For quite some time now, humans have been ultimately dedicated to the pursuit of automation in all of its various, dynamic forms. In fact, from the ancient Sumerian invention of the wheel to Leonardo da Vinci’s proto-helicopter model, the human species has always been deeply inspired and thoroughly fascinated by the mechanics of technological advancement and automation. Traders are no different in their pursuit of automation, scouring for the top crypto trading bots.

Two of the most pertinent examples showcasing this sentiment of chasing automation are the First and Second Industrial Revolutions. Both of these historical époques were fundamentally characterised by a sustained level of mechanical development, enhanced engineering structures and true innovation, all in the name of progress and industry.

Both the First And Second Industrial Revolutions Viewed Automated Structures As The Utmost Expression Of Progress.

To some extent, the same thought process can be applied to our current, blockchain-enabled digital asset economy. Indeed, it is compelling to analyse the parallels that have been drawn between the financial revolution spearheaded by Bitcoin and Ethereum and the forthcoming, somewhat inevitable 4th Industrial Revolution.

Blockchain, in fact, has long been defined as the pillar of the new digital, financial and, with NFTs, even artistic layer in societal economies. Its innovative distributed ledger technology (DLT) allows for the creation of intricate monetary paradigms that inherently go well above the established economic frameworks of the traditional financial system. Furthermore, the digital asset sphere has come such a long way since its inception, progressively architecting new models and conceptualising some of the most electrifying value propositions and FinTech designs.

Consequently, in a similar fashion to the way the Industrial Revolution sought to automate manual labour with mechanical, automated processes, crypto has also integrated a technological framework that enables traders and investors to automate much of their on-chain operations. This aforementioned system primarily relies on robots, commonly referred to as bots, or in crypto, crypto trading bots, to execute transactions, trades, as well as buy and sell orders in a completely hands-free manner.

Automated Trading Systems, Or Bots, Allow Traders To Execute Trades More Efficiently. Image via Shutterstock

The implementation of crypto trading robots, is by no means a structure native to the crypto economy. In fact, a variety of platforms have reported that 70-80% or more of shares traded on U.S. stock exchanges come from automatic trading systems. This is primarily due to the fact that traders and investors can turn precise entry, exit and money management rules into automated, robo-driven trading systems that allow computers to execute and monitor trades.

The trade entry and exit rules can be based on simple conditions such as moving average (MA) crossovers, oversold-overbought Relative Strength Index (RSI) levels, volume-weighted average price (VWAP) or MACD indicators, or they can implement more complex strategies that require a comprehensive understanding of the programming language specific to the trading platform used by the trader.

Thus, while automatic trading systems first made their appearance in the more traditional FX and Stock markets, the demand for crypto trading bots in the incredibly fast-paced cryptocurrency market has skyrocketed over the course of the years. This should indeed come as no surprise as crypto market structures primarily thrive on assets that are by their very nature hyper-volatile, meaning that traders can leverage the pre-established set of rules ingrained into a robot to maximise trade execution in the most efficient way possible.

Traders Can Take Advantage Of A Bot’s Pre-Determined Set Of Rules To Maximise Trade Performance. Image via Shutterstock

Best Crypto Trading Bots: Summary

While there is no one-size fits all, the crypto trading bots in this article have proven themselves to be highly valuable assistance for experienced traders and those looking to automate portions, or all of their trading strategy. It is important to note that crypto trading bots are not “money making machines” as they are best used in the hands of traders who understand the correct market conditions to deploy the bots, and understand when and when not to run them.

Crypto Trading Bots Pros:

- Good for automating tedious tasks

- Can do everything from placing trades, taking profits, to simply alerting the trader to a potential trade setup

- Can help remove emotions from trading

- Can monitor endless trading pairs 24/7, overcoming human limitations

Crypto Trading Bots Cons:

- Can give traders a false sense of confidence. Over 90% of traders lose money with trading bots.

- Can lead to grievous losses if configured incorrectly

- Can be expensive

- Mechanical failures can happen

- Requires monitoring

Alright, without further ado, whether you are looking for a Bitcoin trading bot, or altcoin trading bot, let’s dive into the top, most widely adopted and best crypto trading bot on the market.

Page Contents 👉

- 1 Cryptohopper

- 2 3Commas

- 3 Gunbot

- 4 Top Crypto Bots in 2023: Conclusion

- 5 Crypto Bots FAQ

- 5.1 Best Trading Bot for Cryptocurrency?

- 5.2 Best Asset For Crypto Bot Trading

- 5.3 What are the Best Free Crypto Trading bots?

- 5.4 What Crypto Exchanges Support Crypto Trading Bots?

- 5.5 Which Crypto Trading Bot is Best for Portfolio Management?

- 5.6 Are Crypto Trading Bots Profitable?

- 5.7 How Much Money Can you Make With a Crypto Bot?

