In this Coinberry review, we will take a look at a popular and growing cryptocurrency exchange based in Canada.

Coinberry simplifies the process of buying and selling cryptocurrencies for Canadian users. It is also positioning itself as a highly secure and regulatory-compliant alternative to many exchanges that exist in the market, opening the doors for large institutional investors to potentially want to join.

However, the question remains whether Coinberry can really compete in today's crowded marketplace of crypto exchanges. With many exchanges, such as Binance, OKX, and SwissBorg offering a plethora of crypto products and advanced trading features, the competition is fierce in the industry.

In this comprehensive review, we deeply analyze the Coinberry exchange, going over its fee structure security features, deposit and withdrawal methods and customer support. We also offer our thoughts on the best aspects of the exchange and ways we think it can improve, as well as recommend more suitable cryptocurrency exchanges for those looking for a more robust, feature-packed crypto platform.

With that said, let’s jump in.

Coinberry Overview

Page Contents 👉

- 1 Coinberry Overview

- 2 Is Coinberry Safe?

- 3 Coinberry Fees

- 4 Coinberry Review: Asset Coverage

- 5 Coinberry Customer Support

- 6 Coinberry Registration

- 7 Verifications and KYC

- 8 Funding/Withdrawals

- 9 Coinberry Trading Platform

- 10 Coinberry Mobile App

- 11 Team Members

- 12 Areas for Improvement

- 13 Coinberry Review: Conclusion

- 14 Coinberry Ratings

Coinberry is a Canadian cryptocurrency exchange that was developed in 2017 to make it easy for Canadians to purchase Bitcoin, Ethereum, Litecoin, and a host of other major crypto assets. The Coinberry exchange is headquartered in Toronto, where it started its humble journey.

Co-founders Andrei Poliakov and Evan Kuhn developed the exchange to reduce the learning curve for new people getting involved in cryptocurrency investing.

On Coinberry, cryptocurrencies can be purchased either by bank wire or Interac-Transfer, which is a service that allows you to transfer funds between personal and business accounts at participating Canadian banks and other financial institutions.

Over 250 total financial institutions use Interact, including all major banks in Canada. The partnership allows Coinberry to join 2,000 national merchants, like Indigo, Sony, Adidas, and Dell to make payments easier.

Coinberry recently became the first Canadian exchange to join the list of supported exchanges on Ledger, a prominent hardware wallet company.

Is Coinberry Safe?

Safety is a particularly important point for Canadian cryptocurrency users, especially after the black eye left in the Canadian crypto industry after the QuadrigaCX exchange scam.

With that being said, how does Coinberry stack up?

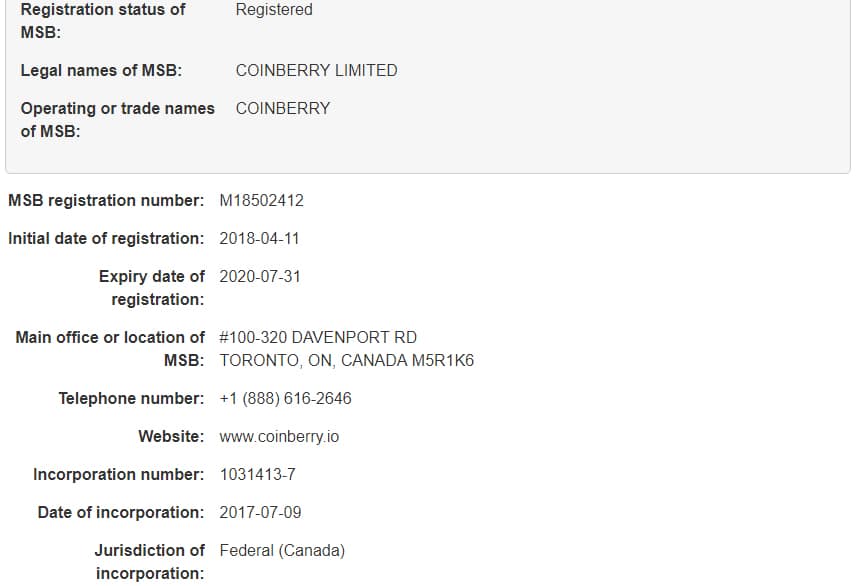

Banking and Regulation

Firstly, Coinberry is registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as a Money Service Business (MSB). This means that the exchange will have had to have undergone a range of compliance checks before they were allowed to accept client money.

Moreover, an MSB licence means that Coinberry will have to conduct regular KYC and make sure that all of the client accounts are above board. It also means that Coinberry will find it easier to get stable banking and payment processing solutions.

