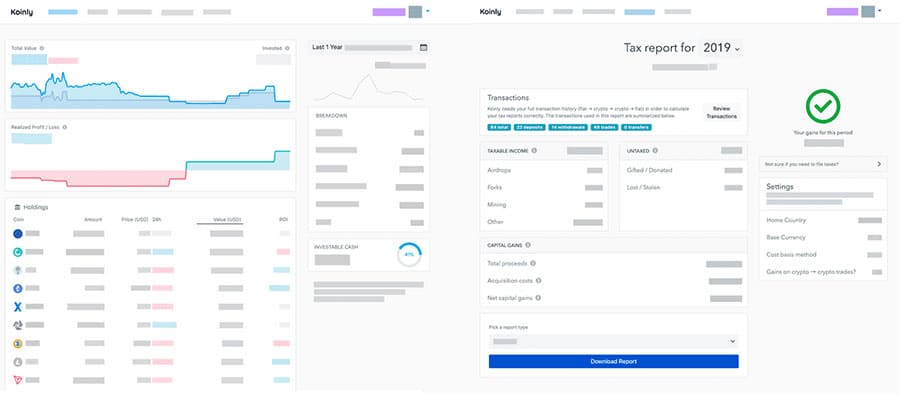

I really like that Koinly approaches users’ personal crypto holdings from a 360-degree view, more than just from a tax perspective. Customers can use it to keep track of their crypto portfolio, watch how it changes over time, and generate some lovely graphs so they know exactly how their crypto portfolio is performing. While there are certainly other portfolio tracking tools, Koinly shines by offering both portfolio tracking and tools to monitor and reduce taxes.

Image via Koinly

Koinly has a feature that matches transfers between exchanges and your own wallets, which helps avoid unnecessary taxes. It also has a smart error-handling system that warns when there are discrepancies in the data or when there might be inaccuracies in the tax report. They also have a crypto tax guide to help users get the most out of the platform.

Koinly also has a lot to offer users for free and is one of the most powerful tools for those thrifty penny pinchers. Here is a look at the pricing plans that compare the free plan to the Trader plan:

Image via Koinly

Koinly is a great platform and with the feature-packed free version, you’ve got nothing to lose by taking advantage of the service and deciding if the extra paid features are worth your hard-earned Satoshi’s. If you want to learn more about Koinly and why it is one of our top picks, you can learn more about it in our Koinly Deep-Dive Review.

👉 Sign up for Koinly and find out why this is a community favourite among crypto traders!

Best Crypto Tax Software #3: TaxBit

TaxBit is another crypto tax software package that was founded by blockchain CPAs and cryptocurrency tax attorneys, so you know it will have all the features required to make up a robust tax reporting platform.

Interesting to note, TaxBit has received substantial venture funding and is one of the most well-funded crypto tax reporting software companies. In early 2021, they had raised $100 million in a Series A funding round, then five months later they raised another whopping $130 million in a Series B funding round. Money flowed in from some big names including the likes of Peter Thiel’s Valar Ventures as well as Winkelvoss capital (among many others).

This brought the Utah-based crypto tax and accounting provider to the valuation of $1.33 billion, which is no small feat, reaching “unicorn” status. With the funds, the company expanded aggressively and is now firmly positioned as one of the major players in the crypto accounting space, connecting them with exchanges such as Coinbase, BlockFi, and Gemini.

Image via Taxbit

Though this is a crypto tax tool, supporting over 4,200 coins and tokens, it also supports a range of other assets like commodities, equities, and other fiat currencies. This makes TaxBit especially convenient for day traders who trade multiple different asset classes.

TaxBit supports integrations from over 500+ cryptocurrency exchanges, NFT platforms, DeFi platforms, non-custodial wallets etc., and provides real-time visibility into portfolio performance. TaxBit has positioned itself as the crypto tax tool of choice for many institutions and government agencies, while still being perfectly suitable for individual retail investors.