Cryptohopper

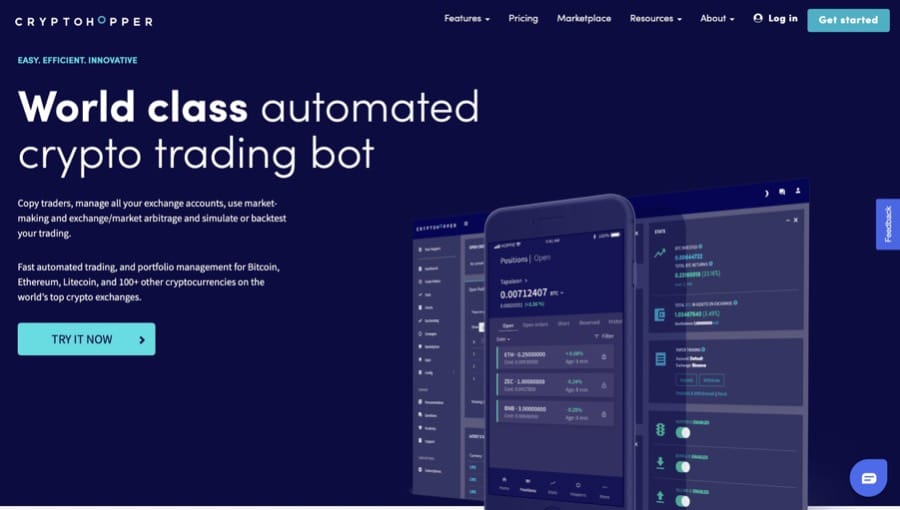

Cryptohopper is a crypto trading bot that aims to simplify the overall process of crypto asset trading and helps users of all experience levels to make the most out of different trading opportunities in the market. In parallel with a few other crypto trading robots, Cryptohopper seeks to empower traders by providing them with a user-friendly, fully featured service that allows its users to seamlessly execute trades on multiple crypto asset pairs while removing the bottlenecks of human intervention.

Cryptohopper Pros and Cons

Pros of Cryptohopper:

- Automated trading: Cryptohopper allows you to set up automated trading.

- Backtesting: The platform provides a powerful backtesting engine, allowing you to quickly test out potential trading strategies.

- User-friendly: The platform is easy to use and navigate for both experienced traders and beginners.

- Security: Cryptohopper utilizes advanced encryption techniques, making sure your funds are safe and secure.

Cons of Cryptohopper:

- Limited markets: Currently Cryptohopper only supports trading on select major exchanges.

- Fees: The platform has a variety of fees associated with it, including exchange fees and subscription fees.

- Limited customer support: The customer support offered by the platform is limited and can be slow to respond.

Cryptohopper, A World Class Automated Crypto Trading Bot. Image via Cryptohopper.com

The primary focus of this cryptocurrency trading bot is to facilitate the process of investing in the dynamic crypto space and benefit from the most profitable trades and market plays, both long and short-term.

The Cryptohopper platform in itself is rather intuitive and allows investors to automate their investing processes, copy professional traders, set signals and alerts through their mobile app or more directly through the Cryptohopper platform. These features essentially enable investors to stay on top of the market no matter which coins they trade, which exchanges they use and where they travel.

According to the Cryptohopper website, the proprietary crypto trading robot was developed by two brothers, Ruud Feltkamp and Pim Feltkamp, who decided to merge their expertise, skills and passion for the crypto space to create a bot that trades automatically for the user, operates on a 24/7 basis, implements a variety of token pairs, while also being compatible with a number of digital asset exchanges via an in-house Application Programming Interface (API).

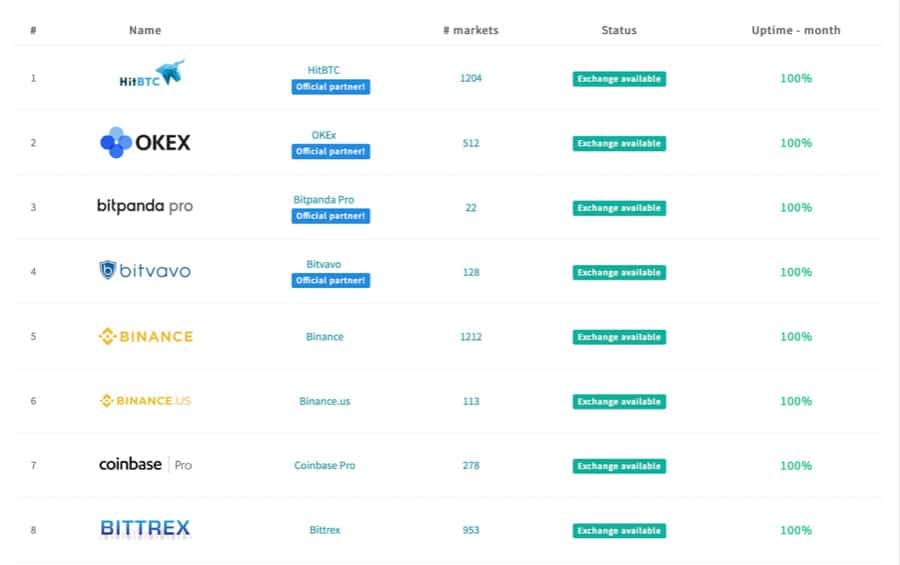

In fact, Cryptohopper recently partnered with 15 major crypto exchanges including Binance, Coinbase, Huobi and Kraken, and offers compatibility with more than 100 tradable assets, making this suitable for those looking for altcoin trading bots.

The Cryptohopper Bot Interfaces With 15 Major Digital Asset Exchanges. Image via Cryptohopper.com

The official site houses a semi-automated cryptocurrency trading bot that allows traders to remove human tendencies and emotions from the trading process and rely instead on purely technical based trading algorithms and programmed trading approaches.

Cryptohopper Features

Cryptohopper offers a wide array of trading features on its platform, including:

- Automatic Trading

- Exchange Arbitrage

- Market Making Bot

- Mirror Trading

Visual Of The Many Features Offered On The Cryptohopper Platform. Image via Cryptohopper.com

The Automatic Trading feature, specifically, is perhaps the most sought-after application on the platform, as it allows traders to either leverage some of the ready-made automated trading strategies built in the bot or even deploy their own personal trading strategies by programming them into the robot. This automated trading methodology has mostly proven to be rather beneficial for those investors who either don’t have the time to stare at charts all day waiting for the perfect entry or simply aren’t experienced enough to execute trades on their own accord.

