Fetch.ai (FET) is a blockchain based artificial intelligence project that is currently in the stages of completing an ICO crowd-sale.

More specifically, Fetch is trying to automate a number of different markets that currently only operate with immense manual work. They have also gathered a great deal of interest lately as they are only the second project to complete their ICO raise on the Binance Exchange Launchpad.

However, is the hype justified and should you consider it?

In this Fetch (FET) review we will give you everything you need to know about the project by taking a deeper look into their technology, team members and roadmap. We will also analyse the long term adoption potential of FET tokens.

Page Contents 👉

What is Fetch.ai?

Fetch.AI has a vision of a world in which economic activity can take place without the intervention of human activity. They are building a decentralized network composed of various autonomous agents which can represent themselves, other individuals, or devices and services.

Overview of the Fetch.ai ecosystem

These agent learn and evolve through artificial intelligence algorithms and are able to work independently or with other agents to provide solutions to complex issues.

It is a permissionless system, and the Fetch.AI team plans on enabling the self-learning network to complete millions of transactions per second, which will allow for global usage and a myriad of use cases.

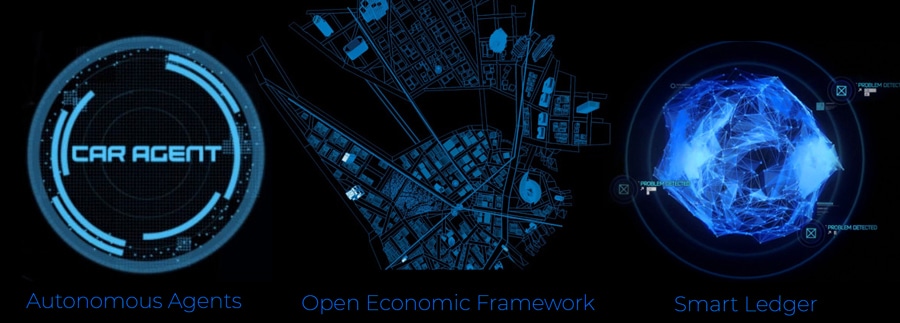

Fetch Technology

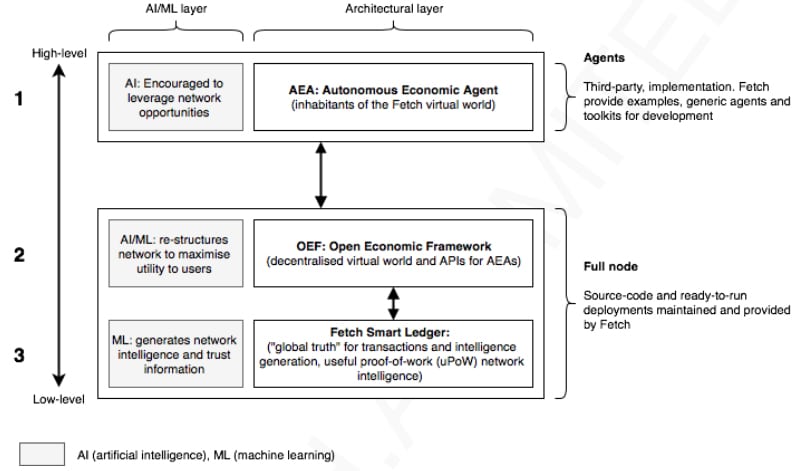

The Fetch.AI technology is comprised of three major parts: Autonomous Economic Agents (AEA), Open Economic Framework (OEF) and the Fetch Smart Ledgers. All of this is underpinned by the Useful Proof of Work consensus model, and the artificial intelligence machine learning employed by the Fetch blockchain.

Autonomous Economic Agents have been created as digital citizens. They are fully enabled to act on behalf of individuals, organizations and devices. AEAs have been paired to data sources and hardware systems, which allows them to navigate the Fetch ecosystem and extract value from its predictive nature and data discovery functions.

This allows AEAs to use detailed data and prediction models to come up with the best solution to real-world problems. They can also learn from mistakes they make, which improves their performance over time.

The Open Economic Framework is an adaptive simulation that functions to provide the AEAs with maximum connections and interaction capacity. The OEF stores information and uses artificial intelligence to optimize the use of that information for prediction and to support the AEAs. The AEAs can collect information from the OEF and the node operators will receive token rewards for providing reliable and consistent information and services.

Key Layers behind Fetch.ai Technology. Source: Whitepaper

Fetch Smart Ledgers are a unique network structure combining the blockchain with elements of directed acyclic graph (DAG) technology. Fetch gathers transactions in a sharding scheme and processes them in chains. Unlike traditional sharding transactions in Fetch can be assigned to several transaction lanes at the same time.

The transation capacity of the Fetch system increases over time through chain forking. When a fork occurs each old lane is referred to by two new lanes, and the first transactions of these new lanes will refer back to the last transaction on the old lane. This allows the Fetch blockchain to track the origin of its new chains.

