OKX Exchange (previously OKEX, more on that later), is a large and massively popular cryptocurrency exchange and one of the OG's in the crypto space, established all the way back in 2016. With the rebranding and platform overhaul, we felt it appropriate to do an updated OKX review as this exchange has got some exciting developments underway.

Using its expertise in the spot market, OKX offers its users the opportunity to trade Futures, perpetual swaps and options markets. In addition, while OKX was, and remains, a paradise for active crypto traders, the platform has added an earn section, access to an NFT marketplace, crypto loans area, Jumpstart launchpad, and even a way for customers to get involved in DOT slot auctions which will be covered below. Each gives traders a unique way to trade, hedge, earn, and explore the crypto markets.

So, is it worth considering?

In this OKX review, we will attempt to answer that. I will also give you some top tips that you need to know when using the platform.

OKEX Exchange Rebrand to OKX

In 2022, the exchange went through a facelift and overhaul, rebranding from OKEX to simply OKX. Dropping the “E” that stood for “exchange” was their way of saying that they are so much more than just a crypto exchange.

Image via coingeek.com

The company has decided to venture into the new crypto frontier and explore DeFi products, NFTs, games and metaverses, becoming so much more than just a crypto derivatives trading platform indeed! It looks like OKX is keen to explore all the avenues that crypto has to offer and are looking to become a one-stop-shop for crypto fans of every kind.

A Bold Claim! Image via OKX

Alright, let's get into what OKX has to offer.

What is OKX?

Page Contents 👉

- 1 OKEX Exchange Rebrand to OKX

- 2 What is OKX?

- 3 Is OKX Safe?

- 4 Derivative Instruments & Leverage

- 5 OKX Fees on Derivatives

- 6 OKX Exchange Review: Registration

- 7 Deposits/Withdrawals at OKX

- 8 OKX Futures Platform

- 9 OKX Options Platform

- 10 Order Forms

- 11 OKX Review Features

- 12 MetaX

- 13 OKX Review Mobile App & PC Client

- 14 OKX API

- 15 OKX Customer Support

- 16 OKX Community & Academy

- 17 OKX FAQs

- 18 Conclusion

- 19 OKX Exchange

OKX was originally founded in Hong Kong in 2016, but in 2018 they moved to Valletta in Malta, while also being headquartered in Seychelles. This was no doubt in response to the favourable crypto regulations in those jurisdictions.

The original exchange was a spot crypto trading exchange that has expanded rapidly since its launch. It is available in over 100 countries. The BTC futures trading on OKX surpasses $1.5bn per day in daily trading volume as the exchange caters to institutional and retail traders.

Although OKX derivatives are available in over 100 countries, some regions do not offer their services. These include the likes of the United States, Hong Kong and a list of other regions. You can see the complete list in their Terms of Service.

For our American readers, I would highly recommend checking out our Kraken Review

We will review the derivative instruments on OKX, including their plain vanilla futures, their perpetual swaps and their options, along with the other platform features. As many exchanges such as Binance and KuCoin aim to become an all-in-one platform to cater to crypto enthusiasts of all backgrounds, OKX is not sitting on the sidelines and have ensured that they are well-positioned to compete with a number of global exchanges.

To cater to their large community of traders around the world, they have translated their site into 11 different languages, including English, Russian, Chinese etc.

Is OKX Safe?

For any crypto trader, this is one of the most important considerations. Unfortunately, we know all too well the risks that could come from centralised exchanges.

Image via OKX

When we look at exchanges, there are several factors that we take into account to determine how safe they are for their traders.

Let's take a look at these, shall we?

Is OKX Secure?

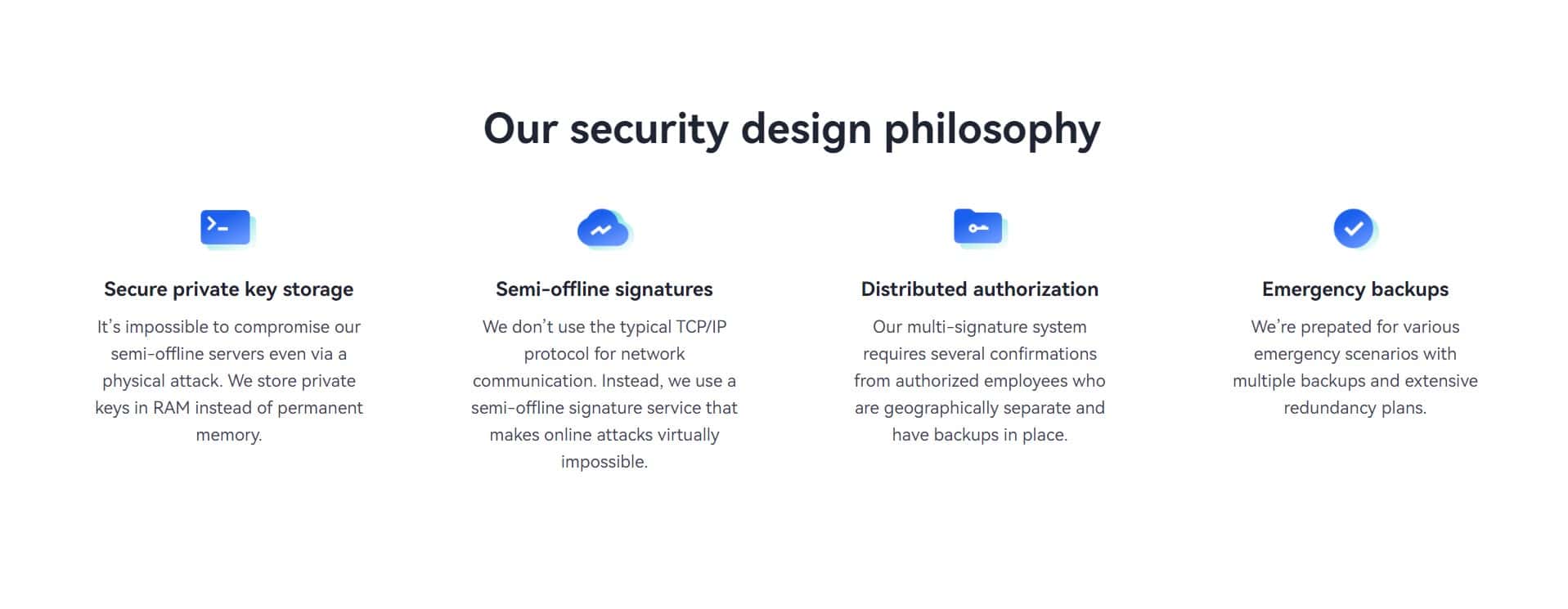

OKX operates a secure hot and cold wallet security procedure. This means that the bulk of their funds are stored offline in a cold environment, meaning the funds are protected from hackers. OKX holds 95% of their funds in offline storage, utilizing a state-of-the-art cold wallet storage system that requires confirmation from at least 2 authorized personnel. OKX has some of the most robust offline storage protocols I've seen; take a look below:

Image via OKX

The other 5% of funds are kept with their servers in a “hot” environment to meet the demand for withdrawals/deposits.

When it comes to exchange infrastructure, they operate GSLB (Global Server Load Balancing). This means that they have many servers worldwide to ensure server uptime and manage trading demand.

It is also worth noting that, unlike many exchanges, OKX has suffered no known hacks to date. Looks like their security protocols are certainly up to the challenges of blocking hackers.

Risk Management

Given that OKX derivatives operate a leveraged trading platform, they have to have measures in place to reduce the risk posed by market movements to the trading pool.

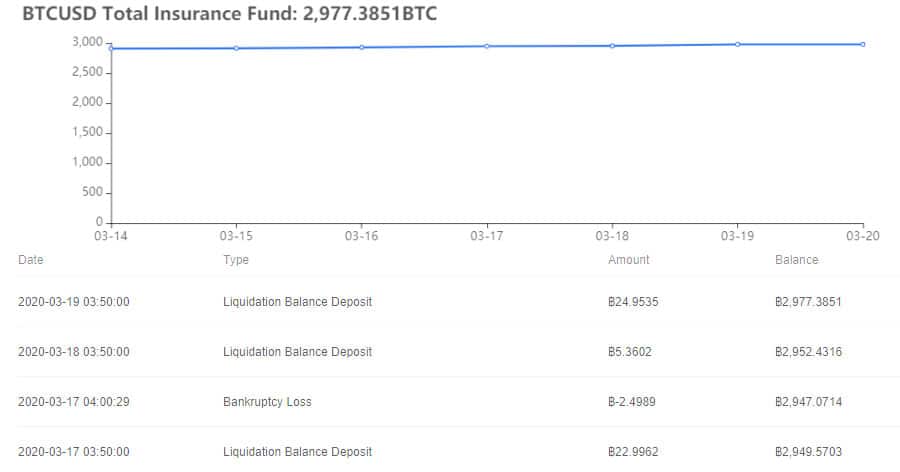

Balances at OKX Insurance Fund

The OKX insurance fund is run to be a backstop for all those trades that cannot be liquidated above the bankruptcy price. The fund is replenished with the initial margin that liquidated traders have at the outset of their trade.

Communication Security

OKX has fully encrypted communications, which means that when you send them information, it is sent securely. This includes all personal documentation and passwords.

This is also helpful as it will help you identify whether you are on a phishing site. If you cannot see the padlock in the browser or the SSL certificate, then that will mean that you are not on the correct site, and you should leave immediately.