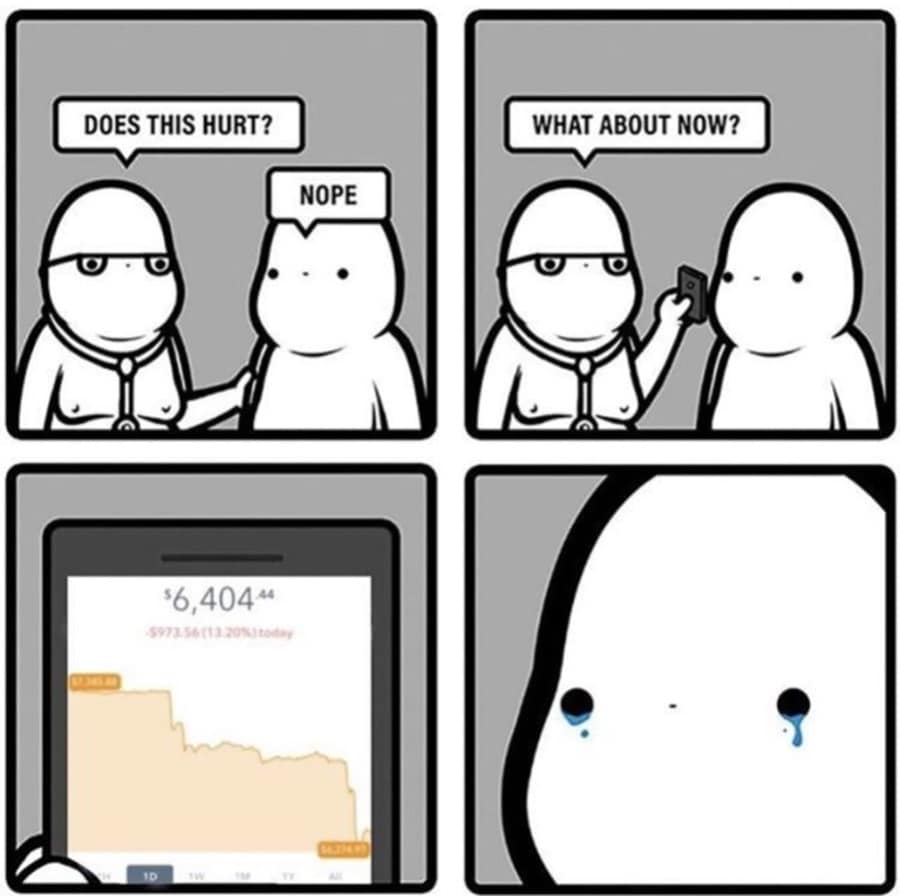

In terms of pure functionality, Cryptohopper operates as a web-based solution and features an easy to use User Interface (UI) that includes a wide range of functions. Users can configure the bot to trade automatically 24/7 and make use of both algorithmic and social trading, for instance.

Trading strategies can be derived via various technical indicators or by following the actions of third party trading experts. Furthermore, the platform provides a good range of trading tools and incorporates features such as a bot backtesting tool, configurable and saveable templates, trailing stops, and customisable technical indicators. Users can also rely on popular TA indicators such as Stochastic, RSI, Bollinger Bands and MACD.

For instance, if the bot is operating in a potential bull market, traders can use the trailing stop loss and take profit features to secure profits and protect themselves against any losses. In essence, this allows traders to exit the market when an eventual correction takes place or exit the market when a specific price target is hit, enabling them to automatically incorporate a risk management strategy into their trading activities.

If, on the other hand, the markets decide to take a turn for the worse, Cryptohopper users can instruct and pre-program their robot to fully prepare by exiting a trade at the first glimpse of a downtrend. Alternatively, depending on the exchange used, traders can also instruct their bot to engage in short selling.

Image via Cryptohopper.com

In addition, the Cryptohopper platform incorporates a support team that is available to deal with any issues users may encounter when utilising the crypto trading bot. Users can contact the team by submitting a support ticket in the Support Section and they may also get in touch with them directly via Twitter, Facebook or Telegram. The Cryptohopper website also contains a number of FAQs in the Support Section, as well as a number of Tutorials that help users to navigate the platform.

Programming the Cryptohopper Crypto Trading Bot

As with the majority of crypto trading robots, bots can only be as good as the individuals programming them. This means that, because the bot is pre-programmed to follow specific rules in pre-determined conditions, a weak crypto trading strategy will almost certainly cause losses. In terms of design, the way these crypto trading robots work is actually pretty similar to the ‘IF-THEN’ function found in Microsoft Excel. The ‘IF’ component of the equation is the market trigger, whereas the ‘THEN’ is what the automated bot should do when the trigger is activated.

For instance, let’s assume that the market trigger is Bitcoin breaking 50k. To be certain that the pricing target is broken convincingly, a user could set the market trigger at $50,100, which would activate the ‘IF’ element of the equation. A trader would then need to pre-program the bot to execute a specific trade at this level, representing the ‘THEN’ component of the equation. This not only enables traders to better gauge the potential direction of the market but it actually gives them an extra layer of confidence and security. This is because, quite frankly, no one really wants to end up like this guy here below!

Image via Twitter

At this stage, a trader could instruct the automated bot to engage in a trailing stop loss whereby the bot purchases say $500 of BTC every time it increases in value by 5%. At the same time, the bot can be programmed to adjust stop loss orders autonomously, so that when the price of BTC decreases by 5% at any given time, the bot can close the trade immediately.