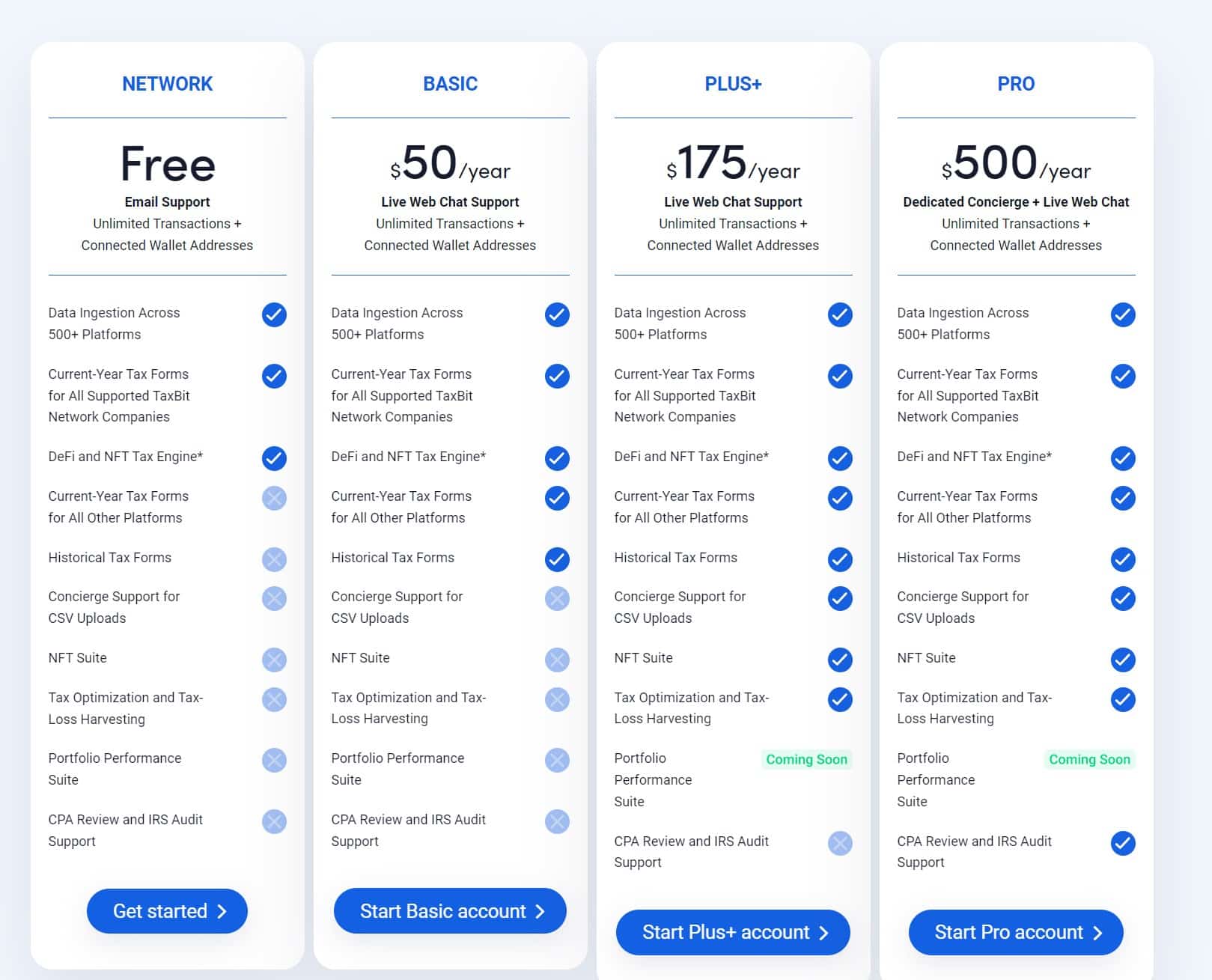

The platform has insanely positive reviews across a multitude of different review sites like Trustpilot and app download stores, boasting a 97.3% satisfaction rating. Users can get started with the free plan, here is a look at the TaxBit pricing plans:

Image via Taxbit

Something else that I liked was their portfolio analytics tool. Unlike most software that is used only at the end of the year to generate tax info, TaxBit allows users to monitor their portfolio live and on a continuous basis. This gives customers a full picture of their potential tax position currently.