User Security

In general, the best security starts with the trader. That is why OKX has provided several tools to help users secure their accounts.

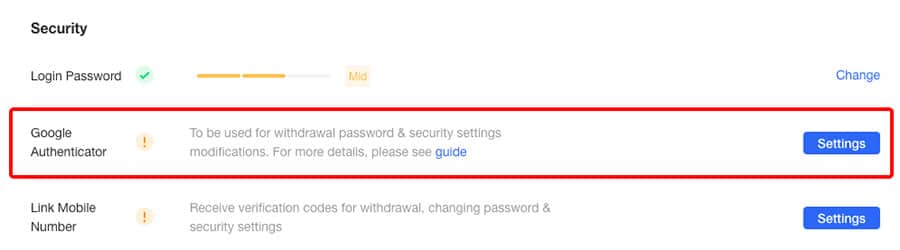

Perhaps one of the most important of these is two-factor authentication via a phone. There are two options to do this. The first is to use an SMS authentication, and the other is to use the Google authenticator.

Activating the 2FA Authentication on OKX

I would advise against the SMS authentication as this opens you up to sim swapping attacks. Hence, you can set up the Google authenticator by downloading it from the app store and binding it to the OKX server.

Another pretty neat tool that they have at OKX is their anti-phishing tool. This is basically a code sent in every single email they send you. So if you do not recognize the code, you know that the email came from an illegitimate sender. Here is a complete look at the security features that OKX users can deploy to help keep their accounts as safe as possible:

- Login password

- Email verification

- Funds password

- Mobile verification

- Authenticator app

- 2-factor authentication

- Anti-phishing code

Proof of Reserves

Given what has happened with FTX recently, exchanges are scrambling to prove that client funds are secure, safe, and that exchanges are adequately collateralised. OKX is one of the exchanges that scrambled to do so immediately following the fallout.

Similar to the other exchanges, OKX also jumped on the Proof-of-Reserves bandwagon and hurriedly pumped out their version of Merkle-Tree proofs to show their customers that the name OKX does live up to its “OK” reputation. According to Glassnode, Proof of Reserves (PoR) displays the assets held on-chain and matching liabilities held both on and off-chain.

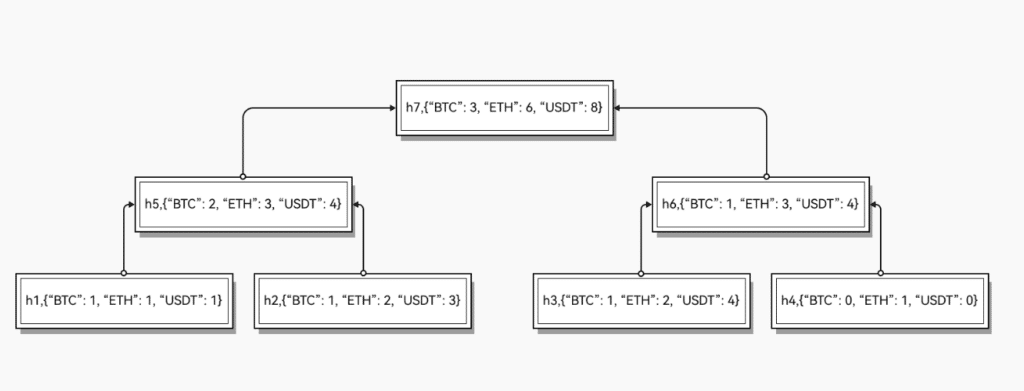

Before continuing, it helps if we know what is a Merkle Tree. It is essentially a data structure for a group of encrypted data. Each transaction, whether a snapshot of balances or a transaction itself, is encrypted, grouped together and further encrypted, layer after layer, like a Russian matryoshka doll, forming a tree-like structure.

The Merkle Tree as explained by OKX. Image via OKX.

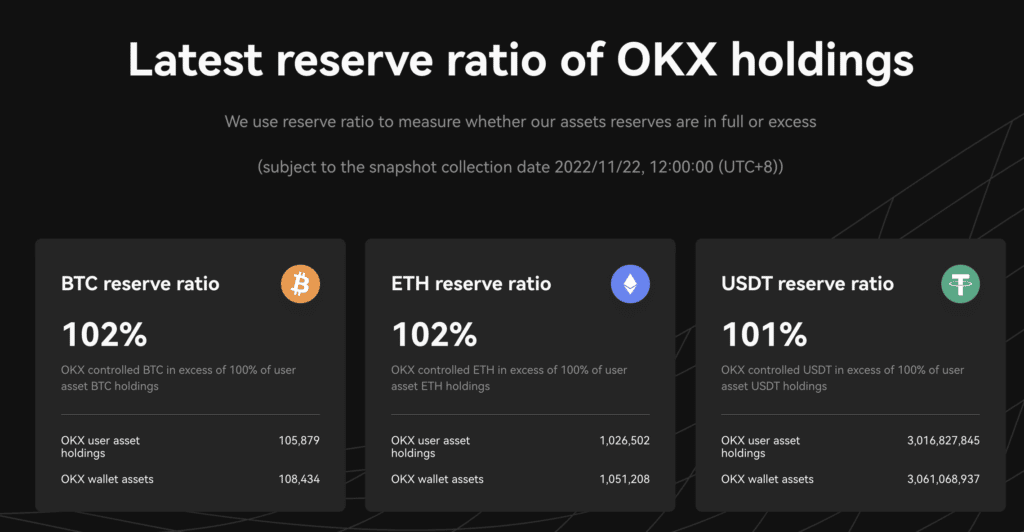

What you’re really verifying is that the information presented in the Tree is correct. This can be your own assets (to show that they were included in the data encryption) or the assets held by the exchange. Based on the latest snapshot taken off Nov 22, 2022, OKX held more BTC, USDT and ETH in their reserves than what they need in liabilities.

What OKX currently has in their reserves. Image via OKX

OKX offers up three types of data for verification by the public: users’ own assets in the exchange, OKX’s wallet addresses and assets and their own reserve ratio.

How Do Users Verify on Their Own?

Customers of OKX sign in to their account, and click on “Audits” to view the recent audits done and “Details” to view the audit data. If you’d like to take a more active role in the verification process, OKX offers a guide on how to do so that involves copying data from your account, export to a .json file, and run it through a verification tool called “MerkleValidator”. This tool checks that the data is captured in OKX’s Merkle tree snapshot.

If you have time to spare and want to verify what OKX has, you can get a list of OKX’s public addresses and run them on Github to check the data.

Use these addresses to verify OKX's held assets. Image via OKX

What Does it Really Mean?

While it’s all well and good that OKX has managed to prove that it has assets in its reserves, please bear in mind that these are snapshots, i.e. a moment frozen in time. What happens to the funds before and after the snapshots are taken is unclear.

Its website states that audits will be published regularly. How regular is that?

To be honest, unless audits are done in real-time on an up-to-the-minute basis, one can only rely on the integrity of the exchange.

How PoR is defined by OKX. Image via OKX

It is small comfort that OKX has moved up the food chain in Nic Carter’s PoR page from Informal asset attestations to the “Gold standard” PoR. Even so, they are listed as self-assessment instead of auditor-assisted, which is a small minus on my part.

In addition, there is the issue of key access to the wallets of the reserves. Who can access them, along with how and when they can be accessed are not reflected in the Proof of Reserves. Even if FTX had implemented Proof of Reserves similar to how OKX did, I don’t think that in itself would’ve been enough to prevent what happened. Other kinds of controls and check-and-balances need to be in place as well and we all know now (page 2 is the juicy paragraph) what kind of shitshow operation FTX ran behind the veiled curtain.

As we breathe a small sigh of relief that OKX, like other exchanges, has managed to prove funds’ safety, moving as much activity to on-chain and reducing opaqueness as much as possible is still the longer-term goal.

Derivative Instruments & Leverage

So, what are derivative instruments? Well, they are an instrument that you can trade that “derive” their value from the price of some underlying instrument. In this case, they are cryptocurrencies.

Derivative instruments are leveraged, which means you can magnify your gains/losses many times over. At OKX, this can be up to 100x, depending on the instrument that you are trading.

So, for example, if you have a trade that has a leverage of 50X, it means that for a $1 move in the price of the underlying asset, your position will move by $50.

Now, let's take a closer look at the derivative instruments they offer at OKX.

OKX Futures

Futures are instruments whereby you agree to buy or sell some asset in the future at some predetermined time. These futures contracts are an obligation to buy/sell, which differs from options.

Payoff Diagram of a Long and Short Future Instrument

On OKX derivatives, they have futures instruments on 12 assets. These are the following: Bitcoin, Litecoin, Cardano, Polkadot, Ethereum, Ethereum Classic, Ripple, EOS, Bitcoin Cash, BSV, Filecoin and TRX. So, a pretty reasonable list.

These futures instruments have leverage of up to 100x. They have expiries that are weekly, bi-weekly, Quarterly, and Bi-quarterly. These contracts are settled every day at 8am UTC.

You can also elect to get your positions margined with either coins (crypto) or Tether (USDT). This will determine where the margin will come from.

Finally, you can elect to cross margin your futures account when it comes to futures. This means that margin can come from any one of your accounts at OKX.

OKX Perpetual Swaps

OKX terms these instruments at Perpetual Swaps, but they are sometimes called perpetual futures on other exchanges. So you can basically think about them as a traditional future except there is no expiry time.