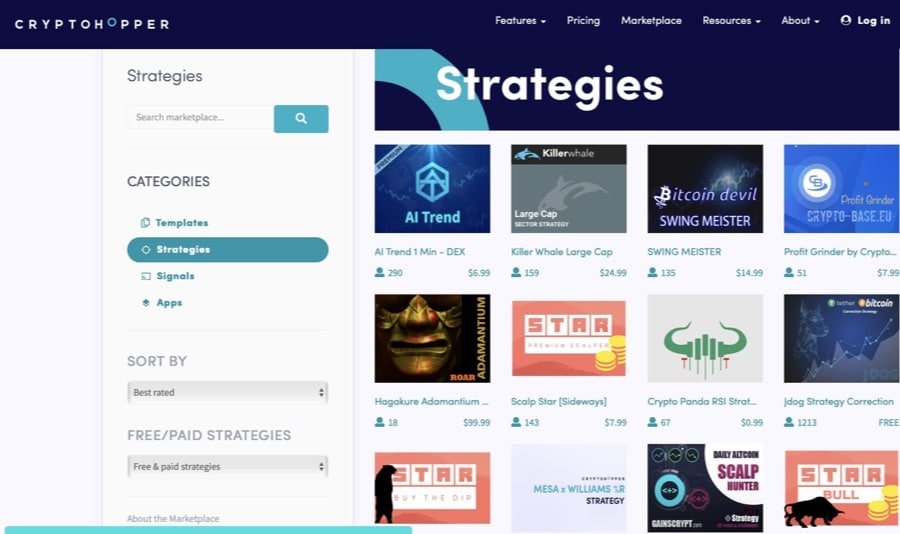

Cryptohopper Marketplace

Another valuable feature offered by Cryptohopper is its marketplace, which is an area containing a variety of different automated trading strategies pre-designed and pre-built by other traders.

Image via Cryptohopper.com

While many of the pre-programmed crypto trading strategies can be obtained for free, some come at either a monthly or one-time-fee cost.

An Example Of A Paid Strategy Offered On The Cryptohopper Marketplace. Image via Cryptohopper.com

As with any crypto trading bot, however, it is important to note that even if the bot has demonstrated an extensive winning streak of trades, users should always exercise caution and some form of due diligence before even thinking about purchasing one. In fact, bots can be an incredibly powerful tool but there is nevertheless no guarantee that you’ll be able to profit when using one.

Thus, Make Sure To Always Do Your Own Research Before Purchasing A Crypto Trading Bot. Image via Tenor.com

Now, let’s briefly discuss how the Sign-up process works for Cryptohopper.

Cryptohopper Account Signup

Creating an account on Cryptohopper is a very straightforward process.

But before you do, just to let you know we have a Cryptohopper sign-up deal that gets you a 7-day free trial, which is worth trying out before committing.

Now, the main thing that you’ll need to do is :

- Head over to Cryptohopper.com

- Enter a name, email address, user name and password to register.

Image via Cryptohopper.com

- You can then confirm your email account by clicking the activation link in the email sent, and gain access to the dashboard.

- From here you can simply follow the wizard as it will help you to quickly configure your Cryptohopper. You just need to select an exchange and configure the bot via your preferred exchange’s API keys and also set up basic hopper configurations. The process is very straightforward and there are links to tutorials and additional useful information on each step.

- From here you can immediately start using your hopper, and once you have used the wizard and set up your account, you will be able to access a host of features from the dashboard. You can subscribe to signals, configure templates, and begin back testing your bot, as well as set up two factor authentication on your account.

- And you’re all set!

If you want to explore Cryptohopper in more detail, feel free to check out our dedicated Cryptohopper Trading Bot review.

3Commas

3Commas is a cryptocurrency trading platform designed to help users build automated trading bots. As of September 2021, 3Commas is considered to be one of the most successful and widely adopted crypto trading bots with over 33,000 regular users and over $10 million in trading volume each day.

**Important Security Notice** In December 2022, 3Commas users reported unauthorized transactions on their exchange accounts, resulting in unauthorized trading and there have been claims of stolen funds. At first, 3Commas stated that the result was likely a large-scale phishing attack that customers fell for, but further investigations show that there was a hack and users' API keys were leaked. 3Commas is recommending all existing users review and update their API keys.

3Commas has since upgraded its security, but users were left upset and demanding apologies after the 3Commas team handled the event very poorly and were criticized for “gaslighting” and falsely blaming users.

3Commas, The Ultimate Crypto Trading Bot. Guy Approved! Image via 3Commas.io

Despite the incident mentioned above, 3Commas remains one of the most popular and widely used crypto trading bot platforms, which we explore in great detail in our dedicated 3Commas review.

The 3Commas platform is relatively intuitive to use, making it a great solution for users trying to get acquainted with the process of automated crypto trading as a whole, as well as catering to more veteran, sophisticated traders.

Beginner Or Experienced, 3Commas Has You Covered! Image via 3Commas.io

In addition, 3Commas works with 23 major crypto exchanges and offers a spot trading interface that adds risk management tools to manual trades.

3Commas Pros and Cons

Pros of 3Commas:

- Automated trading and portfolio management

- Easy to use interface

- Ability to copy other traders

- Alerts and notifications

- Free trial available

- Mobile app support

Cons of 3Commas

- Limited number of exchanges

- Limited customer support

- High fees for some features

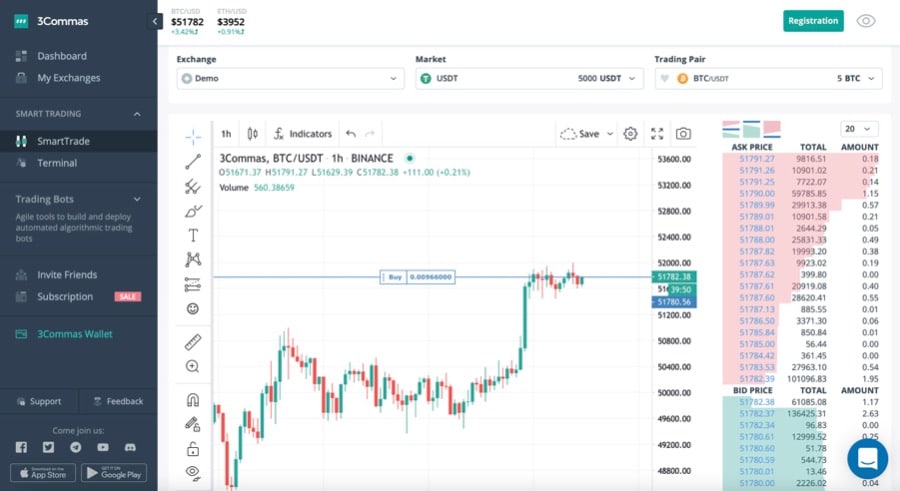

3Commas Smart Trading

3Commas leverages its own in-house Smart Trading system designed to facilitate the process of crypto trading and create the most comfortable, user-friendly, seamless automated bot experience for its users. At first sight, the Smart Trade interface aesthetically resembles the trading interface one might expect from an online FX trading platform or brokerage, expect that it’s primarily geared for crypto trading.