The Fetch Consensus Model

The Fetch Smart Ledgers are the monitors in the system that support, evaluate and track the interactions between AEAs. To do this Fetch uses the unique Useful Proof of Work (uPoW) consensus protocol.

The team at Fetch believes this consensus mechanism has several benefits over the traditional PoW mechanism. In traditional PoW nodes must download every block and add them to the chain sequentially. This is very time and energy intensive. PoW systems can also lead to miner centralization.

The DAG system will deem any transaction valid once it is confirmed by two nodes, leaving computational resources free to train the AI. In uPoW nodes with less power can still earn rewards by validating low value transactions. This is a more efficient system that scales well and encourages nodes to be more spread out.

Machine Learning and Artificial Intelligence

Fetch includes machine learning and artificial intelligence in all three layers of its protocol. They are used to provide trust information in four different layers:

- Trust in how normal any given transaction is

- Trust in the information received from other nodes on the network

- Trust in the parties involved based on their history

- Evolving market and data intelligence

Deep learning methods are used to implement each of the above layers. Fetch uses process mining, long short-term memory, and recurrent neural networks. The use of these natural language processing deep learning methods allow Fetch to predict future authenticity by evaluating the past behavior of the AEAs in the system.

The Fetch.AI Team

The Fetch.AI team is led by the three co-founders and their four additional division heads. Humayun Sheikh leads as the CEO of Fetch.ai and he has a long history with artificial intelligence, having been an early investor in the AI company DeepMind that was later acquired by Google. His past entrepreneurial experience includes the artificial intelligence startup itzMe and the drone company uVue.

Some of the Fetch.ai team members

The CTO at Fetch.AI is Toby Simpson, who comes to the company with over a decade of experience in the role of CTO at other technology companies. He was also involved at DeepMind, serving there are the Head of Software Design.

The third Fetch.AI co-founder and Chief Science Officer is Thomas Hain. He holds a PhD from the University of Cambridge and is a specialist in Machine Learning. In addition to his role at Fetch.AI he also holds a position as a professor at Sheffield University.

In addition to the co-founders the leadership team is also comprised of Jonathan Ward (Head of Research), Troels F. Rønnow (Head of Software Engineering), Maria Minaricova (Head of Business Development) and Arthur Meadows (Head of Investor Relations). The rest of the Fetch.AI team consists of 10 developers, 11 researchers, and 5 admin personnel.

The Fetch.AI Community

The Fetch team is most focused on the technical aspects of the project and is allowing their community to grow organically. This has led to a smaller, but more passionate community of supporters. With the upcoming token sale at Binance it is expected that the social communities surrounding Fetch could have breakout growth.

The largest social group by far is the Telegram user group, which is now over 10,000 users. Otherwise Fetch sees negligible engagement on social platforms. Their Twitter account has just 3,850 followers, both Facebook and Medium have just 56 followers, although they have been more active on Medium recently.

The YouTube channel has 477 subscribers with 27 videos posted over the past year. Reddit, which is usually a very important social media channel for blockchain projects, has just 67 readers and nearly all its activity has occurred in the past 7 days, likely as hype around the ICO builds.

Development and Roadmap

Given the amount of scrutiny that ICOs are now under, it is really important the the team has a clear roadmap with development goals and activity.

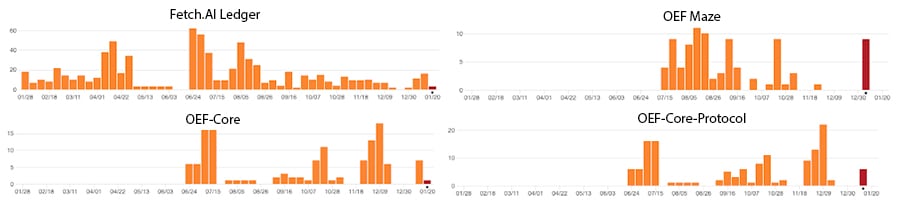

One of the best places to get an idea of how much work is being done on a project is to look into their GitHub repositories. This gives a direct indication of the amount of code that is being pushed and hence the development work.

The Fetch.ai GitHub has four public repositories that are pretty sparse in terms of their recent commits. However, according to this Binance research report, the amount of work being done in their private repos far exceeds this. For example, below are four of those most active private repositories:

Indeed, if you take a look at their website you can see that they claim to have pushed 100k lines of C++ code. This is indeed quite impressive for a project that is only just completing its public ICO. As a comparison, there are many projects that completed an ICO last year and still have sparse GitHubs with virtually no code activity.

In terms of what we can expect from the project in 2019, they have laid out their roadmap on their website. Below are some of the most important development milestones per quarter in 2019:

- Development Release (Q1): Users will be invited onto the test network. There will also be a beta for the applications to participate in the network and wallets.

- Consensus, auctions, Synergetic Computing (Q2): Focus will be on chain consensus alongside an improved Open Economic Framework,. They also hope to include multi-dependency auctions and enhanced decentralised ledger computing.