You can hold a position without any time limit and withdraw your realized profits anytime with a perpetual future. For those of you who trade CFDs or spread betting instruments, a perpetual swap has the same payout profile.

It is called a “Swap” because you are swapping the returns for one asset for another. In this case, it is a cryptocurrency vs. the US dollar. Given that you are doing this, you will have to pay a funding rate.

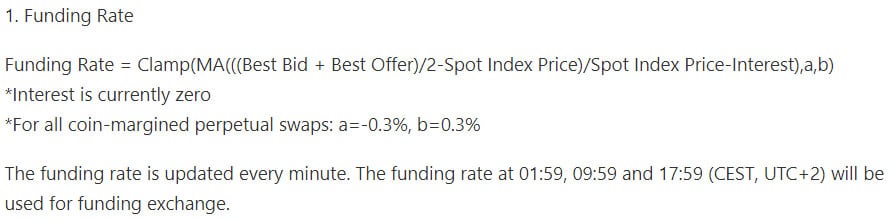

What is a funding rate?

It is used to ensure that the perpetual swap price is anchored to the spot market. When the funding rate is positive, longs pay shorts; when it's negative, shorts pay longs. The exchange is not charged, but the fee between longs and shorts.

How The Funding Rate is Calculated

As is the case with the futures instruments, you have 100x max leverage, and you can choose to margin your position either with coins or with Tether. Also, the settlement on the perpetual swap occurs every 24 hours.

When it comes to asset coverage, you can trade up to 12 different assets. These include all of those that you can trade with the futures above and the addition of NEO, LINK, and DASH.

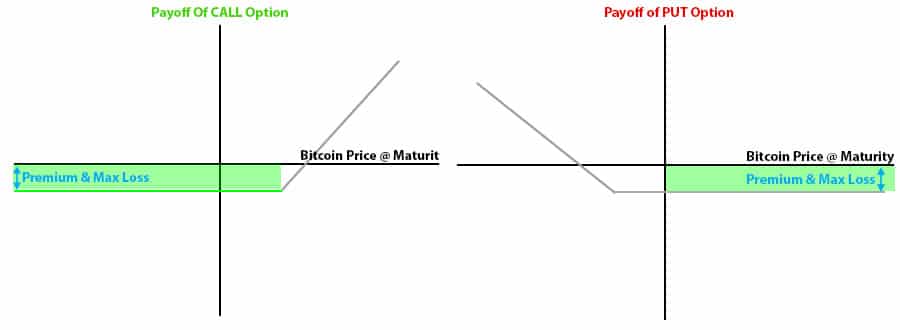

OKX Options

Options are derivative instruments that give the holder the right but not the obligation to buy or sell some asset in the future at some predetermined time. They are asymmetric payoff instruments.

We have an extensive guide on cryptocurrency options which you can read if you want more information. But the key thing to note is that you have a limited downside risk and an unlimited upside potential when you buy an option. This can be the opposite if you sell an option.

Payoff of a CALL option and a PUT option

There are CALL options that give you the right to buy, and then there are PUT options that give you the right to sell some asset. When buying an option, you are paying a premium to the counterparty and some trading fees to OKX derivatives. There is no margin required.

However, if you wanted to sell an option, this could be done, but you would have to request it. In addition, they will require a minimum balance in your account to cover for the event the position moves significantly away from you.

On OKX, there is currently only one asset that you can trade Options on: Bitcoin. When we checked into the platform, there were four option expiry times.

OKX Fees on Derivatives

When it comes to your trading profitability, one of the most important considerations is the trading fees at the exchange.

So, how does OKX stand here?

Quite good actually, OKX fees are among the lowest in the industry, so no need to worry about breaking the bank here. Of course, trading fees will differ according to your trading tier, what the instrument is, and how many OKB tokens you hold in your account.

OKX derivatives also operate with a Maker/Taker Fee model. For those new to the term, you have different trading fees depending on whether you are making or taking liquidity off the books.

Let's take a look at the fees per instrument.

OKX Fees on Futures

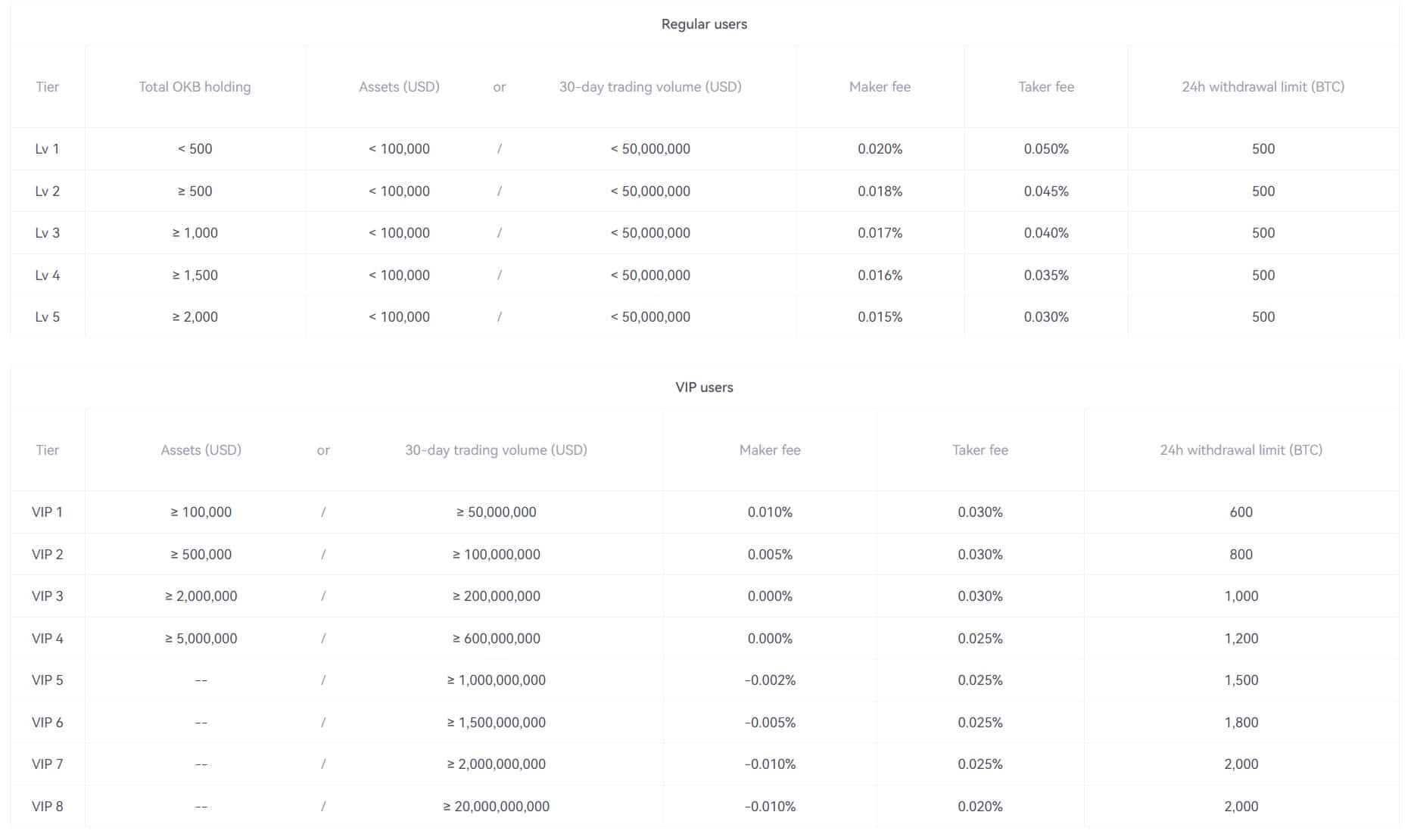

There are two types of users that have different fee schedules. These are your normal user and your VIP user. Normal users are those that have a 30-day trading volume that is below 10,000 BTC.

Within the normal user tiers, you have 5 different levels. These are determined according to the number of OKB tokens that you hold. Then, within the VIP tier, you have different levels determined according to 30-day trading volume.

Image via OKX Futures Fee Page

So, from the above, you can see that those market makers will get a rebate if they can generate over 100k in BTC trading volume on a 30-day rolling basis. These fees are in line with those of other leveraged trading platforms like ByBit etc.

OKX Fees on Perpetual Swaps

Perpetual swaps have about the same fees as normal Futures. However, to reach the VIP level, you have to be trading only a minimum of 5,000 BTC.

The only difference in trading fees for the perpetual swaps comes in when you are a VIP. You have slightly higher taker fees and slightly higher rebates for the makers. I encourage you to check out the OKX page that covers the VIP levels and fees to learn more.

Something else that you will have to consider when you are trading a perpetual swap is that you will have a funding rate. This is not a fee but instead reflects the differential between the funding rate on the cryptocurrency and USD.

The funding rate can be positive or negative, and it is arranged every 8 hours. If you close your position before the funding exchange, you will not pay or receive funding. The funding rate is a dynamic number that will change to reflect market conditions.

OKX Fees on Options

Like with perpetual swaps, normal users will have similar fees when trading options. However, reaching the VIP tier is much lower at only 1,000 BTC.

However, when it comes to these VIP users, you will have exactly the same trading fees for the different levels. You can see more about the option fees on their OKX Fees page.

To sum up the overall fee structure, OKX exchange fees are quite low, making this one of the more fee-friendly crypto exchanges in the industry. Coin Bureau readers can further lower the already rock-bottom fees by another 40% when they use our OKX sign-up link!