The 3Commas Smart Trade Platform Is Visually Rather Similar To A Traditional FX Brokerage Site But It’s Fully Geared For Advanced Crypto Trading. Image via 3Commas.io

With Smart Trade, users can buy or sell pairs of digital currencies using a few essential risk management tools. First, users can set market or limit orders, and even set a price conditional that must be met before a market or limit order is subsequently triggered. Users can also set trailing buy or sell orders, which allow them to repeatedly purchase or sell an asset pair once a specific price condition is triggered.

Image via 3Commas.io

Another key advantage offered by Smart Trade is the ability to add stop loss and take profit levels to every trade, a feature that many crypto CEXes don’t allow.

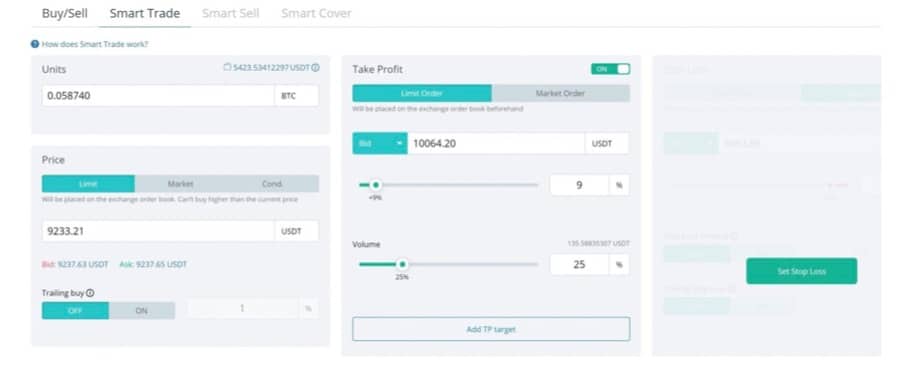

Dollar Cost Averaging (DCA) Bots

As you might have guessed, the main attraction of 3Commas is the platform’s cryptocurrency trading bots. Out of the three main bots designed by the platform, two are primarily centred around dollar cost averaging, or DCA in short.

A DCA, Or Dollar Cost Averaging strategy helps lower volatility risk. Image via Shutterstock

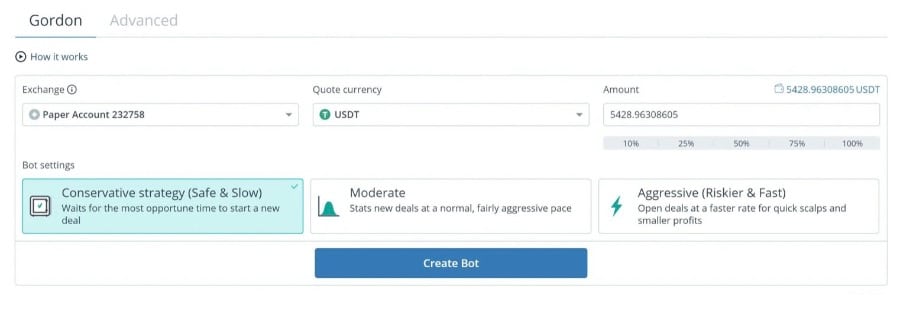

The Gordon bot is a largely pre-made bot that users can program to run in just a few seconds. All one needs to do is decide how much capital to deploy to the bot, which exchange to run it on and select the desired strategy between conservative, moderate or aggressive.

Traders Can Select Between Conservative, Moderate And Aggressive strategies. Image via 3Commas.io

The Gordon bot offered by 3Commas implements the popular QFL trading strategy, which looks for potential dead cat bounces. A conservative strategy, instead, will wait longer for additional price drops before executing a trade, whereas a more aggressive strategy will enter trades at the first sign of a price bottom. Furthermore, it is important to note that the Gordon bot, by default, runs on all asset pairs available on the exchange it is connected to.

In addition to the Gordon bot, 3Commas offers an Advanced bot that is a more customisable dollar cost averaging (DCA) trading robot and a grid trading bot. The Advanced bot allows traders to choose from a variety of trading strategies, including QFL and scalping, or connect a TradingView account to interface personalised trading signals. With the Advanced bot, users can also decide whether to make it a simple, one asset pair bot or a composite bot monitoring multiple asset pairs at once.