Speaking of stable banking, Coinberry has CDIC-insured segregated banking. This means that Coinberry works with Canadian Schedule I banks that help them achieve compliance with Canada’s laws. One of the ways they do this is by keeping company funds and customer funds in completely different accounts.

This ensures that if the company’s bank accounts were ever frozen, it would not affect the customers’ money. The use of segregated bank accounts also helps reduce the time it takes to process withdrawals to just 1 day.

You would also be surprised to know that Coinberry is one of only 2 crypto exchanges in Canada to successfully complete a financial statements audit from an independent third party.

Exchange Security

Bitcoin hacks and data breaches are one of the biggest threats that face nearly all exchanges. Hence, when we are analysing the safety of a crypto exchange, one of the most important requirements that we look at is a robust cyber-security protocol.

For one, Cryptocurrency deposits made to a Coinberry account are routed to hierarchical wallets. Hierarchical Deterministic Wallets (or HD wallets) are digital wallets that automatically generate a hierarchical tree-like structure of private/public addresses (or keys), removing the need for addressing the user to generate them on their own.

HD wallets generate addresses from a single master seed using a variant of the standard 12-word master seed key, which makes it possible to automatically create an unlimited number of new addresses.

Extract from Coinberry “Trust” Declaration”. Image help.coinberry

Coinberry also operates multi-signature wallets in cold storage. This allows for 2 members of the Coinberry executive team to access users' funds, so if one goes missing, then users’ money is still safe (so essentially like a Co-pilot with access to the same flight controls).

They also claim to conduct regular penetration tests with the help of the top Cyber security firms in Canada. And, in the unlikely event of any breach, they operate a redundant database which can be restored to normalcy if ever penetrated.

User Protection

In most cases, though, the front line of security will start with the user. In order to help prevent any hacks or breaches to individual accounts on the client side, Coinberry also has a range of security tools.

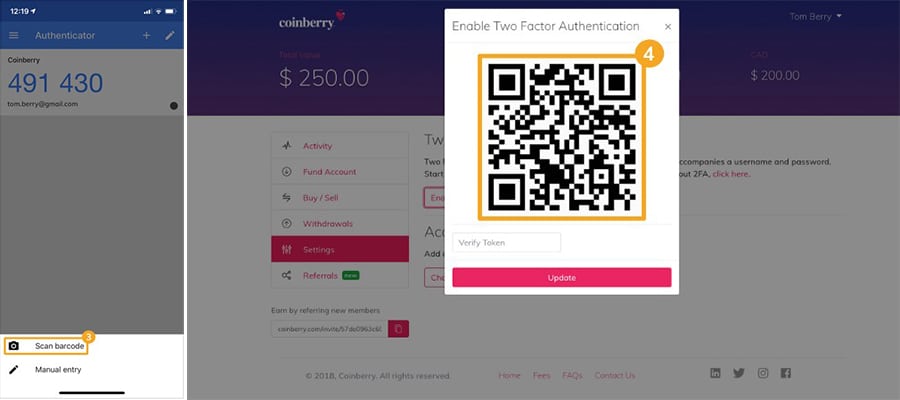

The first and most important of these has to be mobile two-factor authentication. With this enabled, you will need to confirm the account login through your mobile device. Coinberry servers will sync up with Google authenticator, which will generate the unique login codes.

Linking up the Google Authenticator with Coinberry

There are also protections for client data and information. As one would expect, there is standard SSL encryption to prevent any online snoops from intercepting your communication. This is especially important when it comes to things like usernames, passwords, etc.

Lastly, when it comes to your personal information, this is OpenPGP protocol encrypted. PGP (Pretty Good Privacy) is an encryption program that provides cryptographic privacy and authentication for data communication.