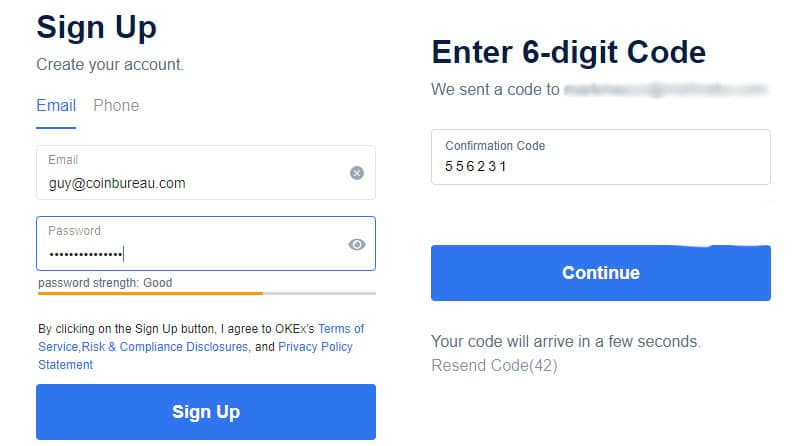

OKX Exchange Review: Registration

Ok, once you are ready to try out OKX you will need to create an account. You can hit “Sign Up” and sign up using an email address, phone number, or link to a Google or Telegram account when you are on the website.

OKX Registration Process

Once you have signed up, they will send you a code that you will need to use to confirm your registration. After you hand this over, you can begin. First, they will ask you whether you would like to buy crypto or whether you will be sending in.

OKX: Verification & KYC

OKX is one of the few remaining platforms that allows you to keep your account unverified without KYC. Though users who remain unverified will be limited to:

- Deposit

- Withdrawal (24h limit 10 BTC)

- Spot trading

- Futures trading

You can find more information about the OKX KYC levels and limits from their support site.

To complete the first level of verification, all you need is an ID number, name, surname and place of residence. Once you have given this information, you will be verified almost instantaneously.

If you would like to move onto level 2 verification to increase your trading and withdrawal limits, you will need to upload copies of your ID document. You will also need to take some selfies of yourself to confirm.

This is all done through the use of Net Verify, which is a third-party KYC service.

Deposits/Withdrawals at OKX

Once your account is set up, you will need to fund your account. There are several ways to do this. These include fiat currency as well as crypto.

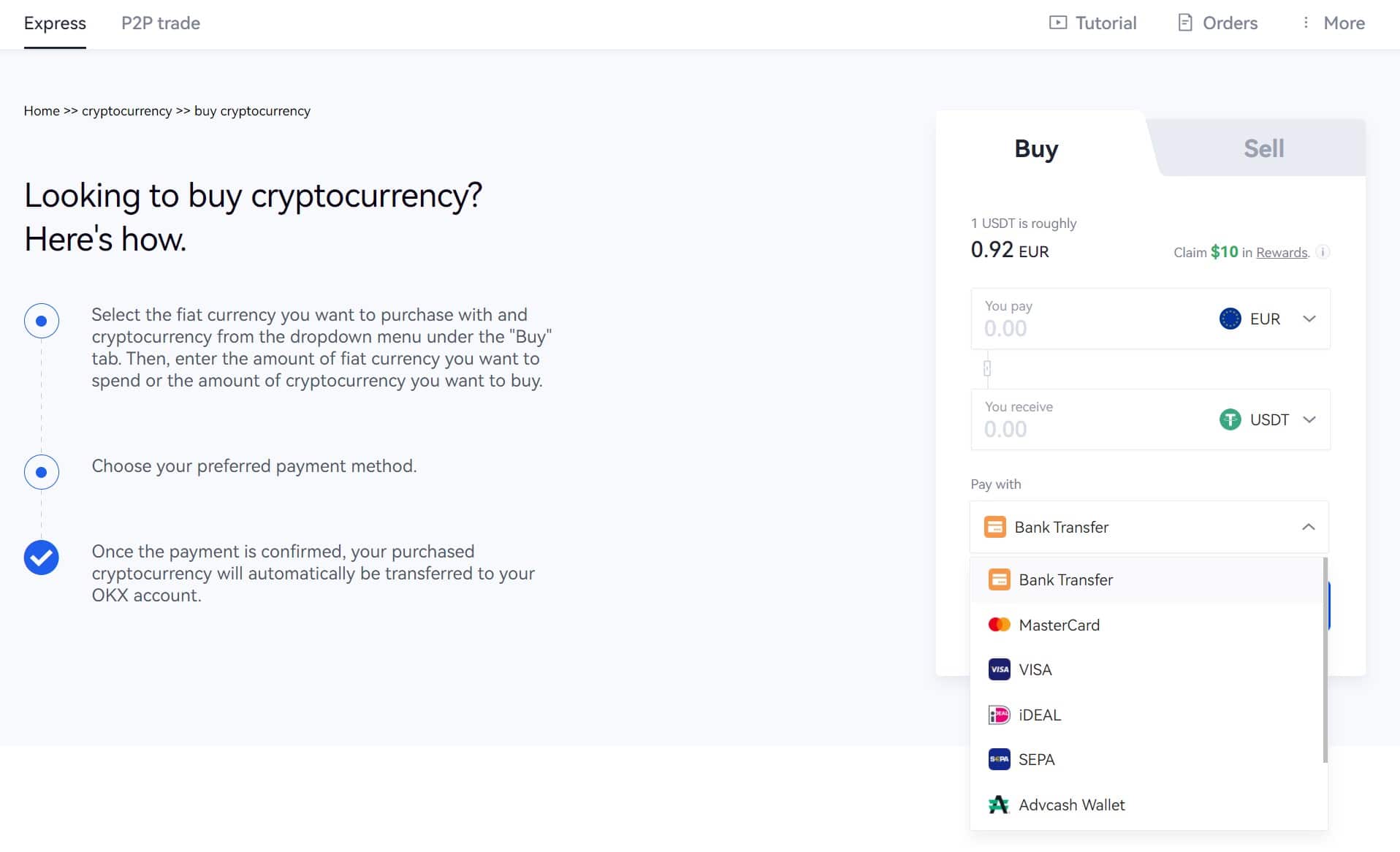

If you are buying with fiat, OKX uses several third-party services. These include the likes of Koinal, Simplex & Others. If you are using a bank wire, you can use Banxa, which offers SEPA and SWIFT banking services.

Some Payment Methods at OKX

The quickest and most convenient method to purchase crypto with fiat is by using a debit or credit card. OKX also supports bank transfers, iDEAL, Advcash, ApplePay, SEPA, Sofort and Google Pay, depending on your location.

Image via OKX

If you already have crypto and want to deposit, you will have to generate an address. This can be done in your “Assets” section of your account admin. Then, you will select the applicable token, which will generate a deposit address.

Once you have sent your funds over, you will have to wait for one confirmation before it is credited. If you would like to track your deposit, you can use a blockchain explorer.

Withdrawals

Withdrawals are made in the same panel as your deposits. Before you withdraw, you will have to set up a funds transfer. This is basically a password that will allow you to confirm any withdrawals out of your account. Also, remember to be mindful of your withdrawal limits which are dependent on your tier and KYC verification level.

Once you have set up your withdrawal password, you can go ahead and place your withdrawal amount and your offline address. Once you have made the request, they will process it, and you can monitor it on the blockchain.

Note that Fiat withdraws are not available in most countries, so you will likely need to find an alternative fiat offramp.

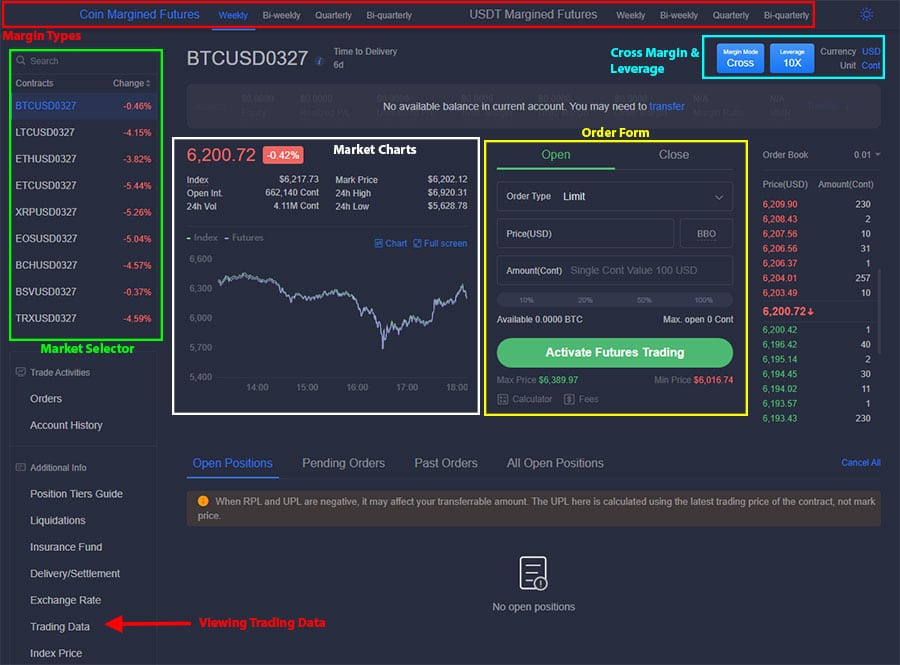

OKX Futures Platform

It's time to move onto the belly of the beast and examine their trading technology and platforms. While they all use the same user interface, they differ in terms of the functionality on the platform.