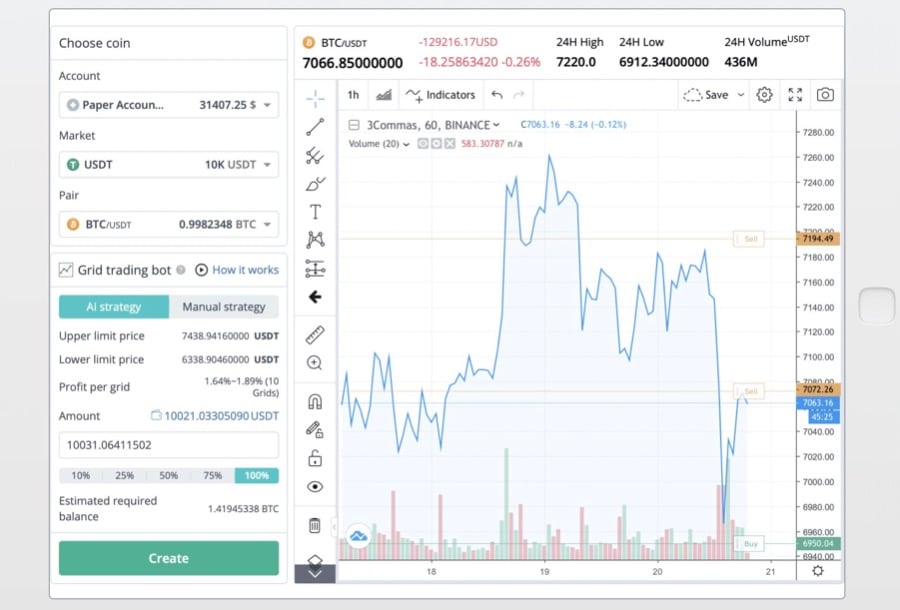

3Commas GRID Bot

The GRID bot is 3Commas’ newest automated trading robot and it works by subdividing a technical price chart into slices. Each one of these slices covering a range of prices is assigned a specific buy and sell signal, and when the currency’s price crosses into a new slice, the GRID bot will automatically buy or sell based on the signal assigned to that particular slice.

The Goal Of GRID Bot Is To Arrange A Grid Of Orders In A Given Range. Image via 3Commas.io

One of the major advantages that come with the GRID bot is that users can either determine slices and their respective price signals automatically via the AI settings, allowing for a more automated trading experience, or they can set their preferred slices manually. For instance, if users decide to set up the bot manually, they can decide the price levels of the maximum and minimum slices and the price range covered by each slice.

Overall, the GRID trading bot has proven to be particularly useful for stablecoins, which typically trade in a sideways range since they are meant to keep a roughly constant value relative to another currency. 3Commas has become very popular for those looking for Bitcoin or altcoin trading bots.

Pricing

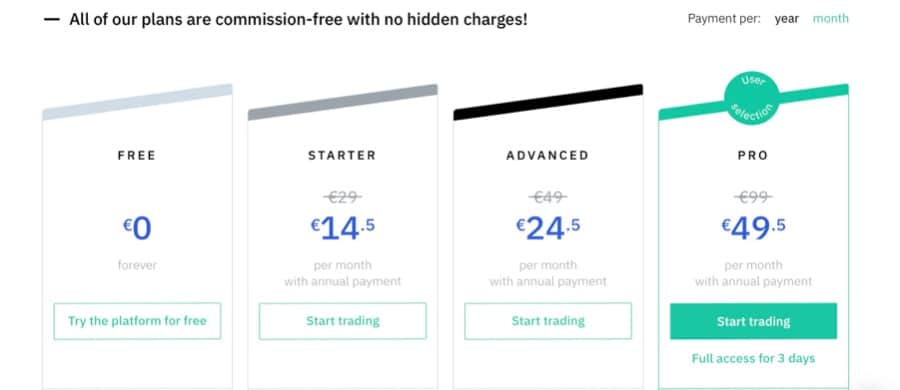

3Commas offers four different plans, with these being Free, Starter, Advanced and Pro.

Image via 3Commas.io

- The Starter plan costs €14.50 per month and includes the Smart Trade manual trading terminal, but limited use of automated trading bots.

- The Advanced plan costs €24.50 per month and adds simple bots, which are able to open trades on only one coin at a time. If you have a separate TradingView account and create custom trading signals through that platform, you can also import them to 3Commas with an Advanced plan.

- The Pro plan costs €49.50 per month and includes composite bots, which enable you to open trades on multiple cryptocurrency pairs rather than only on a single pair. In addition, Pro users can connect to the Bitmex, Binance Futures, ByBit, and Gemini exchanges for automated cryptocurrency futures trading.

Of course, you can try out 3Commas before committing to the platform with a three-day free trial of the Pro plan with no credit card required. After all, it’s Guy approved!

You can also learn more about this powerful crypto bot trading platform in our dedicated 3Commas review.

Gunbot

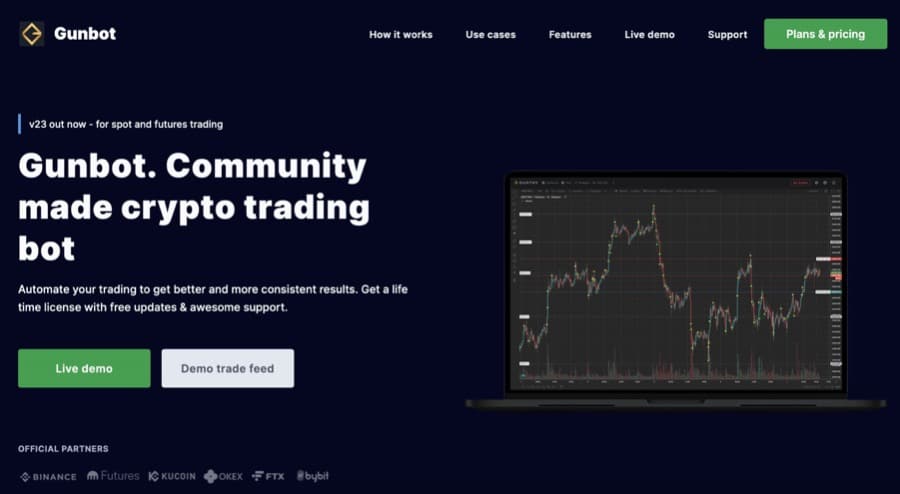

Gunbot is yet another popular crypto trading robot that allows users to perform automated trading of a large selection of asset pairs across the cryptocurrency market.