Coinberry Fees

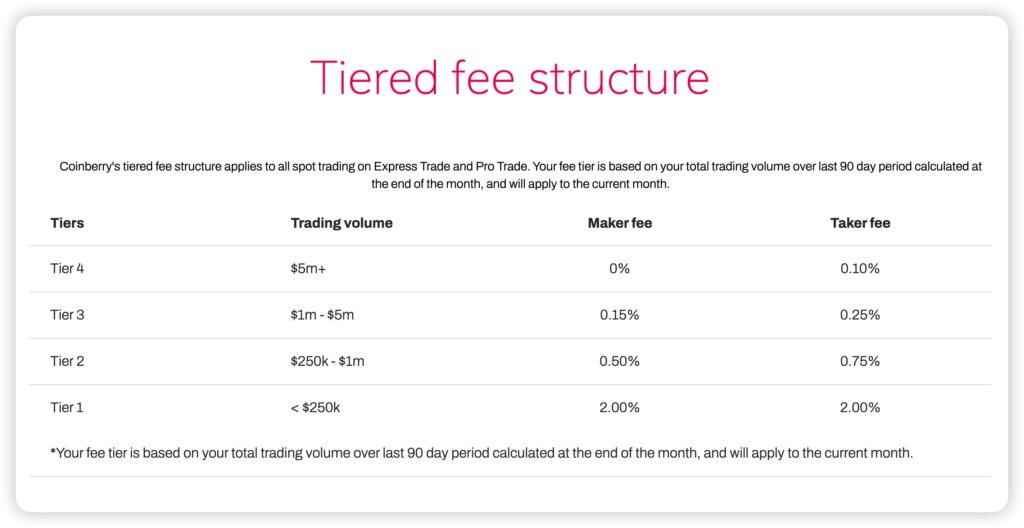

The first thing that stands out on Coinberry’s website is its clear, transparent, and easy-to-understand fee structure. Coinberry users enjoy low fees of 0% on deposits, 1.5% on withdrawals, and a tiered trading fee structure, which can be found below:

Image via Coinberry

Taking a closer look at these trading fees, they are about in line with the execution fees charged at other Canadian exchanges such as Coinsquare, while being slightly less than the trading fees at BitBuy.

Something else that you may have to consider with Coinberry is that they are the “Market Maker” for the coins. This means that they are the counterparty to your trade and will hence make the price for you. This means that the buy/sell price may be higher/lower than it is on other exchanges.

Despite this though, Coinberry makes up for it in their low funding/withdrawal fees.

One of the strongest benefits of Coinberry is the fee-free deposits and just 1.5% withdrawal fee when you consider that most deposits/withdrawals at other exchanges can be up to 3% one way.

Of course, it is important to point out that there may be fees that your own financial institution will charge on the transaction. This is especially true if you choose to use your credit card to fund your account.

Something that is worth pointing out as well is that the “1.5% withdrawal” fee applies to fiat withdrawals only. You will still have to pay an arbitrary miners fee on the withdrawal of crypto, which is standard across the industry.

Coinberry Review: Asset Coverage

Currently, there are only 35+ cryptocurrencies available on Coinberry, a somewhat disappointing and lacklustre selection considering exchanges such as Binance offer 400+ tradeable assets.

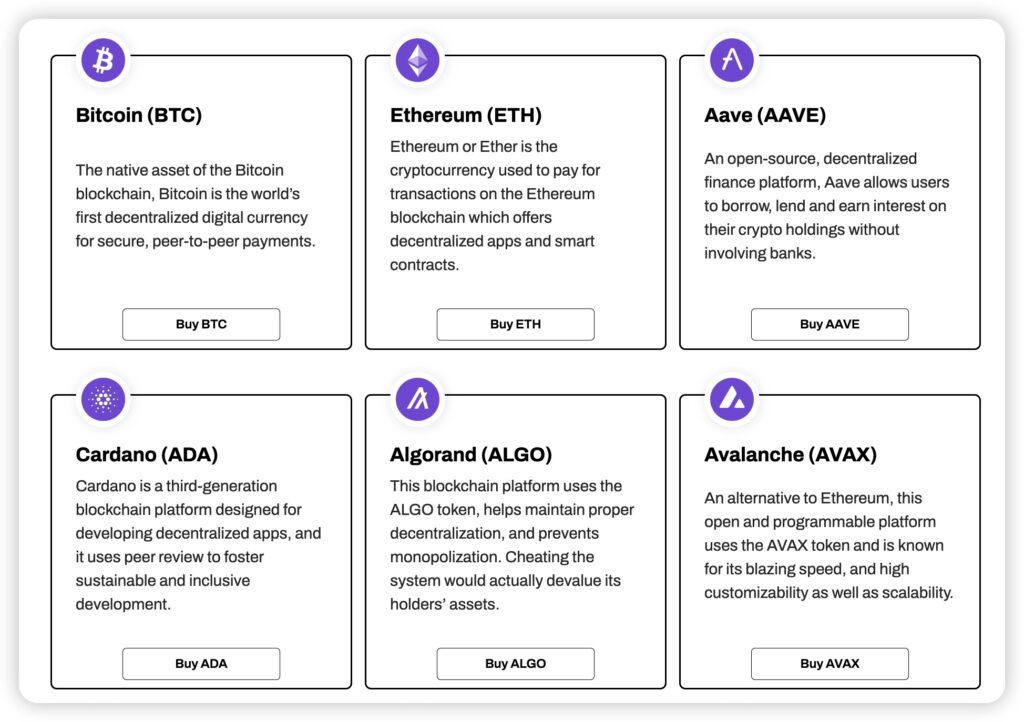

A Few of the Coins Offered on Coinberry. Image via Coinberry

Of course, major assets like Bitcoin and Ethereum are available for cryptocurrency trading, along with some harder-to-find altcoins such as Algorand and Cardano.