You will also appreciate the immutable audit trail that has been designed by CPAs. This means that in the event that you were to ever get an audit from the IRS, you could easily drill down into any transaction and see how gains/losses were calculated on the cost basis.

Taxbit Audit Trail

The software also lets you customise your personal tax rate. Using the demographic information that you provide, TaxBit calculates your individual tax rate by taking into account the state and federal levels. This can give you the most accurate picture of your liability or refund.

TaxBit can help with:

- IRS form 8949

- Form 1099 reporting and tax compliance

- Tax Loss Harvesting

- Tracking NFTs and DeFi trades

- Real-time portfolio monitoring

- CPA review and IRS Audit support

Similar to the other tax tools, once TaxBit has collected all the data, users can either download the data from the integrated exchanges in a simple pdf form to be sent to your accountant, or it can be used to auto-populate the info in tax filing software such as TurboTax, TaxAct etc.

Top Crypto Tax Tool #4: CoinTracking

CoinTracking calls itself the leader in cryptocurrency reporting and tracking, and with over 1 million clients, including more than 25,000 corporate clients and CPAs, they might not be wrong. CoinTracking is particularly detailed, and users will know exactly how their portfolio is performing, how diversified they are, and what their tax burden is going to be throughout the year.

CoinTracking has a web-based solution which allows for the easy connection to exchanges via an API, or through CSV files. This allows CoinTracking to display the complete trading history of a user, and determine profits, losses, and taxes owed in real-time. Final reports can be generated in a number of formats, including CSV, PDF, XLS, XML, and JSON.

Image via CoinTracking

The platform aggregates all of the transactions made through the connected accounts, showing exactly what was sent or received, and the exact trades made over the course of the year. CoinTracking can help with:

- Personal Analysis- 25 customizable crypto reports to show things like profit/loss, audit reports, realized/unrealized gains etc.

- Easy Imports from 110+ exchanges- Automatic import, and direct syncs.

- Tax Declaration- over 100 countries supported for filing capital gains, income, mining, business operations tax and more.

- Tax Advice- Team of tax advisors to help with tax queries and perform tax reviews.

The platform also shows the historical coin prices at the time the trades were made and has over 11 years of data on more than 20,166 altcoins.

CoinTracking has positioned itself to be suitable for individual hodlers, traders, institutions, and companies. Like the other mentions on this list, users can enjoy limited functions for free, or choose one of the paid plans as you can see here:

Image via CoinTracking

One of the requirements for any platform to make it in this article is that they have to have positive reviews and a good reputation, and CoinTracking is no exception. These guys have some raving reviews from the likes of Forbes, Nasdaq, CNN, Bitcoin.com, CNBC and more, so users can sleep well at night knowing their taxes are being done accurately with CoinTracking.

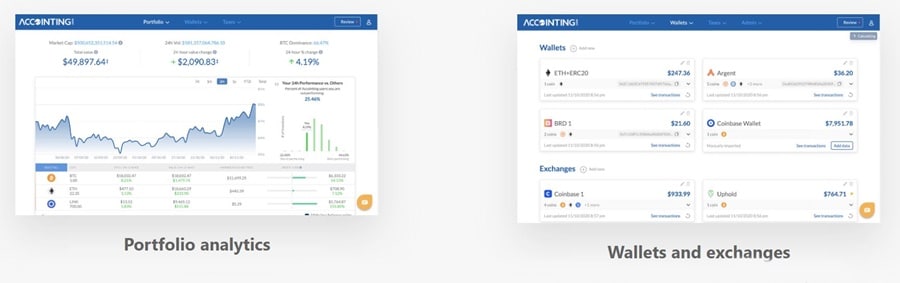

Top Crypto Tax Software #5: Accointing.com

Accointing is one of the newer tax accounting solutions, having been launched in 2019. It also claims to be an all-in-one solution that covers everything crypto and tax-related, helping from Bitcoin to DeFi and NFTs. It has a user-friendly interface, and in many cases, you’ll be able to get your crypto-tax information together in just a few clicks of your mouse.