If you want to trade futures, you will first have to activate your futures account. To do this, you need to complete a few questions to make sure you are familiar with futures trading.

This is actually the first time we have seen this being included on a Futures trading platform, and it is undoubtedly a wise decision by OKX. The questions are not that complex and can easily be answered if you have a basic understanding of futures trading.

Once you are done setting up your futures trading account, you can begin trading. This is, of course, assuming that you have already moved funds over, as mentioned above.

The UI of the trading platform is relatively intuitive. You have all of the markets that you can trade on the left. At the top, you can select the time to expiry and what currency you would like the funds to be margined in.

OKX Futures User Interface

Just below that, you have your options in terms of leverage and how you would like your account to be margined. Just below that, you have your order forms, charts and historical order book.

If you expand the chart, you will notice that you have two options to trade with. One is the default chart offered by OKX, and the other is the Tradingview chart. For those who know trading view, it is one of the most well known third party charting packages on the market, well-liked by technical analysts.

Then, just below the charts, you have the historical & live order section. This will list all of the orders you have running at OKX and your Unrealized PnL.

Then, you have some additional beneficial info to the left of this. For example, you can check out the index prices and mark prices. Remember that the mark price is the one that is used to settle the derivative instruments, whereas the index price is the one that is referenced to formulate the mark price.

Something that I really found quite helpful was their Trading Data tab. This gives you everything you need to know about what is going on in the OKX futures market. This includes:

- Long Short Ratio: The ratio of longs and shorts in the market

- BTC Basis: The difference between the future or swap price and the spot price.

- Swap Funding Rate: Estimated fee rate on the perpetual swap.

- Top Trader Sentiment Index: Percentage of Longs / Shorts held by the top 100 traders

OKX Margin

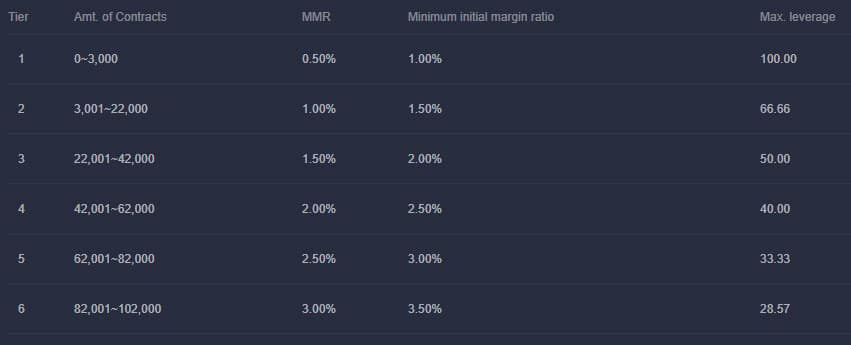

The first thing you should note is that the max-margin of 100x will depend mainly on the size of the position you currently hold.

If you pop on over to the position tiers guide, you will see that the 100x leverage (or 1% margin) only applies to those positions that are less than 3,000 contracts. As you take on more contracts, your leverage factor will decrease. This is because of an increase in the initial margin and the maintenance margin.

Position Tier Guidance at OKX

Then, when it comes to how this is margined from your account, you can either elect to have it margined in crypto (Coin margin) or margined in Tether.

Finally, you have the option to cross margin. This basically means that margin will be drawn from not only your futures account where the funds are but also from the other accounts where you have funds. We would advise against this, though.

OKX Perpetual Swap

If you want to trade perpetual swaps, it has much of the same UI as the Futures instruments. The only difference is that you can't change the expiry time.

Another thing that you should observe is the funding rate. This is dynamic and constantly changing, so be sure to monitor it before you place your trades.

You will also want to take a closer look at the position tier guides and how that will impact the margin requirement. They are slightly different for the higher tier limits than with Futures.

OKX Options Platform

When it comes to the options platform, the layout is similar, although the functionality is quite different.

There are several ways in which you can buy an option. Perhaps the most user-friendly manner is to use the options Discovery tool. This allows you to hone in on the ideal option for your trading conditions.

Using the Options Discovery tool will also draw you out a neat payoff diagram where you can see the profit/loss that will incur for said option. Once you are OK with the set parameters, it will take you to the market for the said option.

Options Trading Functionality at OKX

However, if you want to look at the broader market, you can go to “All Options”. This UI is similar to that of the likes of Deribit for those of you who have used that exchange. You will see an overview of all of the PUTs and CALLs and the different expiries.

Once you have selected the option you want to trade, either through option discovery or All Options, you will have a similar trading interface to the Futures and Swaps.

Something that you should note, however, is that you only have one order type that you can take out on the option. This is a Limit order. So you don't need to place any stops; however, as you know, your downside is limited.

Finally, there is a dropdown at the top of the charts where you can observe the “Greeks” of the options. These are basically the factors that determine the option price sensitivity. We won't go into the specifics of the Greeks here, but Guy did a complete video on that.

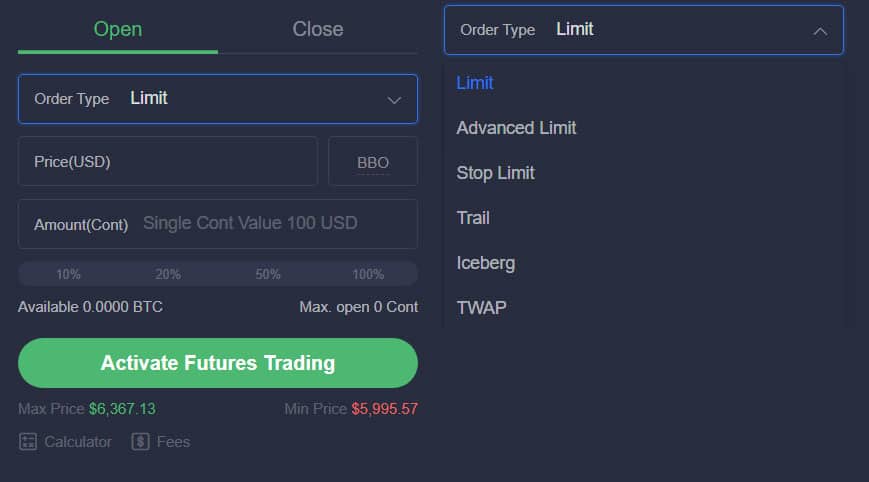

Order Forms

I wanted to go over the order forms separately as these are quite comprehensive, and you have a lot of functionality here.

This is more the case with the futures and swaps than with the options. Below is your typical order form for the swap/future. As you will see, you can either open or close your orders with opposing types.

Order Forms & Order Types

For these orders, you have 6 different order types. This is much more than we have seen at other exchanges and gives the trader many more tools to work with. The order types are:

- Limit Order: These orders are good till cancelled. They are simply orders that are placed at some predefined level.

- Advanced Limit: This is a standard limit order with more functionality around how you would like the order to be executed. For example, it could be Post Only, Fill-or-Kill or Immediate or Cancel. “Post Only” is a standard order. Fill or Kill will execute the entirety of the order or kill it. Immediate or Cancel will execute it now at the best price or cancel

- Stop Limit: This is an order placed only once a specific trigger price is met. Once the trigger price is met, a standard limit order is placed.

- Trail Order: With this order, a limit order will be placed once the price has retraced after breaking a certain trigger level. This is called the “Callback Rate.”

- IceBerg Order: This is an order that allows a trader to place a large order without incurring too much slippage. This order automatically breaks up a user's large order into multiple smaller orders.

- Time-weighted average price (TWAP): TWAP is the average price of the order over a specified period of time. It is basically a strategy that will attempt to execute an order that trades in slices of order quantity at regular intervals. The fill price equals the TWAP price.

If you struggle with any of these order types, you can always check out the OKX derivative docs. They go over them in quite a lot of detail. Okay, that sums up the trading features of OKX; let's look at what else the platform has to offer.

OKX Review Features

As mentioned, OKX has decided to dive into the world of NFTs, metaverses and GameFi, DOT slot auctions, Earn, OKX Pool and more, so there is a lot to unpack here.