This is slightly underwhelming, as most of the competition offers a better selection of assets for traders to choose from. I am not sure why Coinberry has been dragging its feet in adding a better selection of crypto assets, especially considering even heavily regulated US exchanges like Coinbase and Kraken boast better asset support, so there is definitely room for improvement here.

Coinberry Customer Support

No doubt, one of the most important considerations for any cryptocurrency trader is customer support. This is especially true when you have more urgent queries that need to be addressed in a timely manner.

Ticket support is available through the company website, where users can submit a ticket if they have any issues. The lack of chat support is disappointing, as real-time support can be very important when dealing with crypto trading, which is why many of the best crypto exchanges provide customers with access to quick in-app chat support functionality.

Of course, if your question is more routine in nature, Coinberry also has a FAQ page for answering basic questions, like ‘How to Fund with e-Transfer?’ ‘How to Buy Crypto with Canadian Dollars?’ ‘How to Withdraw Crypto?’ etc.

The last port of call to get hold of the exchange is through their numerous social media accounts. For example, you can message them on Facebook or Twitter.

Coinberry Registration

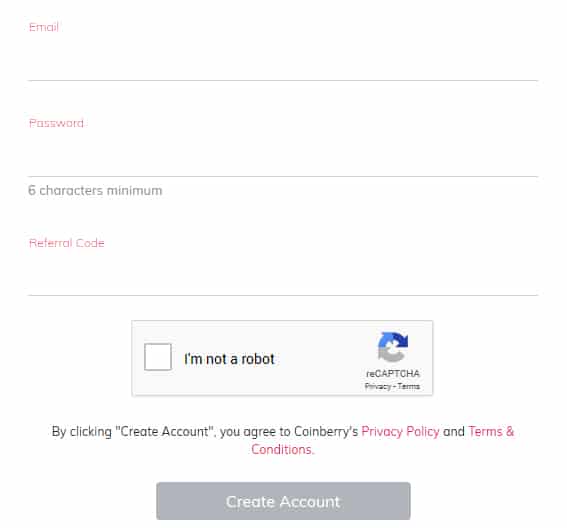

If you have decided that you would like to give Coinberry a try, then you will need to create an account. Hit the “sign-up” button on the top right of the screen and you will be prompted for an email address as well as a password.

Details required for Coinberry registration

You can also add a referral code if you were referred to the site by a friend. The exchange does offer a referral rewards program where you can earn $30 for inviting friends to sign up, but only once they trade $50 or more.

Once you have hit “submit” on the signup, you will have to confirm your email. Once confirmed, you must add a secure phone number to enable 2-factor authentication and protect your account.

Unfortunately, for those traders who prefer to operate anonymous accounts, Coinberry is not for you. This is because of the regulatory licenses that they hold, they are permitted to complete a number of KYC checks on their trading accounts.

Verifications and KYC

Coinberry is fully compliant with Anti-Money-Laundering and Know-Your-Customer requirements set by FINTRAC. This means that account verification is required in order for users to begin depositing funds.

There are 2 ways in which new customers can be verified:

- Instant Verification: Users enter their account details and then Coinberry’s KYC/AML partners will verify their identity. These are usually credit reporting agencies that have information on your financial history.

- Manual Verification: If you don’t pass the instant verification. Coinberry will require more verification documents to complete the process, such as Government-Issued Photo ID and a Proof of Address document.

Personal Questions required for instant verification

If manual verification is the only route that is available to you, then you will have to upload a government-issued form of ID. Coinberry is able to accept the following types of identity documents:

- Canadian Passport

- Canadian Driver’s License

- Permanent Residence Card

- Provincial or Territory Identity Card

- Status Indian Card

In terms of proof of address, you will need to provide one of the following:

- Utility Bill (electricity, water, phone, internet)

- Investment account statements (RRSP, GIC)

- T4 statement

- Canada Pension Plan (CPP) statement

- Property tax assessment issued by a municipality

- Provincially-issued vehicle registration

- CRA documents or Government Benefits statement

Once you have submitted these documents, Coinberry will manually verify them, which could take anywhere from one to three business days.

Based on the strict requirements made by Coinberry, we can see the exchange is very much trying to position itself as a Coinbase or Gemini; a fully compliant service that retail and institutional investors can use without fear of being on the wrong side of government regulations.