One of the most powerful features is the portfolio management tool that comes with Accointing. Users can drill down to view the state of their portfolio within a specific timeframe, historical and current performance. Related to this is the Holding Period Assistant dashboard, which will look at when you added cryptocurrencies to your portfolio and then make tax-strategy recommendations such as tax-loss harvesting based on your holdings and holding period.

So much power with the click of a mouse. Image via Accointing

When it comes to crypto taxes, Accointing has you covered. The Tax Review feature automatically goes through all the steps required to calculate a user’s tax burden accurately. It will even generate reports based on different cost accounting methods, allowing customers to choose the best for their situation easily. It also allows users to mark off transactions as airdrop, hard fork, gift, or payment to ensure they are being taxed appropriately.

All of this is made possible by the import function of Accointing. The data import software included in the Accointing package makes it super easy to upload everything from wallets and exchanges via CSV or API integration. Once a user has linked all their wallets and exchange accounts, it’s as easy as clicking a button for Accointing to pull in all the data and begin its tax calculation magic.

Accointing currently supports:

- 300+ exchanges

- 50+ wallets

- 28 blockchains

Accointing is one of the best options on our list for those who prefer free services. Users with less than 25 transactions per year get full access to the platform for no cost, not a watered-down version like some other mentions on the list.

Though if you have more than 25 transactions, you’ll need to purchase one of the following plans:

Image via Accointing

Accointing is a very powerful and user-friendly tool for tracking your portfolio and generating tax reports. Both features will save you time and quite possibly a good bit of money.

Accointing has plenty of fantastic reviews and was featured in Yahoo Finance, Bloomberg and Seeking Alpha as it is a great tax tool that you can’t go wrong with.