Bold Ambitions! Image via OKX

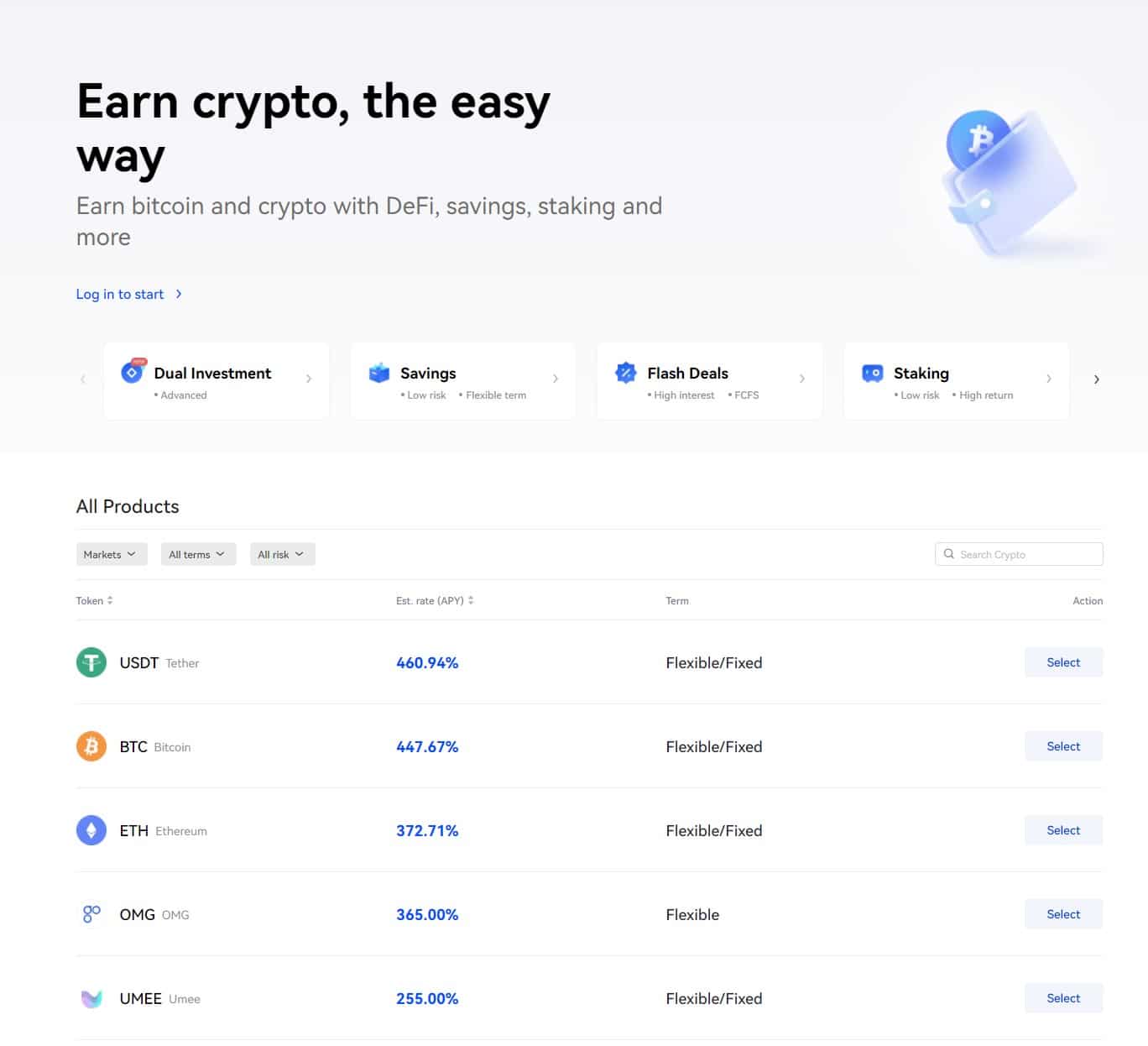

OKX EARN

Don't just HODL. Earn. OKX is a great place for users to earn a nice little APY on their crypto stacks. Major exchanges such as Binance and KuCoin have launched earn sections on their platforms, and OKX wasn't going to sit out on this widely popular crypto feature.

Image via okx.com/earn

OKX offers multiple ways for users to earn on their crypto with products suited to all skill levels and risk appetites. The earn section features products ranging from simple and safe savings accounts to high risk and more advanced dual investment options. Let's take a high-level overview look at each one.

OKX Staking and Saving

These are the most common options utilized as they are easy to get involved with and the safest. OKX savings is a value-added product where customers can earn hourly interest with low risk. The savings product is flexible, meaning that users can deposit and withdraw their crypto at any time. The APY ranges from 1% to 36.50% depending on the asset, rewards are paid in-kind, and there are over 150 assets available to save. You can find the details on these products by checking out the OKX Earn page.

OKX staking APY is generally higher than savings as many staking products require the funds to be locked in for a period of time. Staking rewards range from 1.5%- 70.76% depending on the asset and locked duration. Staking is available for over 80 assets; details can be found on the OKX Staking Rewards page.

OKX Dual Investment

Dual investment is the highest risk and highest reward option. It is essential to know that this product puts your capital at risk. Unlike Savings and Staking, this option could leave users with a loss of their initial funds. Dual investment allows investors to manage their capital and invest BTC, ETH or USDT. “Dual Investment” implies two scenarios for managing deposits and finances: a comparison between the settlement price and the strike price. Here is an example:

Image via OKX

This feature is best suited for advanced traders. You can read more about this feature on the OKX Dual Investment product page.

OKX DeFi

OKX have taken the dive into DeFi. Essentially, users on the OKX platform can access the benefits of popular DeFi platforms: Aave, Compound Finance, Sushiswap, and others through the platform.

Image via OKX

What is great about this feature is that it allows users to access the potential of DeFi without having to go through the harsh learning curve associated with learning how to use DeFi protocols. OKX acts as the gateway. They handle the complex DeFi stuff behind the scenes while users benefit from OKX's simple to use interface.

DOT & Kusama Slot Auctions

This is an interesting feature in the Earn section. OKX have gotten involved in the Polkadot ecosystem and community and have provided a way for its users to get involved in slot auctions. The complexities of DOT and KSM slot auctions are outside the scope of this article. Feel free to check out Guy's detailed video about Polkadot Parachain Auctions to find out more.

Image via OKX

Essentially, this allows users to easily and freely vote on proposals for future DOT and Kusama projects. The most significant benefit is that OKX covers all the fees involved with voting. In addition, if the project that a user supports wins the auction, the User receives rewards for voting. Users who participate in early bird voting also earn exclusive rewards from OKX and the project teams. This is an effortless way to get involved with slot auctions.

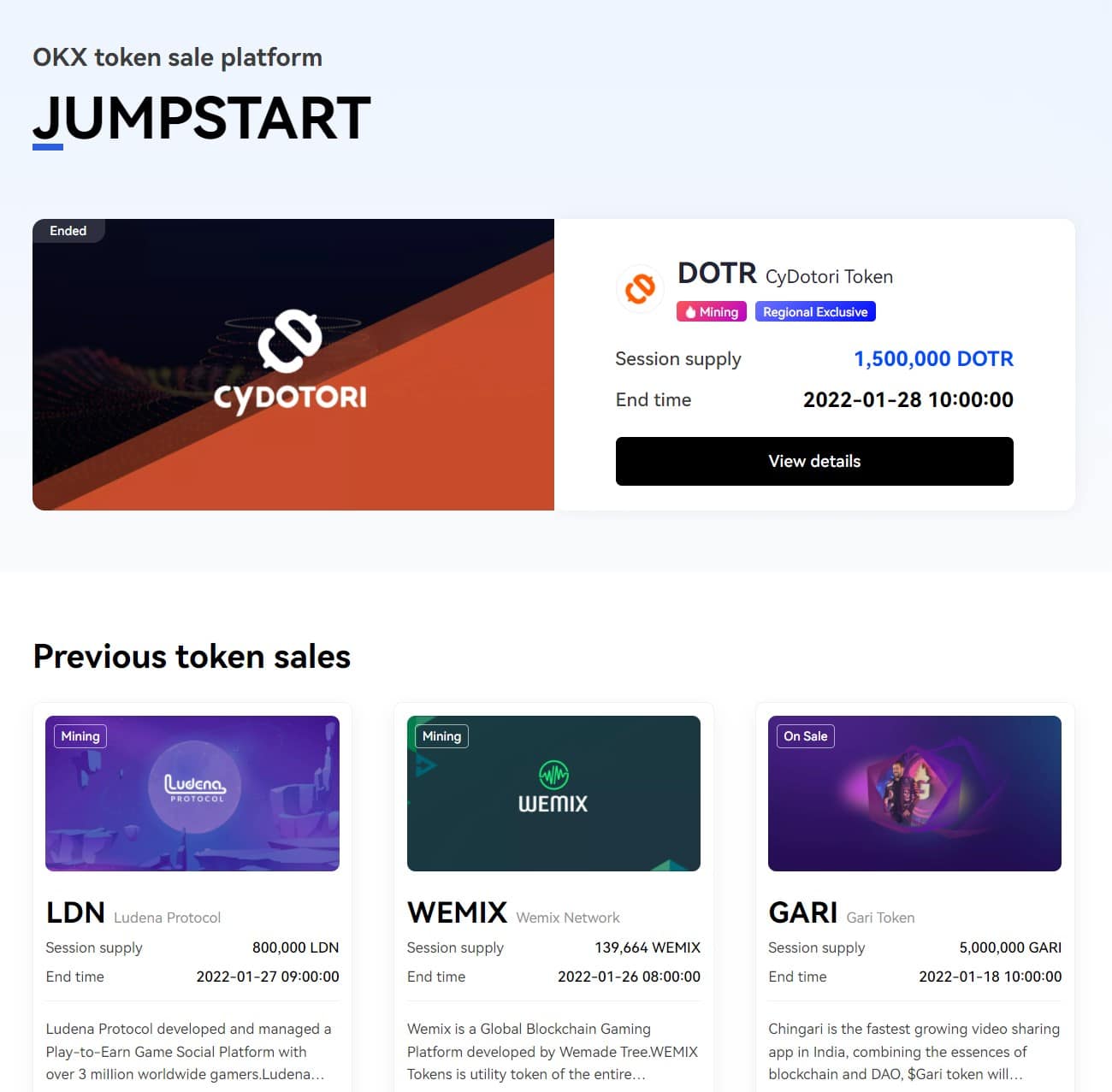

OKX Jumpstart

I told you there was a lot to unpack here. OKX have launched their token sale platform, which they call Jumpstart. This platform helps new projects launch and grow their communities. Users can participate in campaigns by staking their OKB tokens and receiving the tokens from new projects based on the user's staked amounts.