Funding/Withdrawals

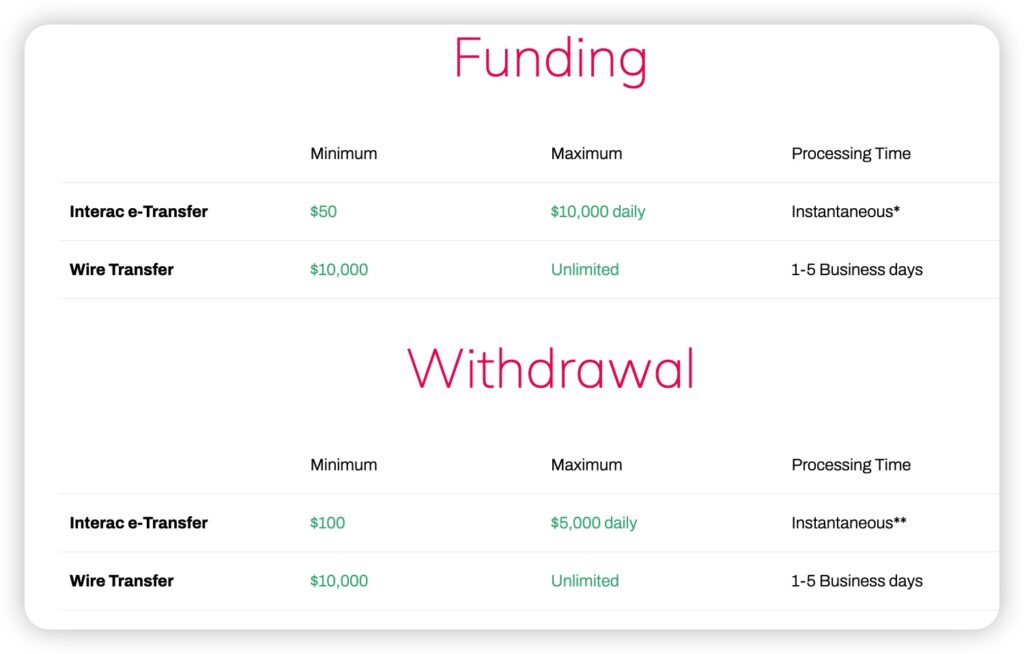

When your account is all setup and fully verified, you will need to fund your account. There are a number of funding options which will vary based on individual deposit limits as well as processing time.

Perhaps the cheapest and fastest way to fund your account will be through the use of cryptocurrency.

Bitcoin & Ethereum

If you already have BTC, ETH, or other supported cryptocurrencies on hand and would like to fund your account, then you can initiate a cryptocurrency transfer.

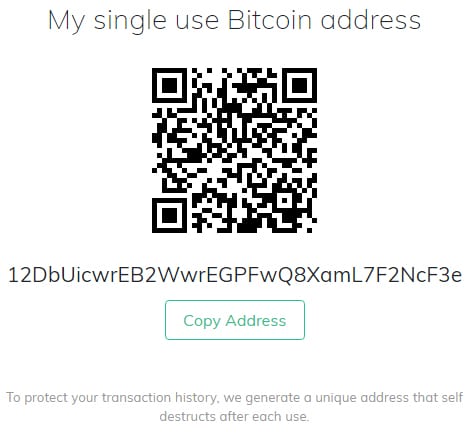

In order to get the address to which to send the funds to, you will need to generate an address. You can do this in your account section under the “Fund Account” section. Here you will have to select “crypto” and then either the crypto asset of choice.

Something that we were quite surprised by is the fact that Coinberry uses unique one-time addresses for those users who fund with crypto. This means that Coinberry is helping you protect your transaction history by not reusing addresses.

Yet, because this is a one-time address, you have to be sure to never send to the same address twice. Once you have confirmed that you understand the above, they will give you the one-time address.

Generation of one time BTC address at Coinberry

You can then either copy the address that you have generated or you can use the QR code in a mobile wallet. The transaction will have to first be propagated through the network before it will show up in your balance. You can monitor this on the blockchain.

Withdrawals will work in a similar fashion where you will select “withdrawals” in your account. Here, they will ask you for your crypto address where to send the transaction. It is best practice to use QR codes or the copy/paste function to ensure your cryptocurrency withdrawal address is without typos, as sending to a wrong address can lead to permanent loss of funds. Due to clipboard hijacking malware programs, be sure to always double-check addresses for accuracy, even if you copy and paste. You can learn more about that and other tips + tricks on crypto safety in our Crypto Safety 101 article. You will also have to insert your password in order to properly authenticate the transaction.