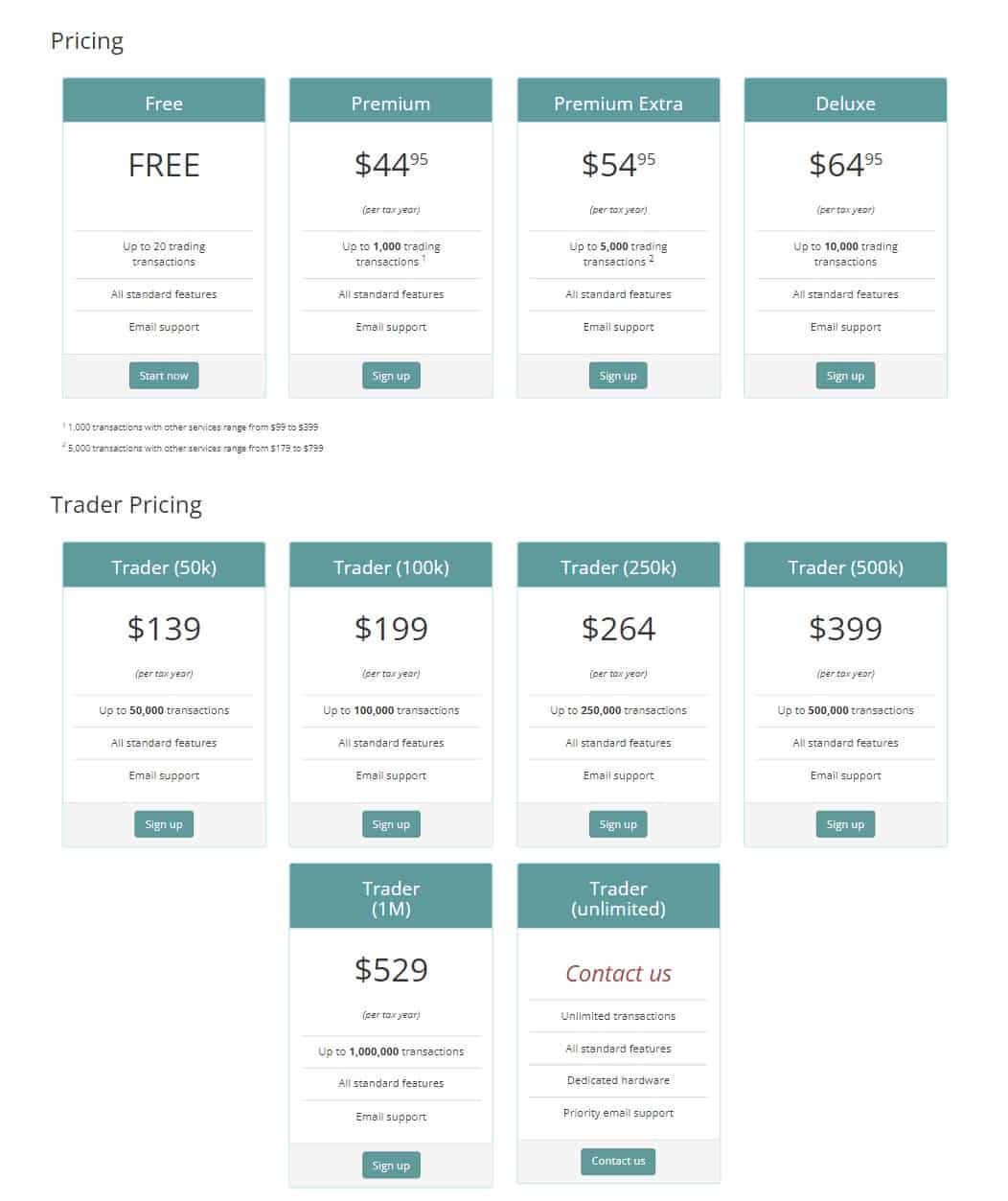

Best Crypto Tax Software #6: BitcoinTaxes

BitcoinTaxes is another popular crypto tax solution. Launched in 2014, it is a web-based solution that offers users a group of excellent tools for tracking annual tax obligations. It includes the ability to generate detailed tax reports, including all the transactions carried out throughout the year.

These reports include transaction data from many popular exchanges such as Coinbase Pro, Bittrex, Gemini, Binance and others. It’s also possible to add your data via CSV files, and users can add any funds they’ve spent on personal items or donations. The platform also supports importing any mined cryptocurrencies that may have been received throughout the year.

Image via BitcoinTaxes

The platform will generate your capital gains for the year, which can then be input into the tax software of your choice or can be printed out to share with your tax accountant, or attached to your tax return.

Bitcoin Taxes has two different pricing methods, one for average crypto users, and one for high-frequency traders:

Image via BitcoinTax

The free version here is great as it provides full platform functionality for up to 20 transactions, and the platform is available to users anywhere in the world. In addition, full-service tax preparations are available to those in the USA and Canada.

Bitcoin Taxes has less platform support than the other mentions on this list, only supporting 21 exchanges. However, any other exchange or platform users need to include data from can be imported manually with a CSV file or added manually into the interface.

Best Crypto Tax Tool #7: ZenLedger

ZenLedger is a simple and effective platform for calculating cryptocurrency, DeFi and NFT-related taxes. Those who use TurboTax may want to consider using ZenLedger for their digital assets as it seamlessly integrates with the platform.