Image via OKX

Jumpstart gives users a chance to earn tokens from projects before they launch to the public. Getting into projects early and being among the first to acquire tokens from projects in their early stages is a great way to help boost your portfolio's performance. As history often shows, once a project goes public, its tokens have a good chance of going to the moon.

MetaX

MetaX is a smart wallet that supports multichain features with over 15 different blockchain networks and over 1000 DeFi protocols.

Image via okx.com/metax

OKX aimed to create a versatile platform that will make navigating the world of DeFi a breeze, and all from one place. Anyone into DeFi understands the pain points involved in bouncing between a dozen different DeFi platforms and crypto-wallets. MetaX is a one-stop solution that integrates multiple DEXs, allows users to create, manage, and trade NFTs, and explore over a thousand DApps with one click. Talk about convenience!

Explore NFTs with MetaX

MetaX could be a serious game-changer in leading to crypto mass adoption. One of the most considerable barriers to crypto adoption and DeFi is the complexities and learning curve. So the fact that OKX has built a bridge connecting a user-friendly CeFi interface with the powerhouse of DeFi deserves a standing ovation. You can learn more about this feature-packed wallet in our OKX Web Wallet Review.

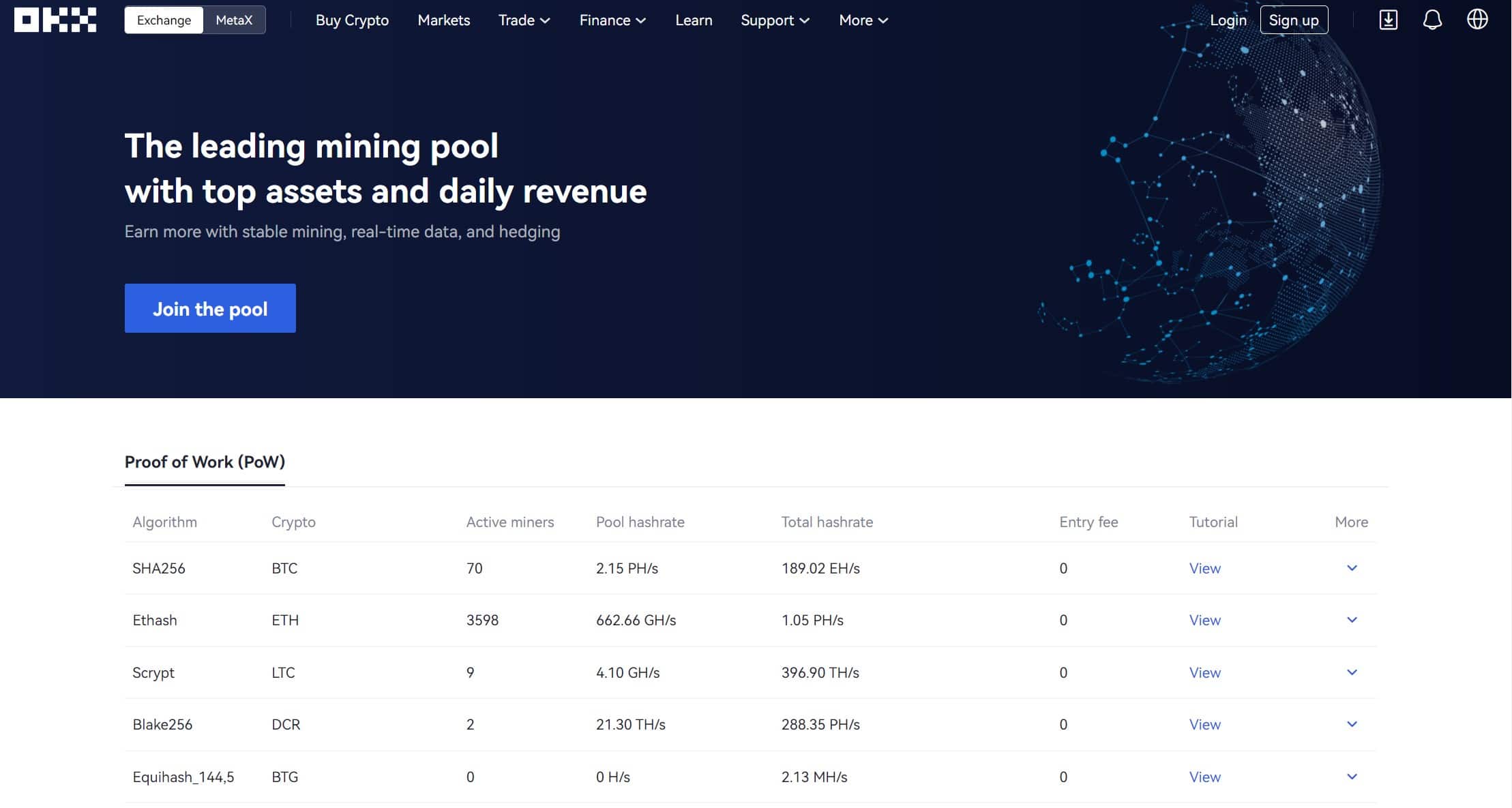

OKX Pool

Grab your water wings and dive into the OKX pool. This feature is a great way to provide users with a way to get involved in PoW mining without all the complexities and hardware.

Image via OKX

Here are some of the highlights taken from the OKX Pool Introduction guide:

- We partner with world-leading digital asset exchange OKX to offer a double bonus for staking;

- We give away 1,500 DOGE for mining 1 LTC, which you can choose to settle in OKB/LTC;

- We currently offer PoW mining services of BTC, BCH, BSV, LTC, ETH, DASH, DCR, ZEC, etc. More assets will be supported in the future;

- Staking service is now available, and we support the mining of a plethora of PoS and PoS-variant assets, including EOS, VSYS, IOST, ATOM, YOU, CRO, etc.

- You can enjoy 1-on-1 customer support and 24/7 protection for your assets

OKX Review Mobile App & PC Client

For those who are on the go, you may need to monitor your positions from a mobile device. That is why OKX have developed their own trading application.

Image via Google Play Store

The OKX app is one seriously powerful piece of software that fits in your pocket. This app allows trading on all markets at OKX, including their futures and spot markets and margin trading. In addition, the mobile app gives users the ability to explore their NFTs and GameFi apps (among others).

Staking and farming can also be done on the app, along with most of the functions that can be done on the computer browser version. The app is safe, transparent and comprehensive.

You also have interactive charts, which means that you can still complete some of your more in-depth analysis while you are at your desk. You also have one-touch ordering, making it a lot easier to execute your trades.

The app is available on iOS and Android and is listed in the respective stores. If you want to get a sense of what people think about it, you can check out the reviews. They seem to be quite favourable for everyone. For the few complaints, the OKX team was quick to follow up, which is a great thing.

So, should you use their mobile app?

I must admit that I am not one of the biggest fans of mobile trading in general. This is just because you cannot properly chart the trendlines or set up multiple trading parameters, in my opinion. Mobile apps are great for opening, closing, or monitoring positions, but for performing TA? Not so much, I will always opt for the web or PC-based version, but the app does make all the other functions and features a breeze to navigate to and access, making the OKX app one of the more robust, useful, and easy-to-use crypto apps available.

And, speaking of PC clients, OKX has developed a program available on both Mac & PC clients. This is just as functional as the web-based trading platform, although it is likely to be a bit faster.

OKX API

For those of you who like to code trading algorithms, you will be happy to know that OKX has a pretty robust API with a number of endpoints. They have both a REST as well as a WebSocket version.

If you want to run a bot connected to their API, you should make sure that your IP address is outside of Mainland China. It is also suggested that you use the Ali Cloud server in a Hong Kong data centre.

There is also an extensive list of SDKs that would allow you to develop bots and trading algorithms in a programming language that you know. These include the likes of Java, node, Python, C++, Go, C#. There are extensive OKX Developer docs that you can check to learn more about APIs and developer tools.

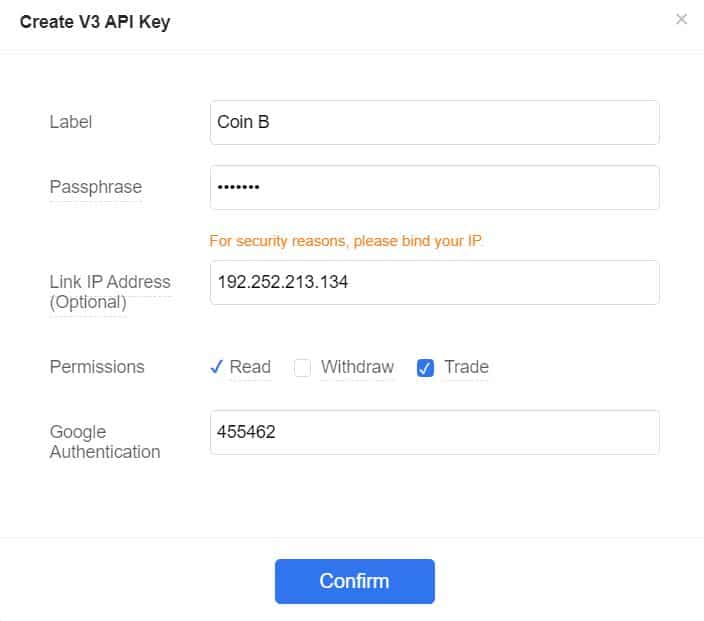

If you want to use the API, you need an API key. You can get this in your account by heading over to your username and then hitting “API”. Here you will select “My API”, where you will be able to create your own key with the following parameters.