- Alpha & Beta Release on test(Q3): By the third quarter, the team hopes to release the Alpha of the network which will include all the features. In this Alpha release will be used as an opportunity to enhance performance. If all goes according to plan then they should be releasing Beta which will include all features functioning as normal. There will be full scale operational testing on the network.

- Release of Main-net (Q4): Assuming that there were no roadblocks in in the Alpha / Beta tesing phase, then the team will release the main-net in Q4. This will be powered by the native FET token.

This seems like a reasonable timeline and is not too specific. It allows the team to develop the technology in a relatively flexible manner and adjust should there be any changes that need to be made. If you want to keep up to date with development announcements then you should monitor their medium blog.

FET Token & Crowdsale

The FET token is the medium of exchange on the Fetch network, allowing the AEAs to transact with one another, exchanging FET tokens for services and data or other goods. This allows for machine-to-machine transactions in a seamless manner.

The FET token will initially be an ERC-20 token, but later the team plans on creating a native token. Once this native token is released the ERC-20 tokens will be exchanged at a fixed conversion rate for the native tokens and the ERC-20 tokens will be burned. With the main-net having a planned release in the 4th quarter of 2019, the native tokens will launch at the same time, although this seems an aggressive timeframe.

The FET initial coin offering is planned for February 25, 2019 at 14:00 UTC and it will be the second ICO to take place on the Binance Launchpad platform. The first was the BitTorrent (BTT) initial coin offering, which sold out in just 15 minutes and has seen the BTT token hold its value quite well despite the ongoing bear market in cryptocurrency markets.

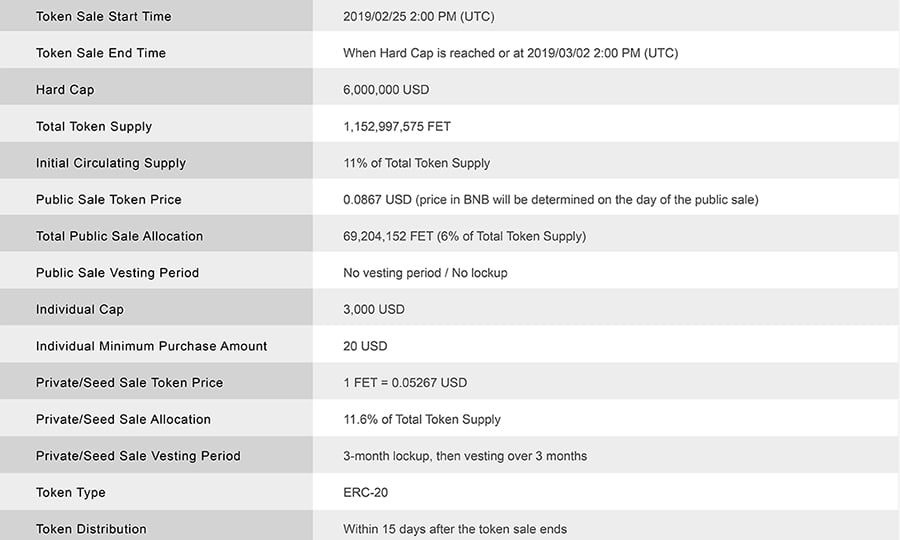

Token Sale Economics of FET. Source: Binance Launchpad

During the ICO private investors will be able to purchase FET tokens using the native Binance BNB token. The high profile launch of the token on Launchpad and subsequent listing on Binance is expected to give the token immediate value. In addition, Fetch.AI has been mentioned in such well-known news publications as Forbes, Tech Crunch, Business Weekly and the Guardian. This exposure could help boost the price of the FET token after it is released.

The FET token will be sold at a price of $0.0867 per token, with a minimum purchase of $20. The Fetch team has also placed a maximum personal purchase cap of $3,000 to ensure no one gets locked out of buying the FET token if they wish to do so. That was an issue with the BTT token, so it is wise of the Fetch team to place a maximum purchase limit.

The token was created to be infinitely divisible, allowing for ease of use in even the smallest micro-transactions. This will be extremely helpful for the operation of AEAs and will also allow the project to keep coin supply low if desired.

Conclusion

Fetch.AI is one of the more ambitious blockchain projects as it is also attempting to integrate artificial intelligence. There is great hope for success as the team seems to have the skills, knowledge and industry experience to create something that can solve numerous real-world problems in a variety of industries from supply chain to energy and many more.

That said, there are still very real risks that the project will be unable to bring their vision into reality. Development is expected to be a long process, and costly as well. The ICO will help to cover these costs, but it would be good if Fetch could secure some strong corporate partnerships to help support the team’s efforts going forward.

One piece of good news is that the project has become more open and transparent. In the past there were detractors who said the project was possibly a scam because of the lack of information made public. That has changed in the past few months, and this added transparency makes Fetch a far more promising project.

Featured Image via Fotolia