Gunbot pros and cons

Pros of Gunbot:

- Over 100 exchanges available for integration

- Lifetime license available

- Windows, Mac, and Linux Support

- Great Community Support

- Extremely Customizible

Cons of Gunbot:

- Only Desktop Support

- Not Great for Beginners

Gunbot, A Community Made Crypto Trading Bot. Image via Gunbot.com

Gunbot comes with a built-in browser interface, and users can safely access the interface on their local machines or open up access from the web. The interface is optimised for mobile devices, supports two factor authentication (2-FA) and can be served via https. Additionally, Gunbot is compatible with Mac, Windows, ARM and Linux, essentially allowing traders to run it on pretty much any device.

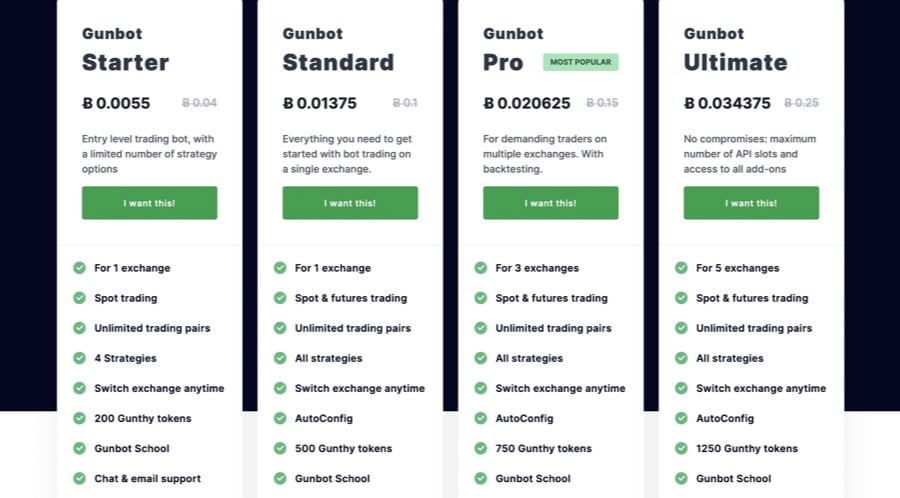

Just like with Cryptohopper and 3Commas, traders using Gunbot can create their own trading strategies or leverage any of the ready-made ones available through the platform. However, Gunbot differs from the two mentioned above in that it doesn’t operate on a monthly-fee-based subscription model but it allows users to purchase its automated crypto trading services with a one-time fee.

Visual Of The Available One-Time Payment Plans Offered By Gunbot. Image via Gunbot.com

In fact, all plans are life time with no recurring costs, a major advantage for those users looking to utilise the platform long-term. These one-time plans can be purchased with Bitcoin, various sets of altcoins, stablecoins and even through PayPal.

The process of using Gunbot is rather straightforward and entails:

- Selecting your desired plan.

- Downloading the software and launching it.

- Choosing your log-in details.

- Setting up your API Keys for the exchanges which you want Gunbot to operate on.

- Setting up your crypto trading strategy by either choosing a preset or customising parameters to your liking.

- Picking the trading pairs which you want to trade.

- Allowing Gunbot to begin trading based on those specifications on a 24/7 basis.

Gunbot Features and Trading Strategies

Gunbot supports some of the most popular digital asset exchanges, including Binance, Binance Futures, Bitmex, Bybit, Coinbase Pro and Kraken, and many more. When it comes to trading, Gunbot strategies can be assigned to one or more trading pairs. Moreover, the platform comes with a variety of free trading presets, which are ready to be used after making some minor adjustments, such as regulating and configuring how much the trading bot is allowed to spend for trade, for instance.

Users can create an unlimited amount of custom strategies, including ones specially adapted to both spot and futures trading. On futures, for instance, users can choose between mean reversion or trend following variants of individual strategies, and they may also incorporate trailing strategies to maximise profit from any given position. Every strategy can use a number of protections, such as setting custom gain and stop limit values, limiting the number of sell orders before trading is halted and preventing buy orders above the last sell rate to protect against buying in a surging market.

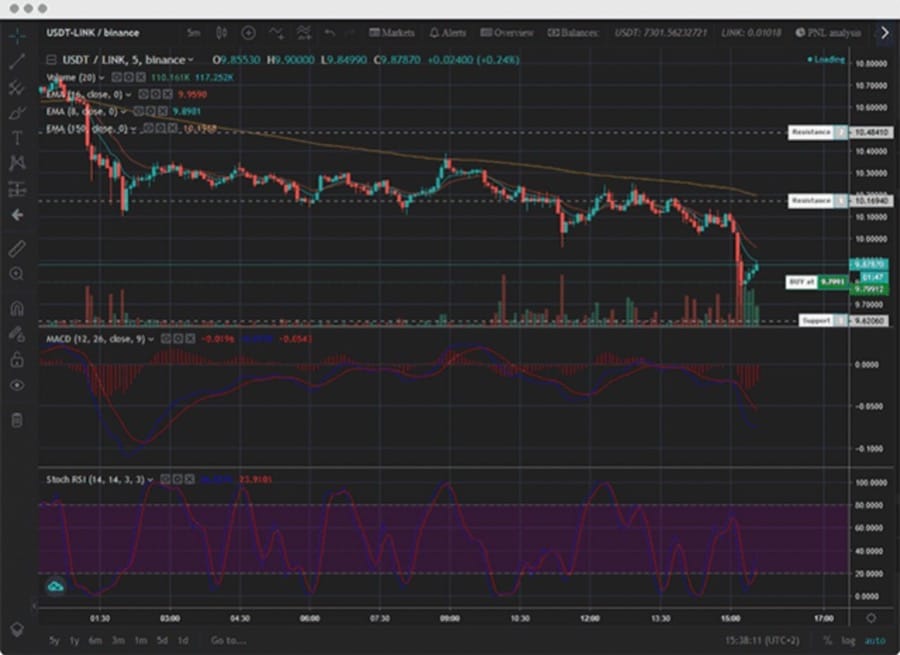

Confirming Technical Indicators

To refine a specific trading strategy, users can configure confirming indicators to activate buy and sell orders exclusively when pre-determined conditions are met. For example, traders can configure their bot to execute a buy order when the Relative Strength Index (RSI) crosses below the 30 zone and execute a sell order whenever it crosses above 70.