API Key Generation Parameters at OKX

Note that the “Link API” is if you would like to bound the API key to a specific IP address. This would mean that only this IP could send commands to the API. Once you have created your key, you can place it in your code to start trading.

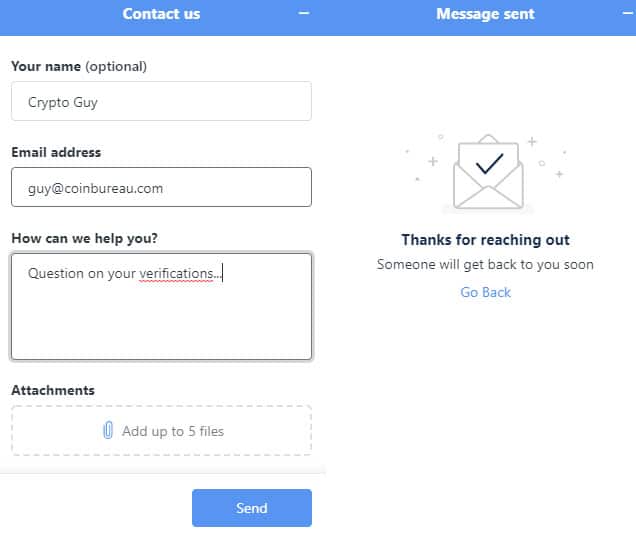

OKX Customer Support

This is one of those critical things for me. We are all well aware of the frustrations of waiting forever to get a response from an exchange on our queries.

Thankfully, with OKX, you have a pretty strong support function that can help users. In addition, there are a vast amount of resources and touchpoints that you can utilize at the main exchange.

Reaching out to Live Chat

Perhaps one of the quickest ways to get hold of an agent is through their live chat function. Either they will have an agent available to speak to you live, or they will email back in response to your query.

Although live chat is the most convenient option, sending a support ticket is also an option through the platform or via email. Telegram support is also available, but please always be careful utilizing Telegram support groups. There are hundreds of scammers pretending to be customer support, so remember that no support staff will ever ask for passwords, private keys, secret phrases, or ask for you to send them funds.

Pro Tip ✅: If you would like to chase up your support ticket, then you can hit them up on their Telegram

Of course, there is no need for you to reach out if you can find the required information in their support centre. They have most of the answers that other users have posted, and it is indeed quite comprehensive.

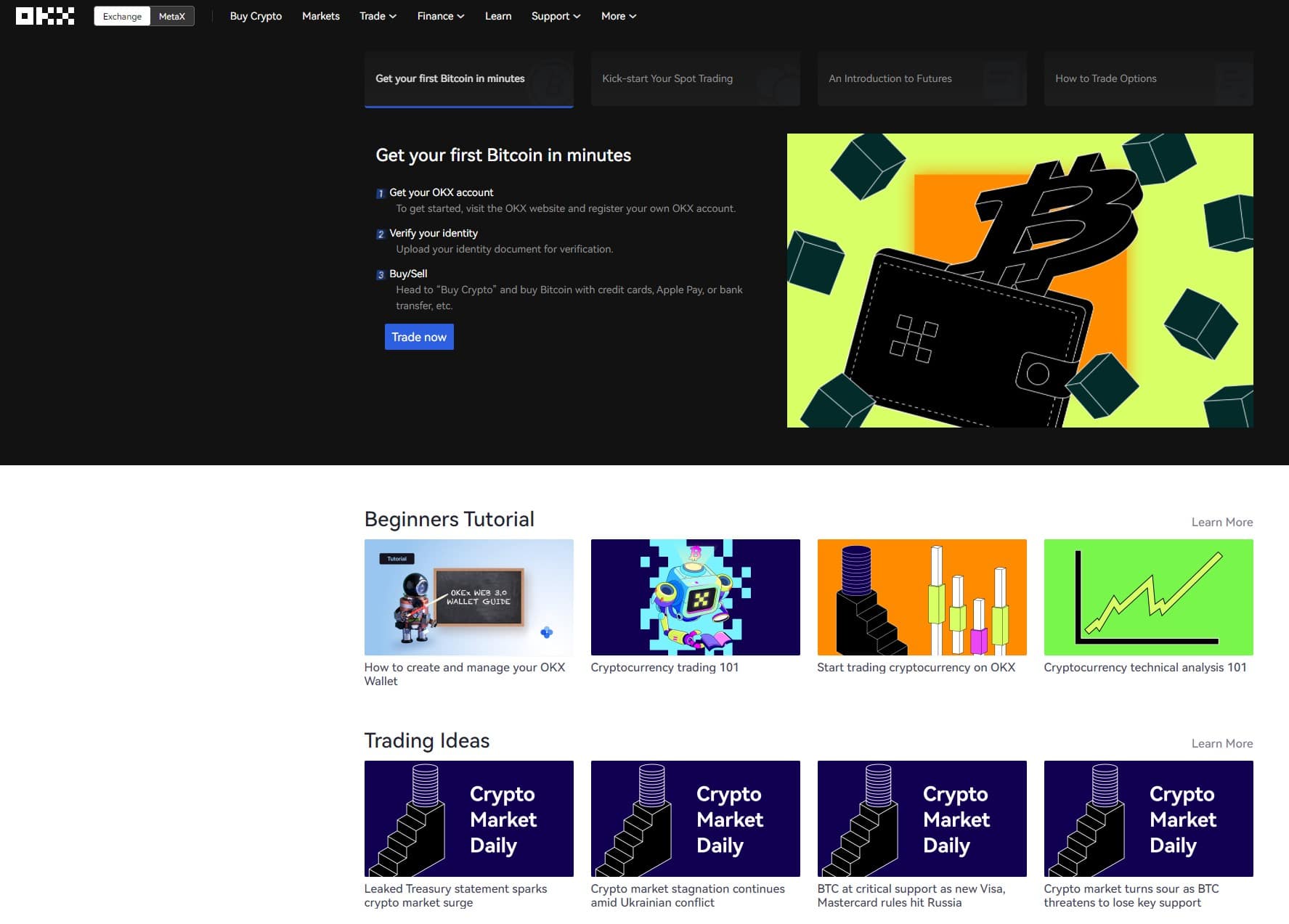

OKX Community & Academy

We really liked OKX because they have a pretty strong community around it with numerous telegram & Facebook groups. This is an excellent way to bounce some trading ideas off fellow local traders.

I also need to give the OKX team kudos as they have placed a strong emphasis on crypto education through their fantastic educational section- the OKX academy. This has got everything you need to know, from simple trading guides to more advanced resources such as how to trade options and futures and bespoke trading strategies and general crypto info.

The OKX Academy is a Great Resource for Everything Crypto Image via okx.com/academy

Finally, there is also a pretty handy glossary where you can learn about a whole host of terms and information. This could be ideal if you are unfamiliar with certain terms on the platform.

OKX FAQs

Is OKX Legit?

OKX is an established crypto exchange and follows industry best practices in keeping customer funds safe. They are used by millions of customers worldwide and have generally positive reviews and customer experiences. However, as with every centralized exchange, there is always a risk of hack attempts.

Is OKX a Good Exchange?

OKX is a very popular crypto exchange and is a prime contender with the likes of Binance and OKX. They have excellent asset support, extra features, and a plethora of tools which customers can utilize for their trading, hodling, and earning needs. They are one of the most popular and well-respected cryptocurrency exchanges in the industry.

Is OKX Available in the United States?

OKX is not available for users located in the United States. Crypto traders in the US should consider Kraken, Binance US or Coinbase.

Where is OKX Located?

OKX is currently headquartered in Seychelles with a location also in Malta.

Conclusion

In summary, we really like the OKX platforms. Not only does it have the advantage of being backed by one of the largest trading platforms in the world, but it is also really well-designed. OKX has really upped their game by adding all the other great features.

The innovation behind the platform to pursue so many different avenues of blockchain is fantastic to see. While OKX started off as a robust trading platform, it has drawn crypto users from various backgrounds and interests and is growing in popularity.

The futures and swaps give you a great deal of functionality for trading assets, order functionality, and data analytics tools. The option to demo trade also makes OKX a great place for beginners to learn the craft of trading and the platform is highly functional and really easy to use. This is best illustrated with their options instruments.

There are, of course, areas for improvement. For example, you only have Bitcoin options to trade at the moment. There is also relatively limited liquidity for the options market, especially out-of-the-money ones.

We hope that as more traders start to use the exchange, the liquidity should follow and hence make it easier for you to place large orders for your options.

So, is the OKX platform worth using?

Well, if you are interested in NFTs, high APYs, HODLing, GameFi, and crypto trading with low fees, then you can't really go wrong with this all-in-one platform. For active institutional and retail traders looking for a highly functional yet simplistic trading interface developed by a well-respected global exchange, then it is well worth a spin.

👉 Sign up for OKX and receive an exclusive 40% trading fee discount for life!

Going to trade a lot? Get in touch with Tom on Telegram for a bespoke OKX VIP Deal @TomCoinBureau