This will be followed by a final step that will ask you to confirm the withdrawal. Withdrawal times can vary depending on whether Coinberry has the required funds stored in their “hot wallet”. This should usually not be more than a couple of hours.

Canadian Dollars (CAD)

If you would prefer to fund your account with your fiat, then you have two options: Interac e-Transfer and Wire Transfer. Below are the limits as well as processing times for these respective methods.

Image via Coinberry

From the above, Interac e-Transfer appears to be the quickest option as these are instantaneous. So, if you are itching to trade and need to get funds into your account as quickly as possible, then this may be for you.

E-Transfer (online or mobile banking) is one of the simplest ways to fund your Coinberry account. All you need is a Canadian Bank account that supports E-Transfer. Here are some of the financial institutions you can use:

- BMO

- CIBC

- RBC Royal Bank

- Scotia bank

- TD Canada Trust

- Tangerine (Email Money Transfer is not supported)

- For the full list of supported institutions, check out the Interac page

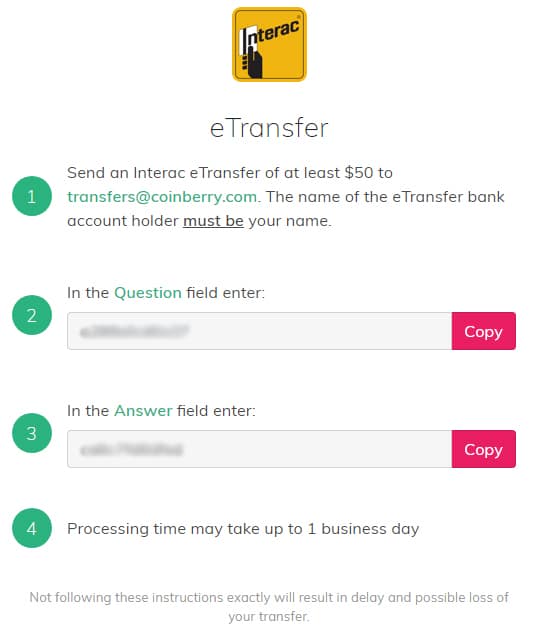

You can fund your account using E-transfer in 2 steps:

- Add Coinberry as a Payee

- Recipient Name & Last Name: Coinberry Limited

- Email: transfers@coinberry.com

- Follow the instructions in your Coinberry account for the security Question and Answer fields.

- Fund Account: Enter the amount you would like to fund your Coinberry account with. The minimum funding amount is $50 and the maximum funding amount is dependent on your financial institution (usually between $3000 and $5000).

Interac form for funding account with CAD

Once the payment has been confirmed, it should be credited to your trading account within 15 minutes.

If you are going to be funding with a wire transfer, then you will need to take down the wiring instructions for the Coinberry bank account. You must also use your Coinberry account number as your reference.

Please take note that the wire must come from an account that is in the same name as you have been verified with. Hence, you cannot make third-party transfers into or out of your account.

To withdraw using E-transfer, simply select the ‘E-transfer’ button then enter the desired amount of funds you want to withdraw. The minimum Canadian Dollar withdrawal amount is $100.

Once you click continue, you will get a confirmation message letting you know that the withdrawal will be processed.

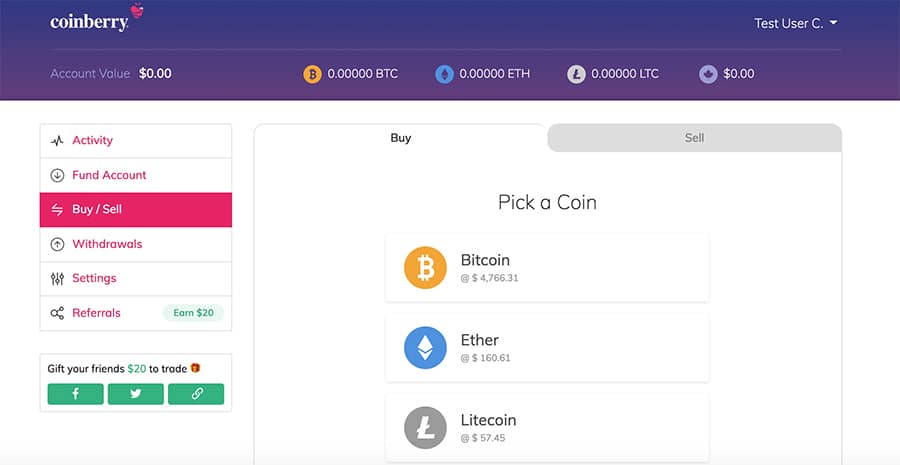

Coinberry Trading Platform

Coinberry’s trading platform is more geared towards investors and beginning traders rather than more advanced day traders. This means that the interface is beginner friendly, but the lack of charting functionality and order types makes Coinberry unsuitable for more sophisticated traders and crypto trading activities.