Image via Zenledger

ZenLedger is another mention on this list that has received pretty significant funding through a couple of funding events. In 2021, ZenLedger raised $6 million in a Series A funding round led by Bloccelerate and saw investment from Mark Cuban’s Radical Ventures, among many others. Then in 2022, the company raised $15 million in Series B funding. It is also interesting to note that ZenLedger is the partner of choice for the IRS, so you know they must be as compliant as they come.

ZenLedger has received positive reviews and was featured in the Wall Street Journal, Bloomberg, Coindesk, Forbes and more. ZenLedger supports the following:

- 400+ Exchanges

- 40+ Blockchains

- 20+ DeFi protocols

- 23 Crypto Wallets

ZenLedger will quickly import transaction history from supported exchanges and will automatically use the data to fill in the required information in tax documents. This includes capital gains, donations, closing statements, profit and loss statements, and income from cryptocurrencies.

All of the reports and documents created by ZenLedger are IRS-friendly. That means they can all be submitted directly or used in conjunction with other tax reporting solutions. As a result, ZenLedger works perfectly for all levels of crypto enthusiasts.

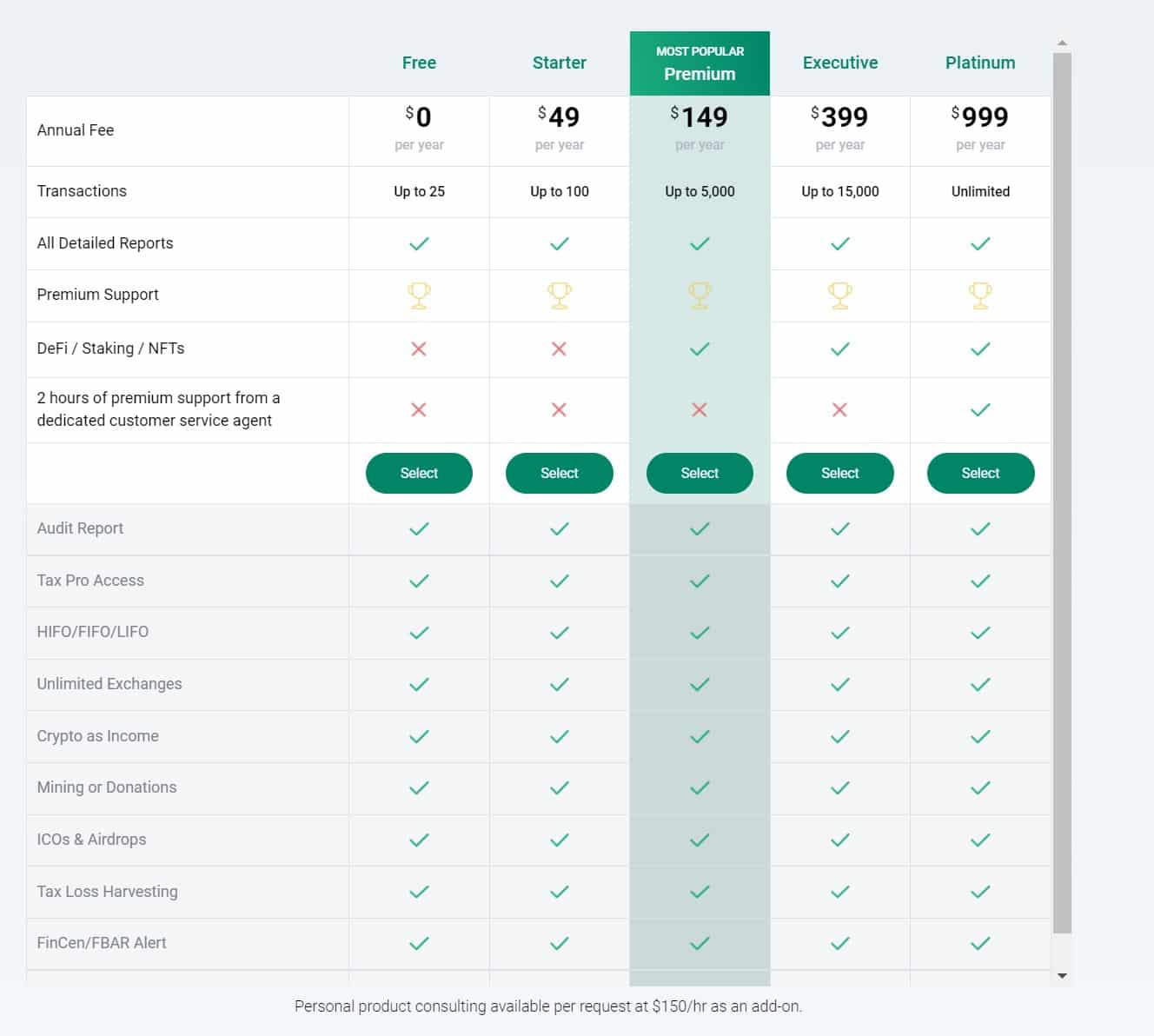

Pricing for the different ZenLedger plans is as follows:

Image via Zenledger

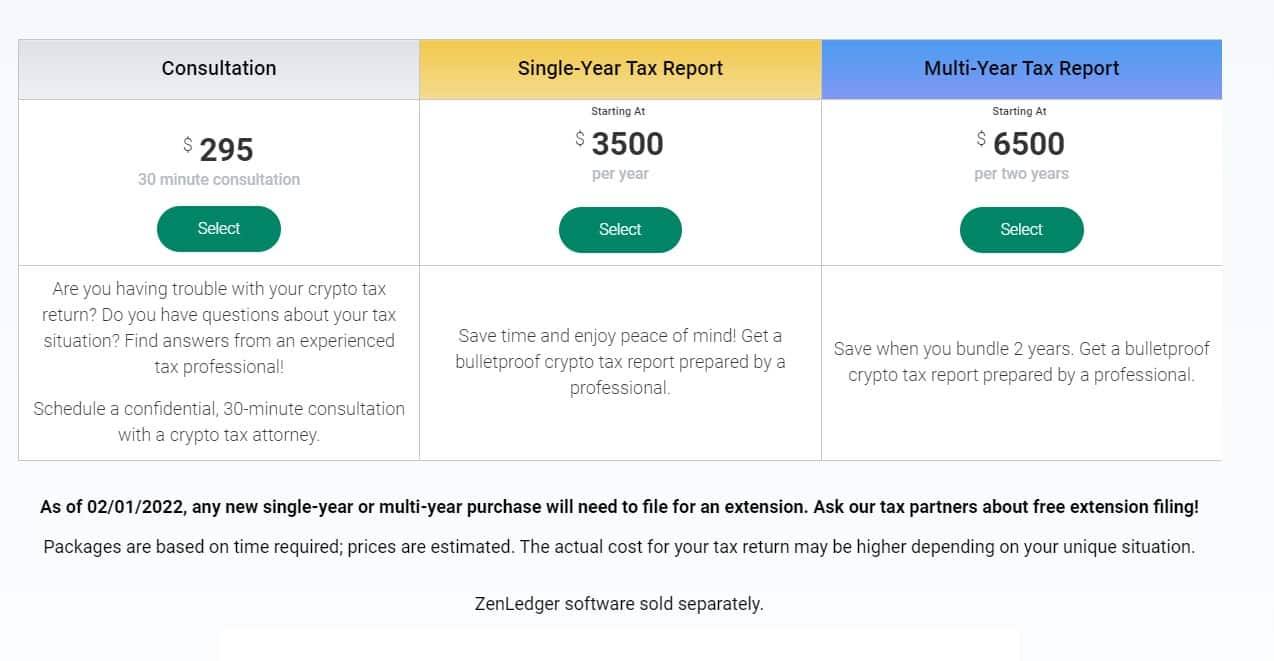

Those who want their crypto taxes done with minimal effort can also use ZenLedger to access tax professionals who can prepare and file a tax return on a customer’s behalf. Here are how those services stack up:

Image via Zenledger

I would say that ZenLedger would be my top pick for US-based hodlers due to the IRS-friendly nature of the platform and seamless integration with TurboTax. You can’t go wrong with this one.