Visual Of The Indicators Available On Gunbot. Image via Gunbot.com

For its set of confirming indicators, Gunbot implements:

- ADX

- EMAs

- EMA Spread

- RSI

- MFI

- Stochastic

- Stoch RSI

- Additional Indicator combinations via AutoConfig.

Back Testing Add-On

Another valuable feature offered by Gunbot is the ability to back test strategies on the popular trading/charting platform TradingView. The back testing add-on allows for back testing of almost all strategy parameters available in Gunbot. It can also be used to send alerts based on Gunbot strategies to be executed by the bot with the TradingView add-on.

Strategy back testing takes place directly on TradingView.com, which offers a powerful engine to back test and visualise tested trading performance. As long as TradingView.com supports the exchange a user is trading on, historical data for back testing is available for almost every available asset pair on the exchange.

Overall, Gunbot offers all the bells and whistles that you would expect from a crypto trading bot. It offers an excellent user experience as well as a suite of tools to develop and execute automated trading strategies. Whether you’re a beginner or an advanced trader, you could add Gunbot to your trading arsenal and use it to efficiently implement your favourite trading strategies.

And that brings us to the end of our top crypto bot article, but we still haven't answered the question:

Are crypto trading bots worth it?

You bet! as long as you have realistic expectations and understand the bots limitations, bots can be invaluable trading tools, especially for advanced traders, saving you countless hours and scouring more charts than any human trader can do. Trading bots are perfect for traders who want to take their emotions out of trading and stick to disciplined, rules-based trading strategies.

However, if you are looking for something you can just flip on, walk away, and make money, then I am sorry to tell you that it doesn't exist. If it did, nobody would be working jobs anymore.

Top Crypto Bots in 2023: Conclusion

Over the course of the last few decades, traders have consistently been on the lookout for the most profitable, most performant trading strategies enhanced by automated technologies.

Emerging first in the more traditional Stock and FX markets, and progressively moving into the more dynamic digital asset space, automated trading systems, commonly referred to as bots, have firmly established themselves as the go-to solution for many retail and institutional traders alike.

This should indeed come as no surprise as crypto market structures primarily thrive on assets that are by their very nature hyper-volatile, meaning that crypto traders can leverage the pre-established set of rules ingrained into a robot to maximise trade execution in the most efficient way possible, and gain access to some of the most sniper-like market entries and exits.

The robots analysed in this piece all present users with top-notch applications, cutting-edge functionalities and highly desirable use cases, allowing traders to increase their profit potential as well as their trading sophistication.

Ultimately, the introduction of automated trading systems in the incredibly fast-paced digital asset sphere constitutes a fascinating development and it has thus far proven to be a massive success. While there are most definitely advantages that come with using crypto trading robots, it is however of utmost importance to emphasise the fact that, firstly, profits from bots are NOT 100% guaranteed and, secondly, that sustained levels of risk management and protection measures are required regardless of the bot’s historical performance.

If you are still on the fence about whether or not Crypto bots are right for you, we explore that topic further in our article: Crypto Bots- Worth it?

Crypto Bots FAQ

Best Trading Bot for Cryptocurrency?

It is hard to say if there is a best crypto trading bot as different traders have different styles and needs. We do find 3Commas, Shrimpy, and CryptoHopper to be highly functional, popular, and have good reviews. You can explore more of our picks in our Trading Bots: Worth it? article.

Best Asset For Crypto Bot Trading

Some traders like to use crypto bot trading for Bitcoin, while others will choose trading bots for altcoins. It is up to the trader, and the best asset for crypto bot trading should be the asset that the trader is most familiar with and is interested in following the news and trends that may affect that cryptocurrency.

What are the Best Free Crypto Trading bots?

The most popular trading bots cost a monthly subscription. There are free crypto trading bots available on places like the MT4 marketplace and in trading blogs, however, I urge extreme caution when using free crypto trading bots from unknown sources. Any automated system used should have good reviews from dozens of users, and a proven track record. There are many free bots floating around online that have malicious code in them or are designed to blow trading accounts. You can gain further insight into crypto bots with our article Crypto Bots, Worth it?

There are no free crypto trading bots that we recommend, as the saying goes, “you get what you pay for.”

What Crypto Exchanges Support Crypto Trading Bots?

Most of the major crypto exchanges like Binance, OKX, and KuCoin have an API setting that allows you to connect a trading bot from the platforms in this list. Each of these bot trading sites will have a list of supported exchanges. KuCoin and OKX are also great as they natively support crypto bots directly within the platform. You can learn more about OKX trading bots in our OKX Bots Review article. Bots Available on OKX:

- Grid bot

- DCA bot

- Recurring buy bot

- Arbitrage bots

- Smart Portfolio rebalancing bot

- Slicing bots.

Which Crypto Trading Bot is Best for Portfolio Management?

I find Shrimpy is one of the best tools for crypto portfolio management. You can learn more about it in our Shrimpy review.

Are Crypto Trading Bots Profitable?

Cryptocurrency Trading bots can be profitable if they are set up correctly and have shown to be fairly profitable when in the hands of experienced crypto traders who understand the proper market conditions in which to use an automated trading strategy. Successful use of trading bots requires an understanding of price action, market trends, and watching news and macroeconomic factors that will have an impact on markets.

How Much Money Can you Make With a Crypto Bot?

While it is true that more traders lose money than make money, professional traders can make good profits by trading Bitcoin or other crypto assets. It is not uncommon for professional traders to make roughly 30% percent per month, but it is important to state that 90% of traders lose 90% of their accounts in their first 90 days, this is known as the 90/90/90 rule.

Trading is a serious career and requires a lot of dedication, practice, and patience.