After your account has been verified and you’re ready to begin trading, the first thing you see is the buttons to buy and sell Bitcoin, Ethereum, and the other available assets. This is the instantaneous purchase of crypto directly from Coinberry.

User interface of the exchange

To purchase Bitcoin, simply click on the Bitcoin icon, and then enter the amount of CAD you want to spend to buy BTC.

Once you click ‘next’, you are directed to a page where you have to select what you will use to purchase your BTC with; CAD, Credit card or Debit Card.

If you select CAD and you do not have funds in your account already, you must fund your account with e-Transfer or Wire transfer.

If you select Debit Card (in the previous menu) you have to first connect your bank account to your Coinberry account for fraud prevention.

Once you’ve paid for your Bitcoin, your balance will show on the dashboard of the site.

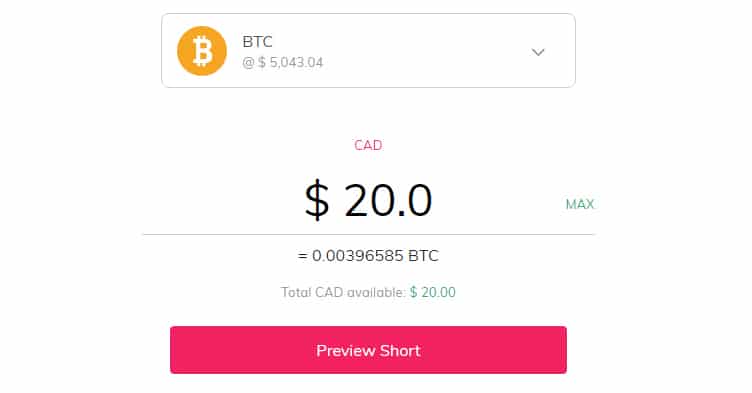

Shorting

Something that we found quite unique about the Coinberry platform was the ability to short-sell an asset.

For those who are not too familiar with the term, short selling is the act of agreeing to sell the asset at some time in the future at some predetermined price. The goal of a short seller is to agree to sell at future prices that are higher than the spot price will be at the time.

Essentially, the trader is hoping the price of the asset falls.

Short selling order form on Coinberry

The Coinberry short-selling feature is really quite simple and allows for one-click ordering. This makes it that much more beginner friendly than the short-selling procedures that are available on more advanced margin trading platforms.

Similarly, unlike the margin trading platforms, this is short selling with no leverage. You will have to put up the full cost of the position upfront in order to fund the position.

Coinberry Mobile App

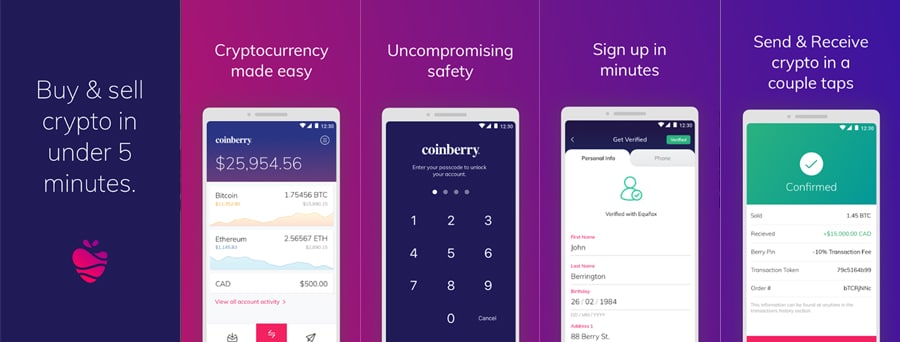

For those of you who would like to buy/sell crypto on the go, you will be happy to know that Coinberry has its very own mobile app that is available for both Android and iOS.

The user interface is attractive, simple and intuitive. Unlike the website version, you can see a chart display for the price of digital assets. One additional feature the mobile app has that the website doesn’t have is the ability to send coins or CAD to other accounts.

Mobile application screenshots

The mobile app looks to be designed well for users who want to not only invest on the go, but also spend their cryptocurrencies at merchant stores or anywhere else that accepts them. The ability to send crypto and scan the barcode as a uniquely mobile feature should help push Coinberry users to see their cryptocurrency funds as not just a store of value but also a medium of exchange.

We decided to jump into the Google Play store in order to see what users were saying about the app in the reviews. These appear to be generally quite positive and users have similar comments about the simplistic interface.