Additional Thoughts

If you are someone who finds taxes a royal pain and would rather avoid them altogether (legally, of course), have you considered moving to a country that doesn't tax crypto? You can find some options in our article on Crypto Tax-Friendly Countries.

If you are seeking more information on whether relocating is right for you, feel free to book a call with our friends from Offshore Citizen to plan and execute your move legally with as little hassle as possible. They help with residency permits, bank accounts, company structures, etc.

Top Crypto Tax Tools: Conclusion

Calculating crypto taxes can be a delightful, stress-free, and fun way to spend a weekend – Said nobody, ever.

I am afraid that for those of us not fortunate enough to live in one of the top crypto tax-friendly jurisdictions, crypto taxes are just a part of life.

Fortunately, these solutions can make the burden of calculating and filing your taxes an absolute breeze and provide crypto enthusiasts with peace of mind knowing that they are filing their taxes accurately.

Best of all, with the landscape surrounding cryptocurrency taxation continually changing and new tax laws popping up and evolving faster than the Fed can print money, these platforms will keep in front of those changes and help their users remain compliant with the latest tax laws in their respective countries.

Using one of the seven solutions above will ensure the correct information is being collected and reported to tax agencies and could help users avoid penalties or fines. Keeping track of tax information for digital assets can be challenging, but these crypto tax tools make it far more manageable.

Crypto Tax FAQs

Do you have to pay taxes on crypto?

Each jurisdiction has separate tax laws for digital assets, many of which are changing quickly. In most jurisdictions, the sale of crypto assets is taxed as capital gains and active trading can sometimes be taxed as income. Be sure to check with an accountant in your country to understand the crypto tax laws in your jurisdiction.

How much is crypto taxed?

Tax rates on crypto will depend on whether it is being taxed as capital gains, interest, or income. Some countries have decided not to tax crypto on any assets held for longer than 1 year, but many countries have chosen to tax digital assets differently, so be sure to check with a local accountant. Crypto tax can also depend on your income level as many countries tax their residents a certain percentage depending on their annual salary level. Many of the mentions on this list have paid full service tools, or a basic free crypto tax calculator to help gauge a tax estimate.

How to avoid taxes on crypto?

The only way to legally avoid paying taxes on crypto is to relocate to a country that does not tax crypto. Check out our article on Top Tax Friendly Crypto Countries to learn which countries have favourable crypto tax treatment. It is not advisable to try and hide crypto taxes as many exchanges now enforce KYC and have agreements with local tax authorities.

Can you claim crypto losses on taxes?

Yes, in many jurisdictions, losses on crypto assets can offset capital gains, similar to stocks and other investable assets.

What is the best crypto tax software?

Koinly is often our top pick for the best crypto tax software, as they service both simple and complex crypto tax situations and are available in most countries. It is also beginner-friendly and good value for money. Some of us here at the Bureau use Koinly and find it is the best crypto tax tracker for our needs.

Koinly vs Cointracker- Both of these tools can help with crypto tax software, but we found Koinly to be the more robust tool, while also being more user-friendly. Cointracker was found to have a better portfolio tracking tool, but for the purpose of crypto tax, Koinly took the win. Koinly also offers a more useful free plan.

Accointing vs Koinly- These crypto tax tools share more similarities than differences, but we found Koinly was the more suitable tool for tracking crypto investments and preparing tax documents, and the direct integration with tax software makes it very user-friendly. Both Accointing and Koinly are capable of tracking NFT and DeFi transactions, but we preferred the Koinly interface.

Coinledger vs Cointracker– Coinledger is our preferred tax tool over Cointracker from a crypto taxation standpoint, but Cointracker had a more fully featured coin and portfolio tracking interface.