There are quite a few suggestions that users have given about how to improve the app's functionality, which are all well-received. It is encouraging to see that the Coinberry developers are “on the ball” and are quickly responding to these queries. They are also taking their suggestions into consideration as they push further updates to the app.

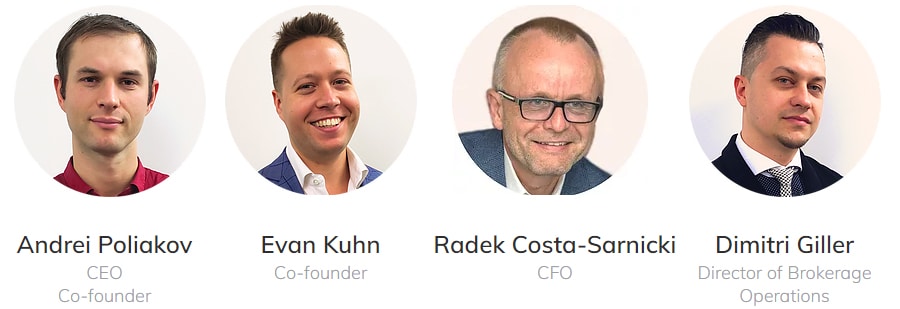

Team Members

Transparency of founders and team members is something that is often in short supply when it comes to cryptocurrency exchanges. It is quite refreshing to see how prominently Coinberry displays its team members.

Some of the Team Members

Indeed, the founding members of Coinberry and the original management team were made up of quite an impressive mix of individuals behind the exchange:

- Evan Kuhn – Co-founder. Kuhn describes himself as a “lifelong entrepreneur.” He started out in the Toronto commercial real estate market with a focus on repositioning mixed-use buildings and built a multi-million dollar business before he turned 30.

- Andrei Poliakov – Andrei is a seasoned entrepreneur, having previously launched and managed various start-ups with a strong focus on implementation and early-stage strategy development. He brought with him +10 years of operations and strategy development experience in various corporate settings with leading multinationals around the world.

Since co-founding Coinberry, Andrei has gone on to become a member of the Board of Directors at WonderFi, along with Evan Kuhn, who became a Strategic Advisor. WonderFi is another Canadian crypto company that acquired Coinberry in 2022. You can learn more about the current team on the Coinberry LinkedIn page. You can also learn more about the ethos and mission of the exchange on Coinberry's about us page.

Areas for Improvement

While there were many things that we liked about the exchange, there were also a few areas for improvement.

For example, Coinberry has very limited options for coin coverage. Now that major players like Coinbase have added several Altcoins to their roster, Coinberry should at least be trying to match the likes of Coinbase and Kraken. Listing more cryptocurrencies is the easiest way for the exchange to increase trading volume and generate more revenue.

Adding more coins will also help introduce the Canadian market to the various altcoins that exist, allowing them to capitalize on small-cap coins that make much bigger price movements than the majors.

We also think that although the trading platform was designed for beginner traders, it lacks any other advanced features and functionality. They should consider adding a slightly more “advanced” secondary platform for those users who would like to trade in a more professional manner.

Lastly, Coinberry has to think globally (or at least cross-continentally) if it hopes to become a dominant force in the market. Its value proposition as a low-fee exchange for new cryptocurrency traders can still be very appealing to segments of the US market where major US crypto exchanges haven’t dominated.

Coinberry Review: Conclusion

Coinberry is an okay exchange to use for first-time cryptocurrency investors who reside in Canada. It offers most of the basic features you need, including the ability to buy and sell some of most popular cryptocurrencies, deposit or withdraw funds from multiple sources (E-Transfer, Credit card/debit card, Wire transfer) and trade with limited to no fees.

The cryptocurrency market is quickly expanding, and so Coinberry may have to figure out ways to differentiate itself from the many exchanges that are dominating the market today. Coinberry’s edge seems to be its emphasis on high security and regulatory compliance.

While there were a few things that we thought warranted improvement, most are relatively easy to address. The team at Coinberry seems to be really open to suggestions and if enough traders telegraph interest, they may consider incorporating it.

For example, now that the market is relatively quiet, it would make sense for Coinberry to focus on expanding its list of tradable assets and working with strategic partners who can help it reach adoption among institutional investors.

So, is Coinberry the exchange for you?

Well, if you are looking for an entry-level exchange with low fees, strong security and a reputable management team, then it could be for you. However, if you are interested in more active trading, and better asset and feature support, then we wouldn't recommend Coinberry and encourage users to take a look at an exchange such as Binance or OKX, or alternatively, SwissBorg for users who want a beginner-friendly platform for crypto investing.

Featured Image via Coinberry